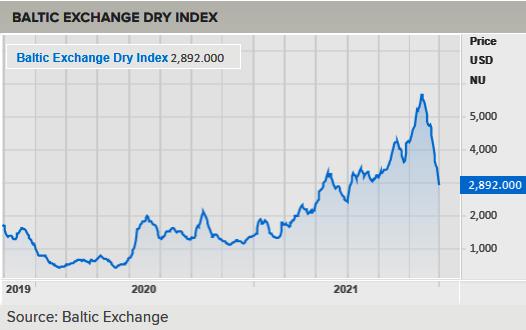

The Baltic Dry Index (BDI) – published by the Baltic Exchange – has fallen for 11 consecutive sessions as freight rates in all shipping segments fell.

The general freight index – including freight rates for capesize, panamax and supramax ships, on November 4 fell 123 points, or 4.3%, to 2,769, the lowest level in 5 months. This index fell more than 30% in October, of which the last week of the month alone fell over 20%.

In which, the capesize freight index fell 54 points, or 1.7%, to 3,221, the lowest level since June 10. Freight by capersize ships, tonnage of 150,000 tons of goods such as iron ore and coal – average daily decrease of 452 USD to 26,710 USD.

The panamax freight index fell 189 points, or 5.6%, to 3,166, its lowest level since June 9. Average daily freight for panamaxes, 60,000 to 70,000 tons of coal or grain, decreased by $1,699 to $28,492.

The supramax freight index also fell 165 points to 2,563, the lowest level since June 10.

Baltic Dry Index (BDI).

“Freights across all waterways are down due to weak demand and rapid fleet growth in both hemispheres,” said shipbroker Fearnleys, referring to the sharp drop in panamax freight rates. . However, the company said: “We believe freight rates will soon hit a reasonable bottom.”

This drop in freight rates is attributed to a sharp drop in iron ore prices and an increase in iron ore inventories in China, reducing demand for capesize vessels.

With the “weaker (iron ore) trade flows” and the “fading state” of China’s property market due to the problems of real estate developer Evergrande, “it is hard to see any real Which positive force will last much longer”, information from Allied Shipbroking said.

China’s January 2021 iron ore futures fell below 600 yuan ($93.75) a tonne for the first time in nearly a year due to rising supply conditions and an unfavorable demand outlook. positive.

Tamara Apostolou, analyst at Intermodal Research, said: “A flurry of news from China regarding policy measures for coal, aimed at increasing domestic supply and alleviating energy shortages, has led to a drop in demand for freight, leaving traders on the sidelines.” This leads to an increase in tonnage supply, especially in the Pacific.

Also according to Apostolou: “The strong sell-off in the FFA market (Forward freight agreements) has created a wave of negative sentiment, affecting real freight transport, leading to a downward spiral in all dry bulk carriers”.

According to London-based brokerage Alibra Shipping, concerns about the ‘health’ of the Chinese economy have led to a sharp decline in the dry, bulk shipping sector, which has been hit by Evergrande (China) case”.

According to Allied Shipbroking, the contagion from Evergrande’s near-bankruptcy has hit domestic steel demand levels in China’s real estate market, which combined with coal supply problems has led to a “negative shock” to market capitalization. “It is very likely that the current trend will continue in the coming days,” the company said.

Like Fearnleys, Shipbroking believes that the outlook for the shipping industry remains stable as cargo demand continues to remain high globally.

The cost of shipping goods by sea has increased 10 times compared to before the Covid-19 pandemic, while the cost of air transportation has increased even higher.

According to Mr. Thomas A. Cook, executive director of supply chain management consulting firm Blue Tiger International, the rental price of a shipping container was in January 2020 – three months before the World Health Organization announced the situation. global pandemic situation – from Asia to a port in the US about $2,700. A year later, that same container costs up to $12,500. In September 2021, the price went up to $ 17,000.

At the event entitled: To reduce risks and costs in the global supply chain: Challenges and opportunities in import and export (as part of AAPEX’s series of seminars in October, Mr. Thomas A. Cook said. : “We’ve seen the price go up to a very high [$20,000]. “So this is something that’s been growing exponentially, and it’s almost (exponentially) going on every month.”

In his presentation, Mr. A. Cook said prices had stabilized recently, but that was only “a blip”. “As the Christmas season arrives and the Chinese New Year arrives, we anticipate the situation will continue to get worse.”

Air freight – the method many companies have used to get products from abroad amid delays in container shipping – has also seen prices skyrocket.

In January 2020, air freight costs 1.80 USD/kg. A year later, that figure had risen to $9/kg. In September, prices even go up to 10 USD/kg, express services can cost from 15 USD to 20 USD/kg.

And if you want to ship by road, the cost per truck from Los Angeles to New York also increased from $1,400 in January 2020 to $2,800 in January 2021 and an average of $4,000 in September 2021; Express service averages $7,000 to move a truck.

“A lot of people in the industry are planning with shipping costs in the range of $8,000 to $12,000 by the end of this year and into 2022,” Cook said.

In addition, delays, congestion, and backlog of goods in transportation from 4-6 months to complete orders are still quite common, even at the present time. According to Mr. Cook, transport anything

As for the delay, a backlog of four to six months to fulfill orders is pretty standard right now, Cook noted. So anything that used to take 90-120 days is now twice as long, and in some cases delays can be up to 12 months.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com