China, India, Indonesia all increase coal mining in the end of the year, but the shortage of energy will continue this winter.

The production crisis in Asia’s “coal bowls” such as China and India is beginning to ease, but this is not enough to stop the energy crisis in Asia.

Key Asian industries ranging from steelmaking to chemicals are expected to continue to face power outages through the winter as fuel supplies remain tight while governments prioritize energy sources. for household heating.

Coal India Ltd., the world’s leading coal miner, has suspended coal deliveries to all other partners except power plants, even as they ramp up production. Natelie Biggs, head of thermal coal research at Wood Mackenzie, said: “Supply to markets is unlikely to increase this winter. If temperatures this year in the Northern Hemisphere are colder than usual, like last year. Last year, we’re going to have severe energy shortages in some areas.”

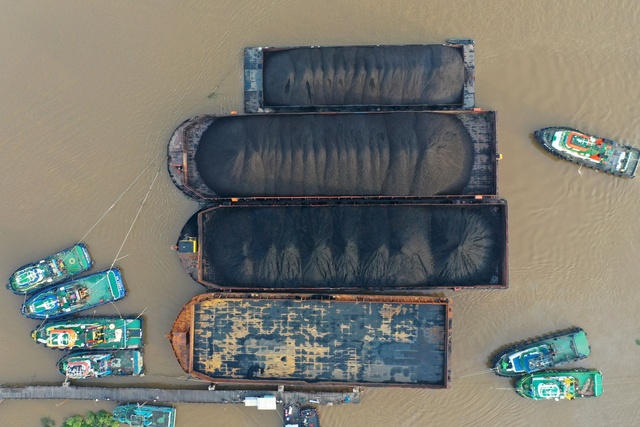

China, the world’s largest fuel producer and consumer, may increase mining output by 100 million tons in the fourth quarter. Stockpiles are gradually building up in India after more than three weeks of decline while Indonesia – the world’s top coal exporter – has also recovered production after being disrupted by heavy rains.

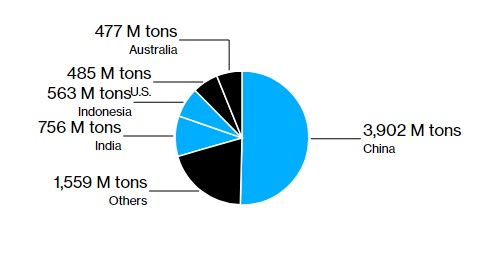

Asia has three coal mining powers: China, India and Indonesia.

These three countries are the world’s top coal producers while China and India are currently the largest consumers – accounting for nearly two-thirds of the world’s supply. Even with increased mining activity, global coal production will still be below 2019 levels while demand grows, according to Biggs.

Safety issues in China, heavy rains in Indonesia and Australia, and logistical problems in Russia and South Africa have hampered coal supplies this year. Combined with the post-pandemic recovery of industrial activity, global shortages became acute, driving prices to record highs causing power cuts.

The mines are playing catch-up. The country has increased production and is expected to reach the annual target of 625 million tonnes, said Synindyo Suryo Herdadi, director of the coal and minerals program at the Indonesian Ministry of Energy, Resources and Minerals.

In China, monthly production was about 18 million tons higher than last year. Authorities are also addressing a number of roadblocks to help producers keep pushing up output. In total, China may add 100 million tons this quarter.

This could help China keep its economy running smoothly, homes warm, but energy-intensive industries will have to cut electricity. According to UBS Group, output from industries such as steel and cement could drop by 30% by the end of this year.

“Energy shortages remain a clear winter risk in China,” said Lara Dong, head of China’s renewable energy research division at HIS Markit. Heating demand is expected to increase with temperatures forecast to drop from this weekend in many parts of China.

In India, coal stocks at power plants are growing, although inventories are still nearly 80% lower than a year earlier. Several states have seen prolonged power outages and electricity prices this week rose to a 12-year high. Coal India is also continuing to divert supply away from some industrial partners, causing complaints from industries including aluminum production.

“The government will do whatever it takes to prevent widespread blackouts, even if it means cutting supply for some industries,” he said.

Reference: Bloomberg

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com