Currently, at least 10 ships related to Russia, carrying crude oil and refined oil products, approached a US port on Wednesday (March 16) as suppliers rushed to deliver goods before the US government deadline. impose a ban on Russian energy purchases, data from Refinitiv Eikon shows.

The United States, the world’s largest oil consumer, has banned the import of Russian energy products due to the conflict with Ukraine. Washington’s ban gives importers until April 22 to unload and move contracts signed prior to the ban.

According to Refinitiv data, at least one tanker bound for the US has diverted, and at least two – previously parked in Russian ports – are waiting to unload at American ports.

Energy strategist Clay Seigle, citing Vortexa data, said that the amount of crude oil and products in the US coming from Russia in March 2022 is preliminary forecast at 18 million barrels, or 597,000 bpd (bpd). ), compared with an average of 672,000 bpd in 2021. Mr. Seigle said: “U.S. importers need to consider not only regulatory risk but also reputational risk when trading in products. be punished or discriminated against”.

Oil tankers are coming to America

The tanker Elli, which arrived in the US after docking in a Russian port, is currently anchored near Ceuta on Morocco’s northern coast. The Beijing Spirit, which carries Russian crude, is anchored in the US, is diverting to France, and there are signs that one will arrive in Philadelphia on March 26.

Halkidon Shipping Corp, which manages Elli, said the ship was “instructed by its charterer to stay and await orders off Gibraltar, during its en route from Novorossiisk, Russia, to the US Gulf Coast.”

On Wednesday (March 16), the oil tanker Confidence docked in Russia – chartered by the US refinery Phillips 66 – anchored near the port of New York – carrying lubricant (vacuum gas oil).

Confidence is not deterred by sanctions, according to a Dynacom Tanker executive. “If it (punishment) happens (in the future), it certainly won’t go to the US,” Dynacom’s manager said.

The Minerva Clara, chartered by BP and carrying fuel oil, has been anchored off the Louisiana coast since last week. Minerva Clara’s agency declined to comment, while Beijing Spirit’s agency did not respond to a request for comment.

No ban on CPC oil

US refiner PBF Energy will receive in Delaware about 1 million barrels of CPC Blend (Caspian Pipeline Consortium Blend) crude oil – with a Russian certificate of origin and loaded in Russia, according to a shipping document. relayed by Reuters and a source close to the matter said.

The US Treasury Department announced last week that the US ban on Russian imports does not include a ban on trading in CPC crude oil. In a recommendation, they said CPC can separate crude oil originating from Russia and unloading non-Russian oil.

CPC Blend oil is mainly composed of oil from Kazakhstan, usually mixed with Russian crude oil and loaded at the Russian port of Novorossiisk on the Black Sea.

A Ukrainian official on Tuesday (March 15) called on Western oil companies to completely boycott Russian ports as well as Russian oil, and demanded that US-based oil giant Chevron – transferring oil from oil fields in Kazakhstan through CPC – halting shipments.

Chevron says it complies with US law and that the portion of its oil entering the pipeline is certified as originating from Kazakhstan. It did not comment on the request to stop shipping at the Russian port.

The world crude oil price has recently cooled down, but is still around 100 USD/barrel. US President, Joe Biden, is very concerned about the sharp increase in gasoline prices in the US, because it hurts American households.

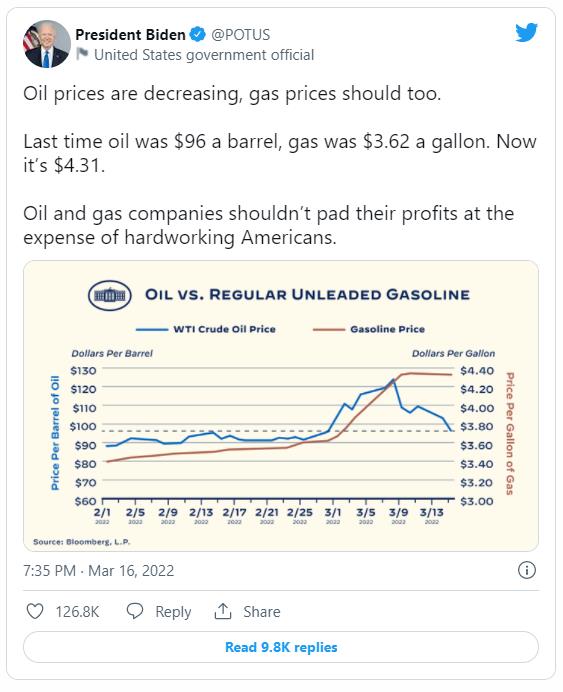

In a tweet posted on the morning of March 16, he wrote: “Oil prices are falling, so are gas prices…Last time oil was $96 per barrel, gas was $3.62 a gallon, now it’s $4.31. Oil and gas companies shouldn’t trade their profits at the expense of hardworking Americans.”

Biden’s tweets.

Gasoline prices in the US last week surged to a record high, after crude spiked to levels not seen since 2008. Retail gasoline prices are now falling, but slowly. The Biden administration’s focus on the complexities of energy prices shows how frustrated the White House is with one of the main drivers of high inflation.

Oil prices have fallen 28% from a record high on March 6, but are unlikely to fall much further. “This has been going on for 40 years,” said Andy Lipow, president of the consulting firm Lipow Oil Associates. “Price is down, looks like it’s going to take a long time.”

References: Refinitiv, Cnn

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com