The steel industry is entering a difficult time when steel prices have plummeted in recent times as well as a large decline in steel demand in China, the world’s largest steel consuming market, causing factory owners to fall. into a bad feeling.

In China, steel mill owners across the country are facing a dire situation. Steel inventories are piling up in the warehouses of the country’s largest steel production hub in Tangshan city, as well as in Jiangsu and Shandong provinces. They said the demand for steel is falling amid the country’s blockade to combat the epidemic, closed factories and paralyzed construction activities.

Steel is an important raw material for the world’s leading manufacturing power, but it is not being used across the country in the context of production activities being disrupted because of Covid, forcing demand and prices down. .

Prices of steel and iron ore (the main component of steel) both fluctuated strongly during the blockade of Shanghai, but began to decline earlier this month.

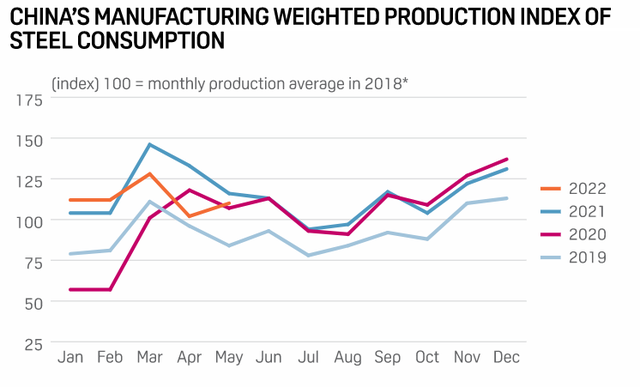

Steel production index of factories in China over the years. Source: S&P Global

China’s steelmaking industry has an extensive supply chain that stretches from China’s blast furnaces to foreign iron ore mines such as Australia and Brazil, the largest suppliers of iron ore to China. Therefore any disturbance in the Chinese market could have a major impact on supply chain networks, adding further pressure on the ongoing supply chain disruptions taking place globally.

According to China Iron and Steel Association, daily output of intermediate steel products such as crude steel and cast iron as well as finished products increased in May by 1% to 3%. On the contrary, the demand has decreased a lot while still operating.

China’s crude steel consumption fell 14% in May year-on-year. Niki Wang, head of iron ore research at S&P Global Commodity Insights, cited the data. This is making China’s steel mill owners worried as demand is affected.

Despite falling steel prices and eroding profits in steel production, steel mill owners continued to produce. China’s blast furnaces are now operating near full capacity, at more than 90% – the highest rate in 13 months – despite lower profits, analysts say.

Price data shows that prices of popular steel products such as rebar and hot-rolled coil used for housing construction have dropped by as much as 30% after peaking around May last year following a resurgence. industry to kickstart the economy.

Steel price movements in the first 6 months of the year. Source: Tradingeconomics.com

Shutting down blast furnaces can be inefficient, as the large reactors used to turn iron ore into liquid steel need to run continuously. After decommissioning, it takes a long time up to six months to restart the operation of blast furnaces. So miners in China are keeping their blast furnaces “hot” by using lower grade ores to reduce production in the hope that they can quickly ramp up and meet demand. steel bridge when recovering and blockade orders are lifted.

“We believe that operators are also producing larger quantities of semi-finished steel products so as not to depress finished steel prices with inventories running high.”

Steel industry experts say another reason for producers to stay afloat is that they can hit their annual allowable output targets before Beijing cuts them next year as part of an effort meet emissions targets by 2030 and 2060.

“Each year’s output is determined by the previous year’s output. So it’s in the advantage of manufacturers to produce the maximum amount of steel each year as the cut will be applied to the year’s output. afterward.”

Future prospects of the steel industry

According to experts, while some factories are contemplating a slowdown in production, inventory levels are still far from “panic” levels and storage capacity is not yet a serious problem.

However, there are early signs that the industry is beginning to adjust to these adverse conditions.

Rumors have begun to surface that the Jiangsu provincial government has asked local steel mills to cut output by about 3.32 million tons for the remainder of 2022. However, this information has not been reported. verified and no one knows whether it was an attempt to curb excessive steel inventories or simply an effort to cut output and emissions.

“I think China is fully aware of weaker domestic steel demand this year and the authorities will step in to force it,” said Alex Reynolds, analyst at Argus Media Energy and Commodity Prices. factories cut output compared to before.”

“If steel prices continue to plummet with prolonged losses, the Chinese government can give an exact number of production cuts – just like what OPEC did for oil when the Covid epidemic was at its peak. in 2020-2021.”

Experts from S&P Global also agree, adding that stimulus from Beijing’s loosening monetary policies will also help revive dwindling steel demand.

While other players in the steel production supply chain, such as the iron ore miners of Australia and Brazil, need not worry as lower output from mines has offset lower demand. However, miners are still concerned about the plunging steel prices in China.

Iron ore prices have fluctuated between $130-$150/mt over the past two months, compared with a low of $30-$40/mt during the 2012-2016 slump.

Reference: CNBC

T&G Import-Export Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 02473010868

Email: hrm@tginterjsc.com

Website: http://tgimportexport.com