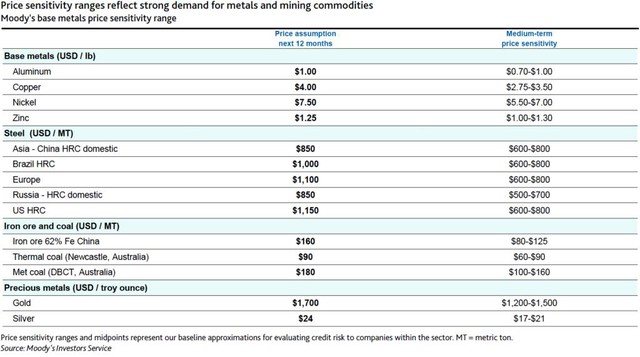

Moody’s has just released a detailed report on the medium-term price outlook of commodities: iron ore, steel, coal, aluminum, gold, silver, nickel, copper and zinc, with the content that the outlook for the mining and metals industry has been changed. there is a fundamental change.

The just-released Moogy’s Investment Services report has revised its forecast for the metals market from “positive” to “stable”, despite suggesting that most metals prices are consistently surpassing milestones. historical highs, but that doesn’t mean prices will continue to rise further.

According to Moody’s, the current high prices will gradually decrease, although the demand for metals in particular and the mining industry in general will remain high. The organization thinks prices of most base metals will remain firm through 2022, after hitting record highs this year.

“We expect this industry’s earnings (earnings before tax, excluding interest and excluding slippage) to grow by about 8% through mid-2022, on the basis that the recovery of the world economy will boost demand for base metals, iron ore, steel and coal increased.”

– Barbara Mattos – Vice President of Moody’s

In this report, Moody’s refers to the medium-term price outlook for iron ore, steel, coal, aluminum, gold, silver, nickel, copper and zinc, with most prices forecast to surpass all-time highs. historical record.

Moody’s forecast for metal prices

Among the key base metals, Aluminium prices are expected to continue rising until at least early 2022, surpassing $2,600/ton, or $1.18/lb, the highest in a decade, then remain steady until mid-2022.

The price of VND is also expected to remain elevated until at least the end of 2022 relative to the historical average. In the long term, the supply shortage is expected to continue to support the price of this red metal. Countries’ efforts to reduce carbon emissions, by switching to clean energy sources, also benefit the copper industry, leaving suppliers struggling to keep up with demand. demand in some regions, including Chile.

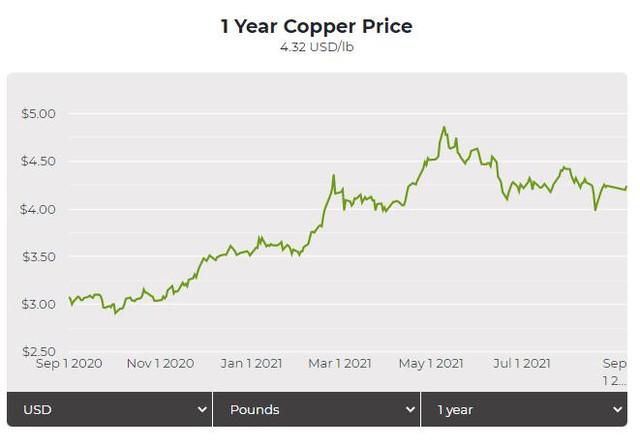

Copper prices have remained above $4.00/lb since February due to a significant recovery in demand. In early May 2021, the copper price climbed to nearly 5 USD/lb, before falling again in the context of China being at risk by the Delta variant Covid-19 virus slowing down production in the country, leading to copper imports also decreased.

Moody’s forecasts copper prices in the third quarter of 2021 will remain at a high level, around $2.50 to $3.00/lb as in the years before the Covid-19 pandemic.

Copper price movements

Despite the resurgence of Covid-19 in many parts of the world, global industrial activity remains strong overall, with the US and European manufacturing purchasing managers indexes both above 60. , and in China it is above 50 (above 50 indicates growth).

Moody’s expects high NICKEL prices in the first half of 2021 to be unsustainable into 2022, but likely to remain high at least through early 2022.

