The Baltic Dry Index (BDI) – published by the Baltic Exchange – for the week ended 11/12 increased for the first week in 5 weeks due to freight rates for capesize ships – 150,000 tonnage. tonnes, which usually carry commodities such as iron ore and coal – rebounded.

The general freight index – including freight rates for capesize, panamax and supramax ships, was at 2,807 on 11/12, up 3.4% for the whole week. In which, the capesize freight rate index increased by 17% last week.

Although sea freight rates increased last week, the increasing trend is unlikely to be sustainable, because in addition to the increased freight rates for capesize ships, the rates for other types of ships have continued to decrease.

There are signs that freight rates will fall again. The fact that the BDI index, despite rising in the past week, is still around its lowest level since June as shipping companies specializing in transporting coal have fallen under the radar of opponents. the use of fossil fuels.

Notably, freight indexes on Friday (November 12) all decreased, with BDI down 37 points (1.3%) compared to the previous session, the capersize freight index in the same session decreased by 36 points. point (0.9%) day-to-day, to $3,836, ending a streak of five consecutive declines, with the average capesize charter price on 11/12 down $298 to $31,811. The reason is that iron ore prices last week continued to fall for the 5th consecutive week due to concerns about the prospect that demand for steelmaking materials in China will continue to be weak.

In the past week, except for the capesize freight index, which increased, the rest of the indexes decreased. Accordingly, the panamax ship freight index – 60,000 – 70,000 tons, usually carrying coal or grain – last week decreased by 4.6%, of which Friday session (November 12) dropped 96 points, or 3 points. .2%, down to 2,930, the lowest level in 5 months, for the whole week decreased by 6.7%; Average freight of panamaxe ships on 11/12 session increased by 2 points, or 0.1%, to $2,253, before that the average freight rate of this type of train had decreased for 15 consecutive sessions.

The shipping market has cooled down after being ‘hot’ for many months. Ocean freight rates have decreased by about 50% since September as a result of the weakening of trade flows, especially iron ore, and the cooling of China’s real estate market due to difficult-to-solve problems of the development company. Evergrande real estate. The fast growing fleet of cargo ships also contributes to cooling the real estate market.

Allied Shipbroking said the contagion from the Evergrande near-bankruptcy had hit domestic steel demand levels in China’s property market, combined with coal supply problems. resulted in a “negative shock” to market capitalization. “It is very likely that the current trend will continue in the coming days,” the company said.

Indeed, shippers have been relieved of their burden thanks to a 50% reduction in container freight rates on the transpacific route since September.

Shabsie Levy, CEO and Founder of New York-based digital freight forwarding company Shifl, said, “With the holiday shopping trend seemingly over and goods coming to an end. With goods already placed inside thousands of containers on ships across the US, spot market rates will continue to fall in November 2021.”

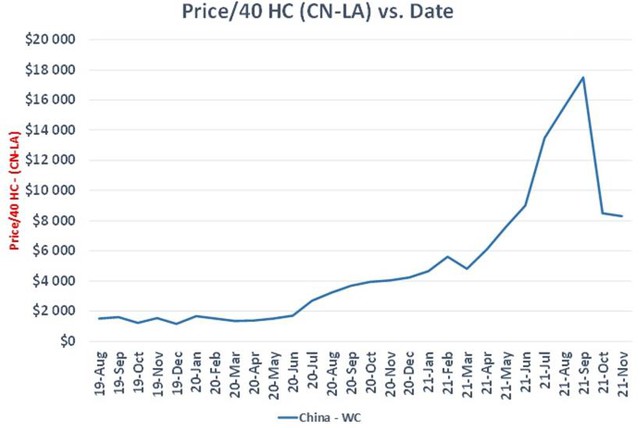

Sea freight rates between China and the United States have decreased from the first week of October until now, and are expected to continue to decrease in November. Accordingly, the freight for 40-foot containers from China to the port of Los Angeles at the end of the year. October 2021 dropped to $8,500, down 51.4% from the high of $17,500 at the end of September.

Container freight from China to the US West Coast (Source: Shifl)

iTVC from Admicro

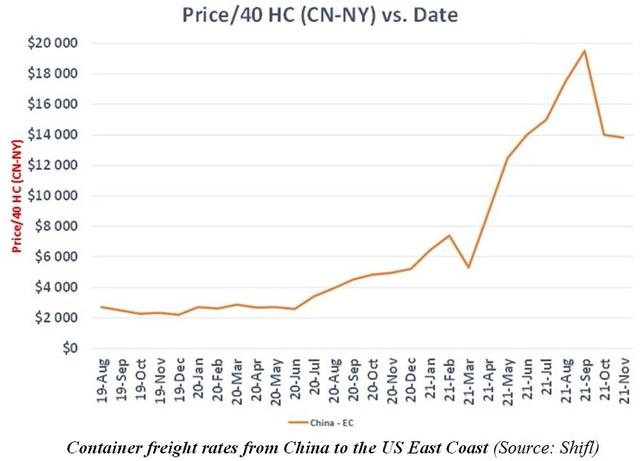

According to Shifl data, spot container freight rates on the China-US East Coast route were about $13,800/container in November 2021, down 29% compared to September 2021, when freight on the route This amounts to $19,500.

Container freight from China to the US East Coast (Source: Shifl)

Regarding the shipping market outlook, Mr. Levy said, “Based on current market conditions, I expect freight rates to increase slightly before the Lunar New Year.”

Shifl CEO added: “After the traditional Chinese New Year, we will enter the quiet seasonal months. I believe the market will soon enter a downward trajectory and gradually stabilize again.” .

Covid-19 has upset the transportation market globally, pushing up transportation costs sharply for many months.

Sea freight rates have increased tenfold compared to pre-pandemic levels. Accordingly, the rental price of a shipping container in January 2020 – 3 months before the World Health Organization announced the global pandemic status – from Asia to a port in the US is about 2,700 USD, skyrocketing. $17,000 in September 2021.

Air freight rates have increased even more, from 1.80 USD/kg in January 2020 to 10 USD/kg in September 2021, express services can be up to 15 USD to 20 USD/kg .

Similarly, road freight rates have also increased, with the price of renting a truck from Los Angeles to New York in January 2020 is 1,400 USD, skyrocketing to 4,000 USD in September 2021; Express truck rental rates are up to an average of $7,000.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com