China has made an unprecedented intervention in the global oil market by releasing its national strategic oil reserve for the first time with the express purpose of lowering the price of this energy.

The announcement comes amid soaring energy prices in China, not only for oil but also for coal and gas, and power shortages in some provinces that have forced some factories to cut production. quantity.

Inflation is also increasing rapidly – a political issue that causes “headaches” for the country’s leaders.

Oil prices soar – the reason why China released its reserves

In a statement released late on Thursday, China’s National Food and Strategic Reserve said that the country has used its oil reserves to “relieve the price pressure of raw materials”. get a raise”. The announcement did not give more specifics, but several sources familiar with the matter said the announcement referred to millions of barrels of oil the Government had brought to market in mid-July.

China’s reserve management agency also said that the “normalization” of the rotation of state crude oil reserves is “an important measure to stabilize the market”, indicating that it may continue to export crude oil. more oil reserves to the market.

The agency added that bringing national oil reserves to the market through open tenders “will help stabilize supply and demand in the domestic market”.

International reporters have made calls to the media agencies of the State Council of China and the National Development and Reform Commission, but have not received a response.

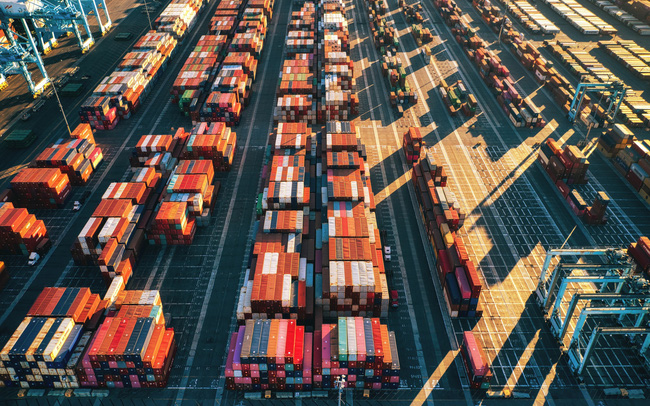

China is the world’s largest oil importer. Over the past decade, the country has built up huge stockpiles of goods. China’s strategic stockpiles, known as SPRs, have a different purpose than those in the US and Europe – to be used only during supply outages or during war. And China is signaling that it is willing to use its reserves for the purpose of influencing the market (lowering oil prices).

“It’s a pretty clear statement of intent to use SPR,” said Bob McNally, a former senior White House policy adviser and current executive at Rapidan Energy Group, a Washington consulting firm. to reduce oil prices for domestic refineries”.

The announcement of the intervention in the oil market came after China’s factory gate inflation accelerated to a 13-year high and just a month after the White House publicly recommended the Organization of Petroleum Exporting (OPEC) pumped more crude oil to the market amid a sharp increase in gasoline prices in the US.

The fact that both Beijing and Washington act at the same time with the same purpose shows that these two largest energy consumers in the world both consider the threshold of 70-75 USD/barrel as a red line for oil prices.

Hurricane Ida also severely reduced US crude oil production due to a series of shutdowns, affecting China’s supply to Unipec.

China has also sold other commodities from its strategic reserves, including copper, aluminum and grains, to cool the rising price of raw materials.

The country’s producer price inflation in August 2021 rose to the highest level in 13 years, as prices continued to rise despite the government’s measures to cool down. Accordingly, the price index of Manufacturers (PPI) rose 9.5% last month compared with the same period last year, stronger than the 9% growth forecast in a Reuters survey and also higher than the 9% increase in July. .5% is the strongest since August 2008.

China’s National Bureau of Statistics (NBS) said the sharp increase in PPI was due to the sharp increase in prices of raw materials for coal production, chemicals and metals. The sharp rise in commodity prices in recent months has hit factory production and threatens to hamper the economic recovery.

In the past, Beijing rarely confirmed such moves, but information leaked to the market through traders. The country’s public announcement of its current plans to sell raw materials is believed to be an attempt to maximize the impact of this move.

While imports of many materials are on a downward trend, crude oil imports into China are still increasing rapidly as refineries are speeding up operations to meet rising fuel oil demand. Independent refiners in Shandong increased their operating rates to 66.25% at the end of August from 62.3% in mid-August.

China Customs data shows that the country increased crude oil imports by 8% in August 2021 compared to July 2021, to 44.53 million tons, equivalent to 10.49 million barrels per day (bpd). bpd), up from 9.71 million bpd of imports in July, but still below the 11.18 million bpd of August imports.

Another indicator of increased fuel demand in China is that while crude oil imports increased, China’s exports of refined petroleum products in August stood at 3.73 million tonnes, down from 4. 64 million tonnes in July, hitting the lowest level since July 2020.

Reference: Bloomberg

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com