Demand for copper for the electric vehicle and renewable energy sectors has surged, making the metal’s price action a hot topic among investors and economic planners.

Copper is one of the most important metals in all industrial production globally. Therefore, the movement of this metal’s price can provide a perspective on the health of the world economy. In the past year, copper price has always been a hot topic, not only for investors, but also for the attention of economic planners.

Closing on August 4, 2021, copper for September futures on COMEX fell 1.2% to $9,551/ton and copper price on LME Exchange dropped to $9,503/ton. Copper prices of the same period on the Shanghai Department also fell 190 yuan / ton to 70,060 yuan / ton.

Copper price and price increase cycle from March 2020 to present

In less than three months, the price of copper has at least three times touched the $ 10,000 mark / tonne, a record price witnessed in 2011, the peak of the commodity price cycle. While other metals such as Gold, Silver, or Platinum are trading more dismal and are currently down slightly compared to the beginning of the year, the price of Copper has recorded an increase of nearly 30% after 6 months.

Copper’s rally is greatly supported by the recovery of the economy and manufacturing activities globally, especially China. In addition, supply is also limited due to the heavy impact of the Covid-19 pandemic and strikes at the world’s largest copper mine – Escondida, Chile.

Copper prices reached an all-time high in May this year at more than 10,500 USD/ton, then prices fell sharply under pressure from the Chinese government’s policies to control the price of raw materials. Specifically, there will be 30,000 tons of copper sold from the national reserve of this country to limit the wave of excessive speculation in the context of strong price fluctuations.

By the end of July, the copper price hit the $10,000 mark again when investors thought that copper demand would increase sharply to restore infrastructure after heavy flooding in Zhengzhou city, China. However, the uptrend did not last long, as the copper price dropped continuously in recent sessions to close to $9,600/ton in the face of negative data on China’s economic recovery.

The Purchasing Managers’ Index (PMI) in the country’s manufacturing sector fell to 50.4, the lowest since February 2020. Not stopping there, the copper price is also under pressure when the spread of the Delta variant is causing many countries to distance themselves again, exacerbating concerns about supply.

Clean energy and the potential of the copper market

Despite being in a difficult period, the fact that the price of copper has tended to touch $10,000 in all three recent months has shown investors’ confidence in the metal’s prospects. Not only supported by the recovery of traditional industrial activities, Copper is also an important metal for the industries of the future, especially in the areas of electric vehicles and renewable energy. .

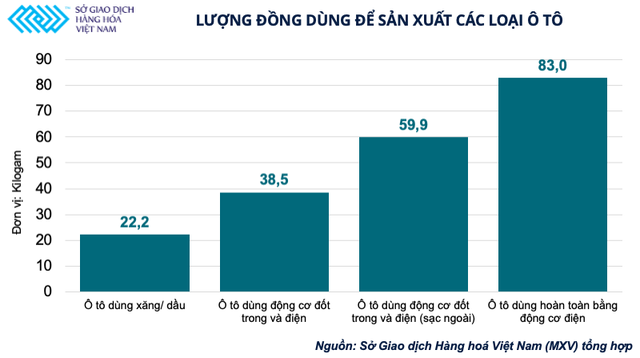

Statistics show that electric vehicles need to use an amount of copper nearly 4 times higher than cars using internal combustion engines and traditional materials such as gasoline and oil. Thanks to its good thermal and electrical conductivity, and low cost compared to other metals such as Gold, Silver, or Platinum, Copper is considered an important link in the achievement of carbon emissions reduction goals. globally.

In addition, developed countries such as the US, Canada, China and the European Union region, constantly strive and innovate technology to achieve sustainable growth goals by using energy sources. With renewable energy, and electrical appliances, copper demand is forecasted to continue to increase sharply in the coming years.

The threat from the Covid-19 pandemic and the Delta variant will also lessen as vaccination rates in the world are increasing, so copper prices will be very well supported in the long term. Goldman Sachs also forecast, copper will be the “oil of the future” and the price of this metal may increase to $ 15,000 / ton by 2025.

Opportunities and challenges for investors

Copper can be considered an attractive investment product not only for large banks or investment funds, but also for retail investors who can seize the opportunity to increase their assets. Compared to precious metals, Copper has a very reasonable margin, with enough volatility in a single session to offer margins that are not inferior to any financial product. Besides, Dong is traded on COMEX, one of the most prestigious commodity exchanges in the world, so investors can be completely assured of the transparency and liquidity of the market.

Besides opportunities, the copper market also has many potential risks when this metal is also a favorite speculative commodity of large investment funds, causing price fluctuations to sometimes be outside the basic factors of supply. bridge. Therefore, like any other financial product, investors need to be cautious and thoroughly understand the market before investing.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com