While iron ore prices in Asia are falling, coking coal prices are moving in the opposite direction, due to China’s import ban from Australia and supply struggles.

Coke prices traded in Singapore on September 7, 2021, and based on Australian spot prices, ended at $274 a tonne, just below the September 3 close of $274.33, which is The highest price since April 2017.

Coke prices have increased 170% since the end of 2020 and are close to closing highs of $299.33/ton reached in November 2016.

Australia is the world’s largest exporter of coking coal, the other key raw material for steel production besides iron ore, and a major supplier to China, the world’s largest steel producer, before Beijing. unofficial import ban. The ban was introduced last year as part of a political dispute with Canberra that is still continuing.

It may sound illogical that Australia’s coking coal has surged in price after losing a top customer, but the reality is that Australia’s prices are being pulled higher by even higher prices for refining coal from other countries.

China is being forced by its own policies to source coking coal from other producers and is paying a hefty fee for this privilege.

The United States is the world’s second-largest shipper of coke, and commodity prices at the Hampton Roads port are at record highs, according to the Argus commodity price reporting agency.

The price of low volatile metallurgical coal at Hampton Roads in the session on September 3 remained at $315.05/ton, surpassing the previous record high of $295.40 compared to May 2011.

The Hampton Roads price has historically traded at a discount to Australian goods, but this was reversed in November 2020 and it has been trading at a premium since.

The shift to premium rates for US coking coal coincided with the outright impact of China’s unofficial ban on goods from Australia.

There are also factors other than China’s action against Australia driving the rally in coking coal prices, chief among them weather-related supply constraints.

|

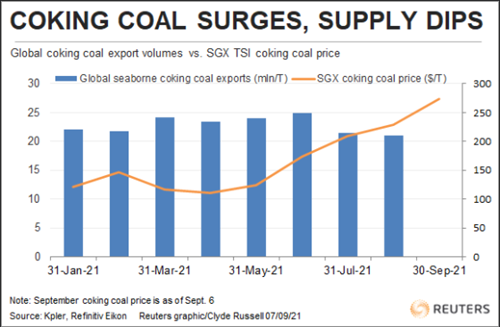

Export of coal by sea compared to SGX Photo Reuters

Global seaborne exports of all grades of coking coal in August were 21.01 million tonnes, down from 21.48 million in July.

August’s exports were also the lowest since February 2019 and also significantly lower than the 23-24 million tonnes a month achieved from July 2020 to June this year.

In addition to weather disruptions that led to the drop in exports, both Australia and the US have seen delays in loading in recent weeks due to storms.

Australia exported 12.73 million tonnes of coke in August, slightly higher than 12.01 million in July, but much lower than 14.77 million in June and 13.77 million in May. 2021.

The US exported 3.12 million tons in August, up slightly from 2.97 million in July, but down sharply from 4.27 million in June 2021.

Russia, the third largest supplier to the seaborne market, exported 2.47 million tons in August, down from 3.18 million in July and corresponding to 2.48 million in June 2021.

It is likely that exports from Australia and the US will return to more normal levels in the coming months, which could ease some of the supply constraints.

However, so far Chinese policymakers have shown no sign of changing direction towards Australia’s coal import ban, despite the high costs of the policy.

While China has imposed bans or restrictions on a number of Australian imports, including barley, lobster and wine, it has left alone the largest of which is ore. Iron.

Spot iron ore prices hit a record high of $235.55 a tonne on May 12, 2021, but have declined in recent weeks, falling to $131.75.

The recovery to record levels was fueled by strong Chinese supply and demand issues in top two exporters Australia and Brazil.

Both of these factors have eased recently, with Chinese steel output falling in line with government targets and improving supply from exporters.

Source: VITIC/Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com