Most logistics enterprises belonging to the “Tan Cang” family such as ILB, TCL, TCW… all grew in revenue and profit in the first half of the year. Member unit Tan Cang Marine Services is about to be listed on UPCoM with more than 63 billion dong in profit after tax, completing 48% of the whole year target.

After nearly 32 years of construction and development, Saigon Newport Corporation under the Navy has expanded its system with 16 seaports, 8 ICDs (inland ports) and warehouse facilities and satellite ports throughout the country. water, providing general services of delivery – receipt – warehouse – transportation. Accordingly, the corporation has become the leading container port operator in Vietnam with a market share of import and export containers accounting for over 90% of the southern region and more than 60% of the country’s market share.

The ecosystem of Saigon Newport includes 22 subsidiaries and 9 business associates in the area from North to South with the main industries being port operation, logistics services, shipping and maritime services. according to the strategic direction of the corporation.

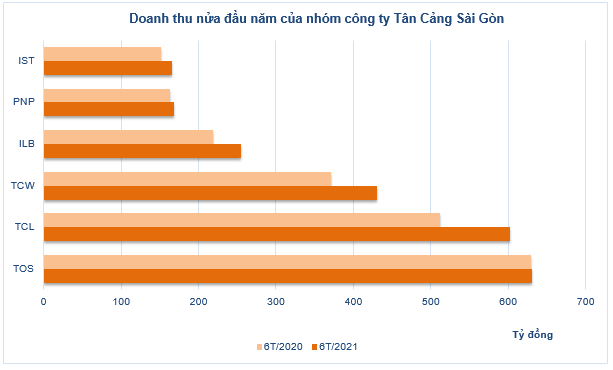

Most of the businesses under the “Tan Cang” family listed on the floor are mainly operating in the logistics field such as ICD Tan Cang – Long Binh (HoSE: ILB), Tan Cang Freight Forwarding Agent (HoSE: TCL ), Tan Cang Logistics ( UPCoM: TCW )… In the first half of this year, these companies all had an improvement in both revenue and profit similar to many peers in the same industry thanks to the growth in import/export activities. Good, freight rates are pushed up, plus the shortage of containers slows down the speed of goods circulation and increases the demand for goods storage. In the first half of the year, the volume of container cargo through the seaport increased by 25% to more than 12.7 million teus, achieving the highest growth rate in recent years (according to statistics of the Vietnam Maritime Administration).

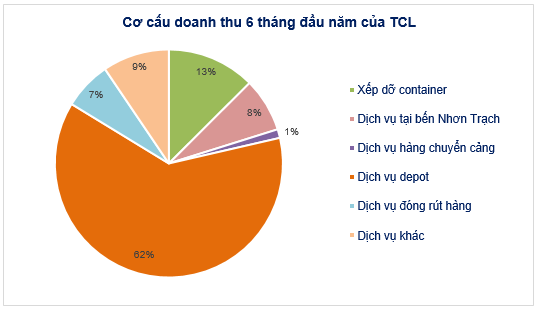

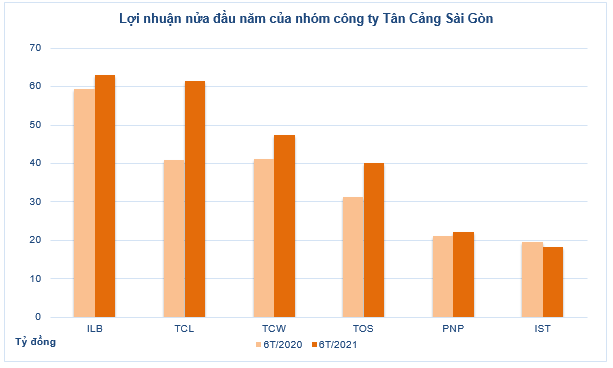

Accumulated in 6 months, Tan Cang Freight Forwarding Agent (HoSE: TCL) recorded an increase of 18% in revenue to VND 602 billion, of which more than half came from inland cargo clearance service (ICD) revenue. /depot). The company also has nearly 8.5 billion dong of profit in joint ventures and associates, while in the same period this amount is negative more than 1.2 billion dong. As a result, profit after tax reached VND 61 billion, up 50% over the same period, completing 55% of the plan.

|

This year, the company will continue to focus on exploiting Tan Cang Nhon Trach ICD, step by step speeding up the construction progress to expand this area by 15 hectares, and at the same time increase the proportion of loading and unloading at Cat Lai port.

Although the two-year business results did not grow suddenly, the company paid a record cash dividend of 70% (in 2019) and 50% (in 2020). Meanwhile, the cash dividend rate in previous years only remained around 15-18%. Regarding this year’s profit distribution plan, the dividend rate is expected to decrease to 22%.

