Experts predict that if rice prices increase by about 15%, Vietnam and Thailand may issue an order to restrict rice exports similar to India.

The world is preparing for a bad scenario when India issues a ban on rice exports. Specifically, when the market is short of about 10 million tons of rice – a gap left by India, major exporters may try to fill this gap by boosting exports to sell at high prices. As a result, it is possible that those countries will have to follow India’s lead in enacting a similar ban to ensure food security in the country.

Analysts are seeing a similar scenario when India imposed a ban on rice exports in 2007-2008, causing a domino effect as many other countries were forced to restrict rice exports to protect consumers. domestic.

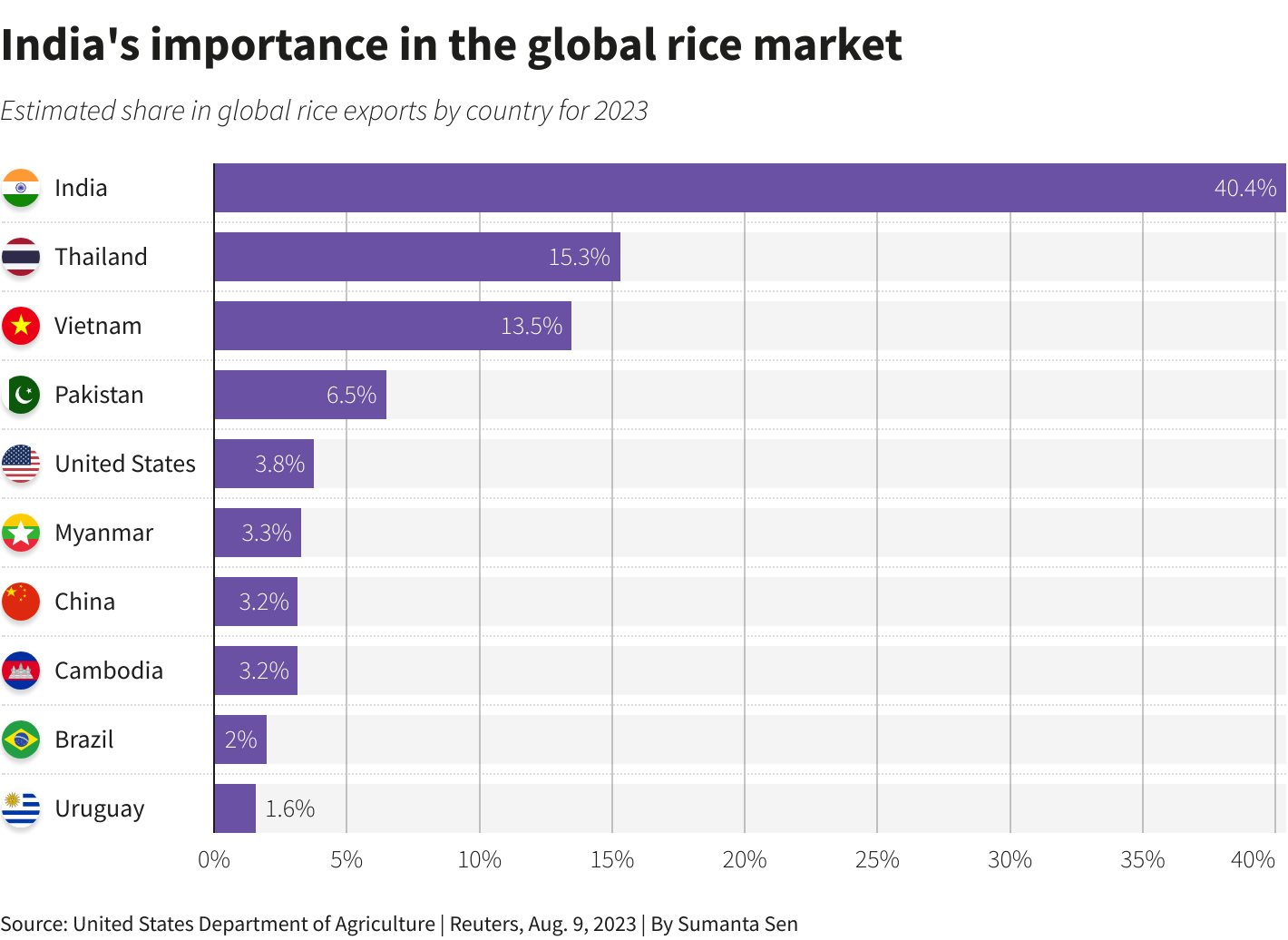

This time around, the impact on supply and prices could be even more far-reaching as India accounts for more than 40% of global rice trade compared with only about 22% 15 years ago, putting pressure on exporting countries. Other major rice exporters are Vietnam and Thailand.

What to take to make up for the shortage of Indian rice?

“India is now much more important to the rice trade than it was during 2007-2008. India’s ban then forced other exporters to implement similar restrictions in a domino effect, Even now, they have little choice but to improvise according to market conditions.” , a New Delhi-based grain trader told Reuters.

