Coal prices in Europe and Asia rose to record highs while US coal prices exceeded $100/ton for the first time in 14 years. The global coal market is heaving in fear that an EU embargo on Russian coal exports will disrupt global coal supplies.

The European Commission (EC) on April 5 proposed a ban on coal imports from Russia worth 4 billion euros ($4.3 billion) a year in the fifth package of sanctions against this country. Russian oil and gas could be the next subject of sanctions. Other proposals target imports from Russia in the technology and manufacturing sectors, valued at 10 billion euros.

EU decisions will not only increase the electricity bill of every European household. The proposed EU coal embargo would force global wholesale coal flows to be diverted, driving up coal and gas prices, driving up the cost of electricity generation, and ultimately pushing up electricity and gas bills. to businesses and households, not only in Europe but will certainly have a significant impact on other coal importing countries in Asia, Africa and Latin America.

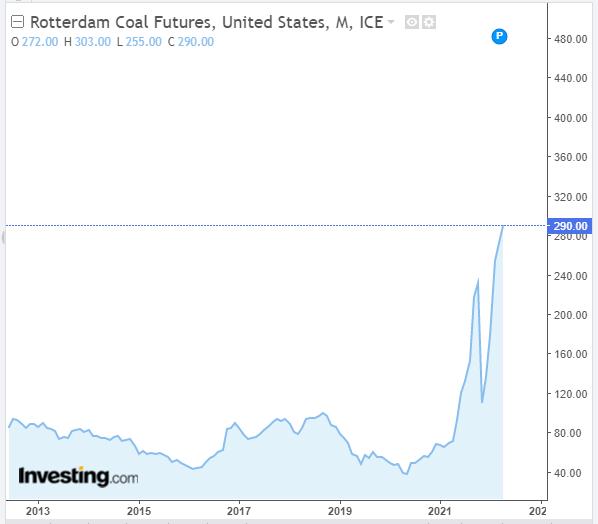

The one-month coal futures price on the Rotterdam market in Northwest Europe is currently at 266 euros/ton from its previous historic high of 174 euros in June 2008 (price adjusted for inflation).

Coal prices in the Netherlands.

Europe’s coal production has fallen faster than consumption in recent years – leaving the region increasingly dependent on imports, especially from Russia, to make up the shortfall.

Europe now depends on imports for more than 40% of its coal consumption, up from less than 30% at the turn of the century, according to data from BP (“Statistical Assessment of World Energy”, year 2021).

Russia supplied about 50% of coal imports in both 2019 and 2020, accounting for more than 20% of the region’s total coal consumption.

Coal exports from Russia to Europe were the world’s third largest bilateral flow in 2019 – before the pandemic, and fifth largest in 2020, when the outbreak was at its peak.

Russian exports to Europe accounted for 6-7% of inter-regional coal trade in both years. If Russia’s exports to Japan and South Korea, America’s main allies in Asia, are included, the share rises to 10-11%.

Assuming the EU implements an embargo on coal from Russia, it would have to increase imports from Colombia, South Africa, Indonesia and Australia significantly.

That would force other major coal importers, including China, Japan, India and South Korea, to turn to Russian supplies.

In fact, total global production is likely to decline, as Russia and perhaps other exporters are struggling to switch destinations due to logistical constraints caused by the pandemic. causing the price of coal to rise affecting all consumers.

Global coal supply has been tight over the past year as shortages in China and India affect power production, so the loss of output by Russia or other producers will not easily be resolved. if not raise prices.

And even with price increases, rerouting coal flows in this way would force all countries to import from sources much farther away than in the past, significantly increasing transportation times and costs. transportation – a very important factor for this commodity because coal is a bulky commodity, so transportation costs account for a large proportion of the price when it reaches the end consumer.

On the other hand, most coal is used to generate electricity, an area where it competes mainly with gas. Meanwhile, gas prices in Europe and Asia are currently trading at very high levels as traders anticipate possible disruptions in supply through the Russian pipeline to Europe. The current sky-high gas prices are signaling the need to maximize coal-fired power output as much as possible this summer to save gas for storage before next winter.

As such, coal and gas are creating a vicious cycle of interdependence where both are in short supply. High gas and coal prices are driving each other up further. Record high coal prices will certainly keep gas prices high, and electricity prices will not be able to leave record highs.

Like crude oil, coal is a partial substitute – coal from different sectors and countries also varies considerably in energy content, volatile organic compounds, ash and other impurities.

Most generators are designed to work efficiently with specific types of coal. Switching to imperfect substitutes will increase fuel costs for all generators, increasing the price of electricity.

Reference: Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com