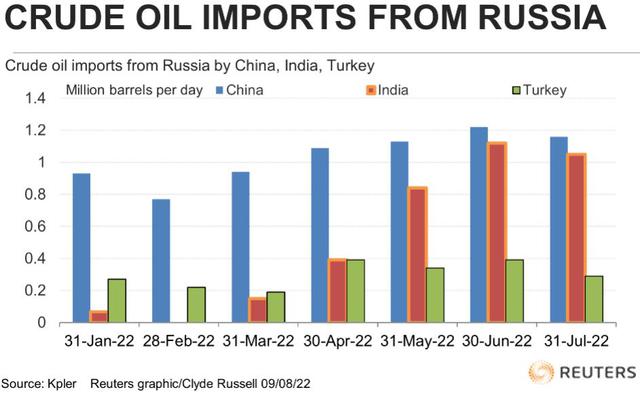

Russia is becoming increasingly dependent on China and India, which account for more than 40% of its oil exports. But worrying for Russia is that crude oil imports of these two markets have shown signs of ‘peaking’.

According to data from commodity analysis firm Kpler, China – the world’s largest crude oil importer – and India – the world’s third largest importer – imported a total of 1.85 million barrels of Russian crude. per day of the 4.47 million bpd that Russia exported in July 2022.

Accordingly, the two “Asian giants” accounted for 41.4% of Russia’s total crude oil exports in July, nearly double the 21.7% in the same period last year.

However, the share of Indian and Chinese crude oil imports in total Russian oil imports has fallen in recent months, from 45.4% in May 2022, which is when Russia was desperately seeking new customers to buy their crude oil in the context of Western countries restricting Russian oil imports because of the country’s conflict with Ukraine.

In June 2022, China and India accounted for 45.2% of Russia’s oil exports. That means that the share of the two markets in Russia’s total oil exports fell in July due to problems related to China.

Import of China

In terms of export data, China was the destination of 843,000 bpd of Russian crude in July, down from 1.33 million bpd in both June and May, according to Kpler data.

Turning to import data, according to Kpler, China imported 1.16 million bpd of crude oil from Russia in July through the sea market, while Refinitiv Oil Research estimates total imports across both sea and pipeline is 1.67 million bpd.

According to Refinitiv, China’s total imports from Russia fell to a three-month low.

That could indicate that China’s demand for Russian crude has peaked, although Russian oil is still at least $10 a barrel cheaper than grades from Middle Eastern suppliers like Saudi Arabia. .

Import of India

There are some indications that India’s appetite for Russian crude has also peaked. Kpler estimates Russian oil imports to India in July at 1.05 million bpd, down from 1.12 million bpd in June.

Even so, India’s imports from Russia are still high compared to before the Russia-Ukraine conflict, as Russian oil imports into India last year did not exceed 200,000 bpd in any month.

It is also interesting to know that India is buying large amounts of Russian Urals crude, which is exported from European ports and therefore has a longer sea journey through the Suez Canal or around the Cape of Good Hope below. of Africa.

According to Kpler data, India imported 666,000 bpd of Urals crude oil in July, exceeding 145,000 bpd of ESPO crude oil (ESPO crude is loaded at Russian ports in the Pacific and is the highest grade. oil is mainly supplied to China).

Elsewhere in Asia, Russian crude is still struggling to find buyers, with exports to Japan falling to zero in June and July, from a 2022 high of 112,200 bpd in March.

Russian oil exports to South Korea are also falling, to just 115,400 bpd in July, down from 131,000 bpd in June and a 2022 high of 307,000 bpd in March.

With some indication that Asia’s “craving” for Russian crude may be peaking, it is risky for Moscow that European buyers make good on their limited plans, or even stop importing.

According to Kpler data, Russia’s exports to Europe have certainly decreased in recent years, but not significantly. That’s largely because Kpler’s data includes Turkey, which is part of Europe, and it has increased its purchases of Russian crude in recent months, with Russian oil exports to Turkey in July reaching around 312,000 bpd, up from 222,500 bpd in the same month of 2021.

If Turkey is included, Russia’s exports to Europe were 2.15 million bpd in July, down slightly from 2.19 million bpd in June and down from 2.99 million bpd. day in February, the month before the war in Ukraine began to affect the continent’s oil trade.

The overall picture of the oil market today is that Russia has in general increased its crude oil exports to customers in Asia, especially India, but there may be signs that Russian oil exports may be present. to this area is reaching “peak”.

Can Europe significantly cut crude oil imports from Russia in the coming months? This is becoming the key point, which could determine whether Moscow is really starting to feel “vulnerable” on the “export front” of crude.

Figure: Crude oil imports from Russia to China, India and Turkey

Reference: Refinitiv

T&G Import-Export Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 02473010868

Email: hrm@tginterjsc.com

Website: http://tgimportexport.com