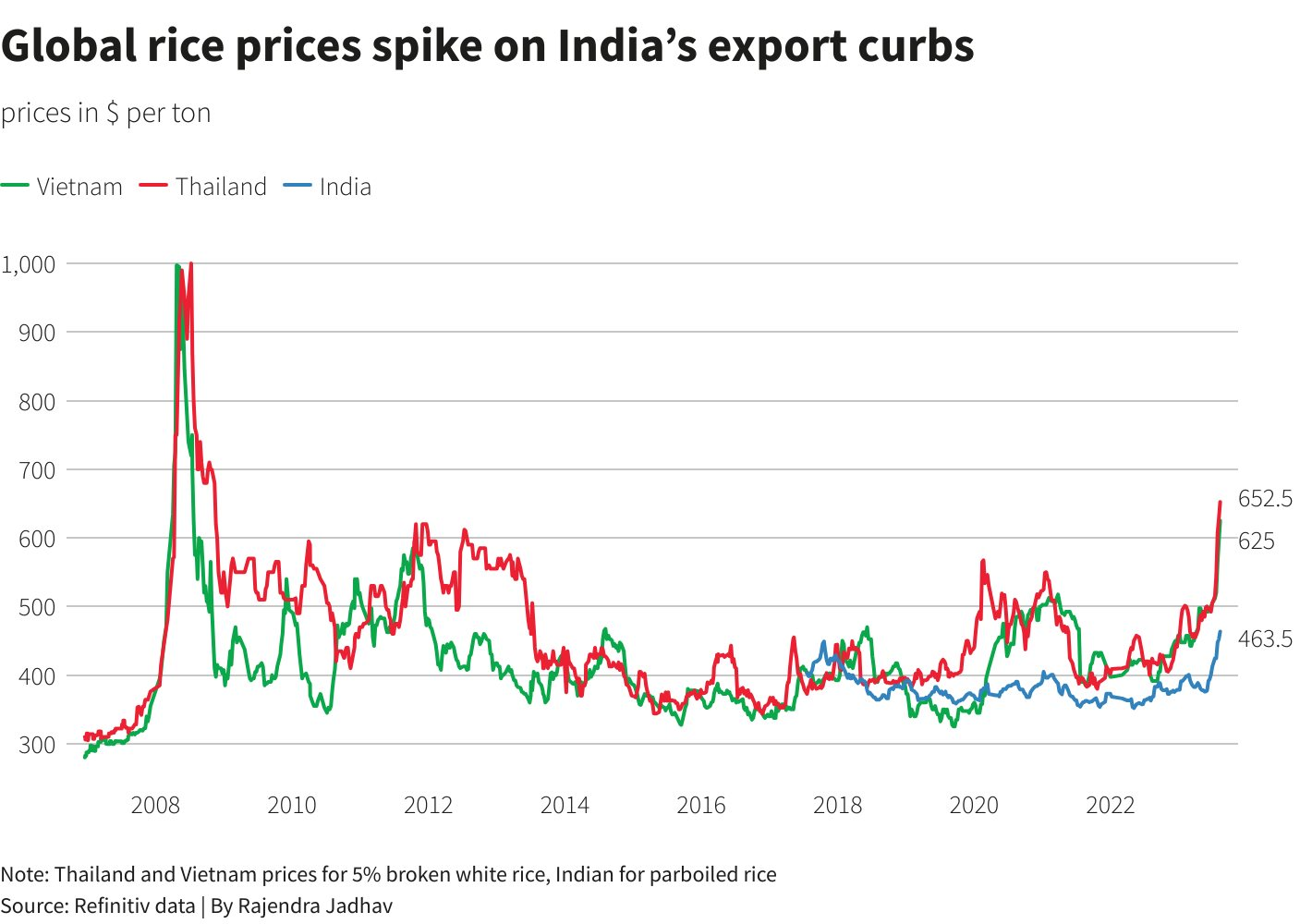

The impact of the export ban was immediate as the world’s most consumed food commodity hit a 15-year high. Analysts and traders say the limited supply risks increasing rice prices and global food inflation, affecting impoverished consumers in Asia and Africa. Importers are struggling with tight supplies due to erratic weather and disruptions to shipping through the Black Sea.

“Thailand, Vietnam and other exporting countries are ready to boost exports to make up the shortfall from India,” said Nitin Gupta, senior vice president of Olam Agri India, one of the exporters. the world’s top rice said. “However, there is a limitation in their ability to export. This limitation could set the stage for bull runs, reminiscent of the 2007/2008 bull run.”

In 2008, rice prices hit a record high of over $1,000/ton after India, Vietnam, Bangladesh, Egypt, Brazil and a number of other small exporters restricted exports.

This time, exporters will not be able to increase exports by more than 3 million tons a year because they still have to try to meet domestic demand, three agents of weekly rice traders said.

Thailand, Vietnam and Pakistan, the second, third and fourth largest exporters in the world, respectively, said they are keen to increase sales after India’s ban. Both Thailand and Vietnam have vowed not to let domestic consumers be harmed by increased exports.

“It is not acceptable that a rice exporting country faces a tight supply and high domestic prices,” Minister of Industry and Trade Nguyen Hong Dien said last week.

According to an official from the Paksitan Rice Exporters Association, the country can export 4.5-5 million tons from the current 3.5 million tons/year. However, it is difficult for Pakistan to export unrestrictedly amid double-digit inflation, he said.

