A stockpile of aluminum in Vietnam is large enough to end a global shortage. But for now, that aluminum warehouse is untouchable. According to estimates, the aluminum warehouse could be worth up to 5 billion USD at current prices.

The above aluminum warehouse belongs to Global Vietnam Aluminum (GVA) or Global Aluminum, an FDI enterprise of Chinese-Australian owners.

Bloomberg recently quoted an official from the General Department of Vietnam Customs as saying that 1.8 million tons of Global Aluminum is currently kept under strict supervision, only a small amount is transferred to the company. service production line.

Going back to the past about the formation of this aluminum warehouse, at the end of 2016, the Wall Street Journal published an investigative article showing that the Global Aluminum Company, which is behind China Zhongwang, is the aluminum gathering point in Vietnam to delete the origin of Chinese goods before exporting to the US to avoid taxes.

Our data on the inventory value of Global Aluminum recorded at the end of 2016 was more than VND 50,400 billion. In the next two years, Global Aluminum’s inventory increased sharply, reaching VND 96,750 billion at the end of 2019.

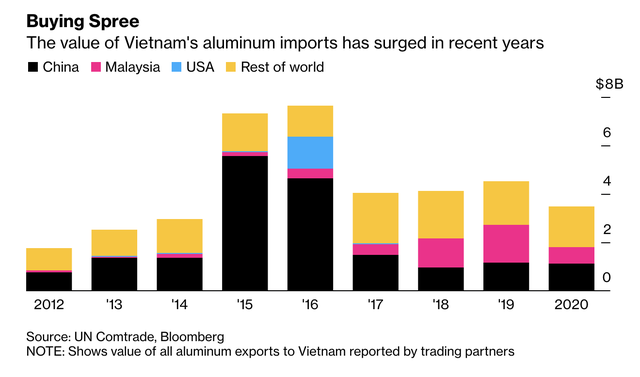

Data from Bloomberg shows that the market price of Vietnam’s aluminum imports was at a high level in the 2015-2016 period, at $7.3 billion and $7.7 billion, respectively. In these two years, aluminum imports from China accounted for the most, recording $5.6 billion and $4.6 billion.

After the impact of the COVID-19 pandemic, aluminum prices increased rapidly. Since the end of March 2020, aluminum prices have increased by nearly 120% by mid-October 2021, before adjusting again recently. The sharp increase in aluminum prices and the global shortage made people start to notice the huge aluminum stockpiles that have been covered for many years.

In July 2020, the State Audit (State Audit) made a conclusion that Global Aluminum Company had signs of price transfer, corporate income tax (CIT) evasion and illegal money transfer abroad.

According to the State Audit, Global Aluminum has increased the warehouse rent of the relevant unit, PTL Logistics Services Co., Ltd. (PTL Logistics) many times higher than the input rent for the purpose of transferring the price to at least 2,680 billion dong in the period 2015 – 2019. By transferring shares and dividing profits, PTL Logistics has transferred hundreds of billions of dong abroad.

According to the State Audit, the amount of transfer pricing will, in principle, increase costs, reduce the payable CIT taxable income of Global Aluminum Company or increase the amount of loss transfer to offset taxable income in the following years.

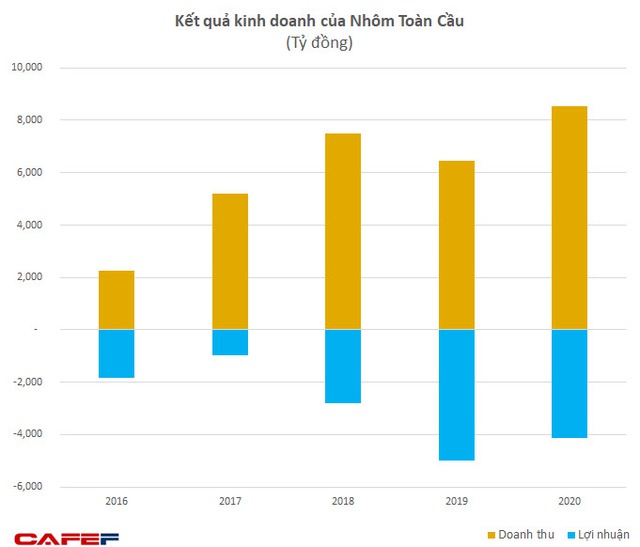

According to the data we have collected, in the period 2016 – 2020, Global Aluminum lost a total of 14,716 billion VND. This company has a gross loss on each year and recorded a very heavy loss in the last two years. Therefore, the equity of Global Aluminum as of December 31, 2020 is negative to 11,323 billion dong.

In the opposite direction, in the above 5-year period, PTL Logistics achieved total revenue of VND 4,230 billion and profit after tax of VND 2,562 billion. Operating gross profit margin fluctuates at a high level of 75 – 80%.

The story of Global Aluminum’s aluminum warehouse was covered in the international press many years ago.

At the end of 2016, the Wall Street Journal (WSJ) published an article exposing the fact that Chinese billionaire Liu Zhongtian borrowed Vietnam as a transit point to export aluminum to the US market to avoid anti-dumping tax. It is known that if Vietnam’s aluminum exports to the US only pay about 15% tax, but China’s aluminum exports to the US are subject to tax up to 374%.

According to the WSJ, behind the Global Aluminum company is China Zhongwang, one of the world’s largest aluminum production companies in China, the company of Liu Zhongtian. At that time, he owned a fortune of nearly 3 billion USD (Forbes), now it has decreased to 1.8 billion USD.

However, Zhongwang replied that Global Aluminum (Vietnam) was not involved, and was not a customer of the Chinese company.

On the Vietnamese side, in mid-2017, relevant authorities and Ministries conducted an audit of Global Aluminum Company under the direction of the Deputy Prime Minister.

In the latest report of the General Department of Customs on aluminum warehouses in Ba Ria – Vung Tau province (November 2019), this agency said:

From 2015 to September 30, 2019, the total amount of aluminum material imported by Global Aluminum was more than 2.44 million tons, with an export of 400,000 tons. On average, the company imports 488,000 tons/year, while exporting 80,000 tons/year (equivalent to 16.3% of annual imports, 40% of capacity compared to designed capacity). Particularly, import activities decreased significantly in 2019, as of September 30, 2019, the import volume was more than 64,435 tons, relatively in line with the average annual export volume of products.

At the time of reporting, Global Aluminum is storing more than 1.8 million tons of aluminum in outsourced warehouses and more than 200,000 tons of aluminum at the factory. Aluminum raw materials the company imports mainly from China, Mexico, USA, Australia, Russia, Mexico, Malaysia, Indonesia. The company’s finished aluminum products are exported to many different countries such as Canada, Egypt, India, Malaysia, Indonesia, Singapore, USA…

In the introduction, Global Aluminum notes that it is a 100% Australian owned company. Global Aluminum’s factory has a capacity of 200,000 tons of products per year, partially produced and then sent to leased yards. The party also providing warehouse leasing services are Phu My General Petroleum Service Port Company (PTSC yard, TH Thi Vai yard), PTL logistics service Co., Ltd (PTL Logistics), Joint stock company Thanh Chi.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com