Nickel production has fully recovered to pre-pandemic levels, so nickel supplies are expected to be plentiful. In August 2021, nickel prices were around $19,000/ton, or $8.62/lb, up nearly 40% from the 2020 average of 13,784 tonnes ($6.25/lb) amid activity. economic recovery, the lifting of restrictive anti-Covid-19 policies and expectations of high demand for batteries.

However, analysts say the supply of nickel pig iron (NPI) – a low-grade ferronickel and a cheaper substitute for pure nickel in stainless steel production – will increase. In Indonesia, more mining facilities have come into operation.

An increase in Indonesia’s NPI is expected to offset falling output in China, which faces reduced ore supply and rising ore prices.

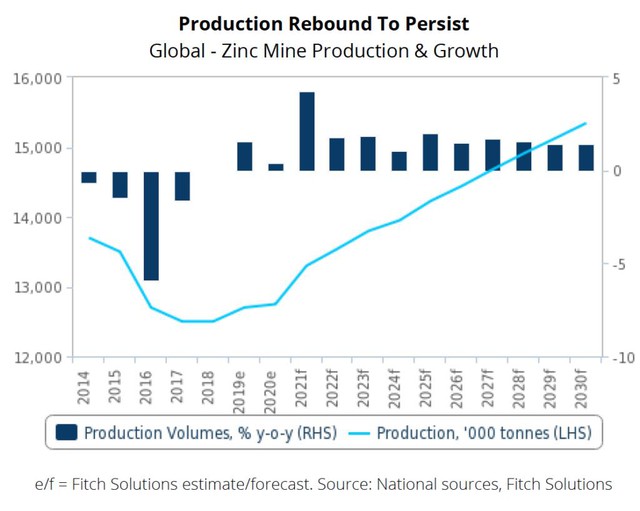

While the KẼM price has demonstrated “strength” (bullish) in mid-2021, the long-term price of this metal is forecast to decline as long-term zinc production growth outpaces low demand growth. Even so, zinc prices are forecast to continue to rise in the second half of 2021 amid strong demand from the steel sector and reduced zinc production in China.

The world zinc market is currently moving from deficit to surplus, with production recovering in the major zinc mines of Peru, Mexico and Bolivia among others.

Based on that, Fitch Solutions’ Risk and Industry Research has released a report claiming that global zinc mined production in 2021 is likely to grow at the fastest rate since 2012, 4.3%, when the Covid-19 epidemic gradually subsided and the anti-Covid-19 lockdown/social distancing policies were gradually lifted.

Zinc production

After 2021, the recovery in catches – which began in 2019 after five consecutive years of decline – will continue, Fitch said. “However, a gradual decline in zinc prices will limit the scale of expansion of existing projects as well as the development of new projects because the attractiveness of such projects decreases with the price of zinc. “We forecast production. Global zinc mining will grow at an average annual rate of 1.9% between 2021-2030,” Moody’s said.

A series of metals are forecast to return to their previous levels. It is forecast that the price of IRON after 2022 will gradually return to an average level of 70 to 80 USD/ton as in the period 2016 to 2019.

In the short term, tight iron ore supply will keep prices high until 2022. However, prices are now sharply down from their peak in early 2021 due to increased supply and reduced demand growth. gradually.

The price of THAN is expected to remain relatively high but will gradually decrease as supply problems and geopolitical disputes will subside.

Meanwhile, the worldwide supply-demand imbalance for STEEL will return in 2022, causing prices to forecast to gradually decline towards historical averages, after reaching an unusually high this year.

As for precious metals, Moody’s forecasts that market volatility, low real interest rates and inflation will keep GOLD prices above previous years’ normals until 2022, but predict prices will fall away from around $1,800. /ounce in the third quarter of 2022, in the context of continued economic recovery, stronger US dollar and gradual increase in gold production.

“Several economic indicators suggest inflation will rise above central bank expectations, and the US Federal Reserve is unlikely to change its policy stance anytime soon.

Silver price is forecast to continue to stay high in 2022, reflecting the same factors as for gold, and by continued industrial demand.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com