The top non-basmati rice importers include the Philippines, China, Senegal, Nigeria, South Africa, Malaysia, Ivory Coast and Bangladesh.

Chain reaction

Global rice prices have increased by about 20% since India introduced the ban. According to traders from international trading companies, if rice prices continue to increase by 15%, Thailand and Vietnam may limit exports. “The question is not whether they will restrict it, but how much and when to implement those measures,” said a New Delhi-based trader.

This week, rice prices in Vietnam and Thailand jumped to 15-year highs as importing countries rushed to buy to offset a drop in exports from India.

Worries of El Nino

Rice is the staple food of more than 3 billion people and nearly 90% of global rice is grown in Asia, where El Nino is threatening crops in major producing countries.

After rainfall fell below average in June and July, Thailand has advised farmers to limit planting of the second crop of rice.

In India, the erratic distribution of monsoon rainfall has led to flooding in some northern rice-growing states, while some eastern states lacked enough rain for planting.

B.V Krishna Rao, President of the Rice Exporters Association of India said good rainfall is a necessary condition for normal production. This will allow New Delhi to reverse the rice export ban. Only when India’s supply resumes will the global rice market restore equilibrium, Rao said.

“We have to see how long India’s export restriction is in effect. The longer the ban is in effect, the harder it is for other exporters to make up for the shortfall,” said Peter Clubb, an analyst at the International Grains Council (IGC).

Source: Reuters

T&G . International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 02473010868

Email: hrm@tginterjsc.com

Website: http://tgimportexport.com