Tan Cang Logistics (UPCoM: TCW) recorded nearly VND 431 billion in revenue, up 16% from the first half of last year and fulfilling 55% of the full year target. In which, providing services such as loading and unloading goods, exploiting warehouses, storing goods, transporting … brought in more than 428 billion VND. Profit after tax increased 15% to 47 billion dong, equivalent to 56% of the plan.

According to businesses, the Cat Lai CFS warehouse project – Phase 2 (the retail warehouse) put into operation this year will contribute to improving the quality of Cat Lai CFS warehouse services. In addition, the implementation of projects outside Cat Lai port such as the 3.2 ha Phu Huu project, Thuy Inland port and the 7.3 ha Dong Nai project will contribute to expanding production areas and increasing revenue for the unit. , as well as reducing pressure on the warehouse system.

Regarding Tan Cang – Long Binh ICD (HoSE: ILB), 6-month revenue increased 16% to nearly 256 billion dong, mainly from warehouse leasing and related services. The company said that thanks to the growth in warehousing demand and the reduction in financial costs due to the reduction in lending interest rates, profit after tax increased by 28% to more than VND 40 billion, equivalent to 62% of the year plan.

Although appearing relatively late compared to competitors, ICD Tan Cang – Long Binh is currently a leading enterprise in the field of logistics and ICD inland customs clearance services in the Southeast region. The company also has the advantage of being located in a location surrounded by many large industrial zones of Dong Nai province and arterial roads, which will be one of the biggest beneficiaries of this trend. growth of import-export activities and freight demand of Dong Nai province to Cat Lai and Cai Mep port systems.

In addition, this enterprise owns a land bank of nearly 230 hectares in Bien Hoa City, Dong Nai, which is the logistics and ICD unit with the largest ground area in the country and possesses the advantage of outstanding scale. compared to regional enterprises such as ICD Transimex (10 ha), ICD Sotrans (10 ha), ICD Phuoc Long (15 ha).

In addition, some other “Tan Cang” businesses listed on the floor such as ICD Tan Cang – Song Than (UPCoM: IST) or Tan Cang – Phu Huu (UPCoM: PNP) also have relatively positive results. Half a year.

|

In early August, the Hanoi Stock Exchange (HNX) approved the registration for trading of 26.5 million TOS shares of a member unit of Saigon Newport, which is Tan Cang Marine Services Joint Stock Company. The floor price and the official date of listing the shares for trading on UPCoM have not been announced.

Established in 2012, this business is different from the above logistics and ICD companies when it takes the orientation of exploitation and fleet management for the oil and gas industry as the foundation. Specifically, some core business activities can be mentioned such as providing oil and gas service ships; transportation and installation of marine oil and gas works; survey of underground works; towing and rescue; Port operation management, financial investment… Tan Cang Marine Services also owns 4 subsidiaries and is associated with diverse industries such as providing hotel services, travel agencies, waterway transport, construction. build a port…

The company’s service fleet consists of 19 ships, diverse in capacity and types, capable of supporting drilling, exploration, oil and gas production, rescue and rescue operations, etc. The unit also owns 2 barges. serving the transportation of marine works and 2 underground survey equipment.

This year, the company continues to rejuvenate the fleet by liquidating old, old ships such as TC 69, TC Princess, TC 63 and investing in new ships with modern equipment and less age. more than 10 years.

Chi tiết một số tàu dịch vụ của Dịch vụ biển Tân Cảng. Nguồn: BCTN năm 2020 của Dịch vụ biển Tân Cảng |

The unit also plans to develop the project of petroleum service port Hon Chong, Kien Giang; seek to invest in more infrastructure of wharves, river ports/seaports with strategic locations to be put into operation in the area of Long Son – Ba Ria Vung Tau and Nghi Son industrial park – Thanh Hoa. In addition, the company plans to develop more in new domestic and regional markets such as Thailand, Myanmar, Malaysia; completed the construction investment of 9 hectares at ICD Tan Cang Que Vo, Bac Ninh and transferred shares to the strategic investor PSA – Singapore.

Regarding the business plan for 2021, the enterprise sets a target of 1,049 billion dong in revenue and 130 billion dong in profit after tax, increasing by 5% and 8% respectively compared to last year. After the first half of the year, revenue was flat at 630 billion dong, profit from selling ICD Que Vo shares brought in nearly 6 billion dong. Accordingly, profit after tax reached more than 63 billion dong, up 6.5% over the same period. With semi-annual results, the company fulfilled 60% of revenue target and 48% of profit target.

Regarding shareholder structure, as of June 30, Saigon Newport is the only major shareholder with an ownership rate of 35.28%, equivalent to more than 9.3 million shares. At the Annual General Meeting of Shareholders in 2021, the company’s shareholders approved the plan to issue more than 4.2 million bonus shares to existing shareholders and offer 298.125 shares at the price of 10,000 VND to the expected investor, Tan Cang. Saigon. Accordingly, charter capital is expected to increase from 265 billion to 310 billion.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com