The crisis in Ukraine has thrown global energy markets into turmoil, with a particularly unloved commodity – coal – enjoying a resurgence as European countries rethink fuel sources. , including “dirty” fuel to be able to get rid of dependence on Russia.

Western sanctions on Russia, such as restrictions on access to European ports, have prompted Asian and European companies to rush to find alternative suppliers, such as Australia.

The Russia-Ukraine conflict has created a global crisis, exacerbating concerns about coal supplies amid a market already undersupplied by supply disruptions in the world’s top exporters. The world is Indonesia and Australia, as prices for oil and other commodities also skyrocketed to multi-year highs.

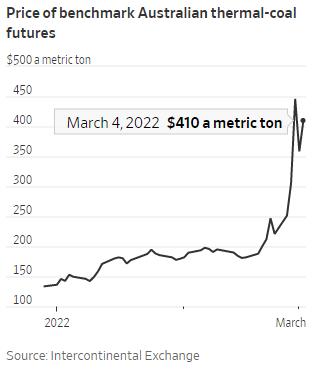

Australian thermal coal prices.

The price of thermal coal on the world market in the first week of March spiked to a record high of $446/ton, reflecting that governments are rearranging priorities after trying to eliminate them. phasing out fossil fuels because they contribute significantly to climate change.

Immediately after Russia carried out the “Special Operation” in Ukraine, Poland asked Australia if it could provide coal that could replace the Russian imports. The Italian Prime Minister has proposed restoring coal-fired power plants because of concerns that natural gas supplies from Russia will be cut off. Meanwhile, Germany signaled it could extend the life of its thermal power plants – expected to close by 2030 – just days after it suspended licensing for the road project. Nord Stream 2 gas pipeline – a pipeline that could double the amount of gas that the country imports directly from Russia.

The European Union imports more natural gas from Russia than any other country, presenting a significant hole in the bloc’s economy if supplies are cut. The advantage of coal is that power plants can switch from natural gas to fuel in a short time. But the difficulty is that Russia is also a major supplier of thermal coal to Europe.

Russia is the sixth largest coal producer in the world, having exported 223 million tons in 2021. Its thermal coal accounts for 17% of global coal trade, while coking coal accounts for 9%. China is Russia’s largest coal customer. Russian coal accounts for 17.6% of China’s coal imports in 2021, which is 324 million tons.

Annalena Baerbock, Germany’s Foreign Minister and a member of the pro-environment Green Party, said Germany would be forced to use coal for a long time due to the conflict between Russia and Ukraine.

According to ICE Futures Europe, the price of Australian thermal coal futures on March 9 reached 141 USD/ton. Australia is one of the world’s leading coal exporters. In early 2022, the price of Australian thermal coal was only $134/ton. In just the past week, the price of Australian coal has increased by 35%, in the past month it has increased by 70%, and compared to the same period last year, the price is now 358% higher.

Northwestern European coal prices.

Coal prices in other regions also increased rapidly. In particular, coal prices in Europe continuously break records.

“These are times that I haven’t seen in 40 years in my business,” a US-based coal broker said of global coal prices. “We’ve never seen a disruption like this before.

“The price movements right now are crazy. ‘One hundred dollars’ – crazy really,” said Rory Simington, a senior coal analyst at consulting firm Wood Mackenzie.

Coal is not covered by Western sanctions against Russia, but European and Asian coal buyers are scrambling to buy, depending on how much of an impact the Ukraine incident has on coal imports. surname.

On the global market, Russia accounts for about 15% of thermal coal traded by sea and about 16% of metallurgical coal, used to make steel, which has also experienced a price surge to record highs. green. For Europe alone, Russia meets about 40% of coal demand.

Coal importers fear that financial restrictions on banks could deter trading, or that coal could be included in a broader set of sanctions if the crisis deepens than. Buyers are also concerned that Russian coal will not be delivered if the conflict escalates, as shipping from the Black Sea becomes crippled.

Danish company Orsted AS recently said it had stopped supplying coal from Russia for its energy operations.

Another example of the threat to coal supplies is a large ship that was recently hit by bullets in the Black Sea. KRU, a Russian steel and coal producer, had declared force majeure on cargo arriving at western Russian ports before the conflict escalated because of difficulties in rail transport. Several Russian thermal coal miners also reflect the same problem.

Credit Suisse analyst Matthew Hope said: “The thermal coal market has been scarce since before Russia launched ‘Special Operation’ in Ukraine, so there is no chance for the world to replace the source of thermal coal exports from Russia”.

Another important issue is Europe’s reliance on Russian high-energy coal, which is found only in a few parts of the world. In addition, miners often run their operations near full capacity, meaning they cannot produce more coal quickly. That hasn’t stopped European nations from developing networks, though, in search of new supplies.

“Recent requests from Poland for Australia for coal to replace Russian coal show that the world is increasingly looking to Australia for the resources it needs to provide energy security,” said the Finance Minister. Australian resource officer, Keith Pitt, recently said. Coal is leading the spike in Australia’s export earnings from natural resources, he said.

Jean-Sébastien Jacques, former chief executive officer of Rio Tinto PLC, the world’s second-largest mining company, said: “In response to the immediate energy situation in Europe, all means should be considered. projects — including increased coal use in some countries.

References: WSJ, Minning

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com