While industry groups were in the red, coal stocks – a group of stocks that had been quiet for a long time suddenly rose up and raced to break out.

Stocks rose at the same time

The stock market opened the morning session in red covering most of the industry groups. Although selling pressure is gradually cooling down in large-cap groups, the sellers still prevailed, causing the VN-Index to lose 1,500 points.

While industry groups were in the red, coal stocks – a group of stocks that had been quiet for a long time suddenly rose up and raced to break out after a long time of not being noticed by investors.

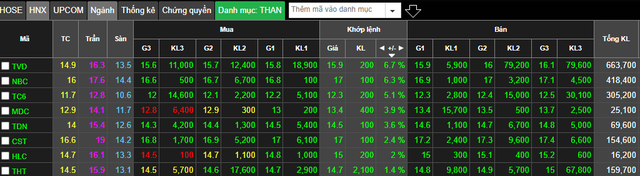

Specifically, TVD code of Vang Danh Coal Joint Stock Company led the increase with 6.7% to 15,900 dong in the morning session of February 14. Compared to the price of 12,500 VND/share on January 28, this code increased by 27% in value.

Similarly, Nui Beo Coal Joint Stock Company (code NBC) also accelerated 6.3% to 17,000 VND/share. After just over a week of trading, this stock has increased 34% in value. Liquidity maintained more than 418 thousand matched units in the morning session on February 14.

TC6 is also a bright name in the group of “black gold” stocks when reaching the milestone of VND 12,300/share. Similar to the above codes, this stock established a gaining momentum after the Tet holiday when it increased by 26% in value after only a few trading sessions.

Besides, a series of coal codes also raced to break out in this morning, typically MDC (+3.9%), TDN (+3.6%), CST (+2.4%),.. .

According to the analysis of many experts, the reason that triggered the rise of coal stocks came from the recent sharp fluctuations in international coal prices. As of February 14, coal futures price was at $245/ton, up 2.5% from the previous day and up 180.3% over the same period last year. This is the highest level since October 2021 when the price of this commodity nearly touched 270 USD/ton.

Coal prices rose in the context of geopolitical tensions between Russia and Ukraine, which pushed up world oil prices sharply last week, in addition to global demand for “black gold” recovering faster than expected, while supply Supply has difficulty keeping up.

In addition, the French government has just allowed power plants to use more coal in January and February to ensure energy security. Regarding the Chinese market, the country’s coal price has increased sharply since Indonesia banned exports. Although on January 21, the Southeast Asian country lifted the above order, but Indonesian businesses must focus on domestic supply.

Accordingly, the above factors have pushed up prices. Coal prices have increased in the context of peak oil prices and shortage of coal supply.

Poor business, which “door” for 2022?

Contrary to the increasing momentum of coal prices, the business picture of coal enterprises is quite poor and often unstable. This is clearly shown in the business results of the fourth quarter of 2021 when there was no breakthrough in revenue and profit growth, even some companies recorded a double-digit decline.

For example, Nui Beo Coal Joint Stock Company (code NBC) recorded an increase in revenue but a deep decrease in profit over the same period. Specifically, NBC’s revenue in 2021 reached VND 2,670 billion, up 22% over the same period. However, after deducting expenses, the company’s profit after tax decreased slightly to 46 billion dong.

Due to the sharp increase in the cost of mineral mining rights and Covid-19 prevention and control costs, Coal Coc Sau – Vinacomin (TC6) recorded a profit after tax in 2021 of VND 2.4 billion, down 67% compared to the same period in 2020. In the fourth quarter of 2021 alone, coal enterprises also recorded a loss after tax of 1.2 billion dong.

Although the profit did not go backwards like many enterprises in the same industry, the business results of Deo Nai Coal (code TDN) did not prosper. Specifically, profit after tax remained flat compared to the same period in 2020, reaching more than 45 billion dong. In the fourth quarter of 2021 alone, the company’s profit decreased by 73% to approximately VND 7 billion.

It can be seen that, although business results have not had many bright spots, coal stocks still went up thanks to expectations about the escalation of world coal prices. However, analysts believe that with a certain “latency” compared to world prices and a different price control mechanism, even in 2021 coal stocks are unlikely to benefit from the price rush. coal recently.

In particular, investors should pay close attention to the fact that the operating and business mechanisms of coal enterprises are very different, making the expectation of benefiting from world prices may not coincide with reality. . Specifically, coal is a special mineral. For a long time, coal mining enterprises under the Vietnam Coal and Minerals Group (TKV) are not allowed to export and apply direct prices to buyers, but they only have exploitation capacity according to the annual production quota.

All coal is mined, businesses must sell to commercial enterprises of the coal industry, these commercial enterprises have the function of direct export. At the same time, the profit margin rate is also usually set according to the previous estimate and not adjusted too much despite the sharp increase in world market prices.

In addition, domestic coal mining is mainly bran coal, which has lower price and quality, not coal – which is widely used in industrial production and is a commodity with a sharp increase in price in recent times.

In a recent report, SSI Research also said that the coal price in Vietnam is not in line with the world coal price due to the price management policy in Vietnam with only two units allowed to exploit and sell coal in the country, namely TKV. and Northeast Corporation. Notably, the domestic coal price is usually adjusted only when there is a large increase in production costs and usually only happens once every 3-4 years.

With a vision to 2022, SSI Research believes that the coal industry will have many positive signs when the domestic coal price is expected to adjust by 10-15% due to the high cost of coal production in 2021 and the demand from thermal power. Electricity started to recover again when social distancing was eased. As a result, listed coal mining enterprises will also begin to benefit when renegotiating a new selling price for TKV in 2022.

However, the report of SSI Research also notes that the price of coal mined in Vietnam is much more expensive than in the world in the normal period, so there is not much room for domestic price increase, especially when the price of coal is still low. World coal is likely to cool down quickly in 2022.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com