The spike in gas prices led investors to bet that crude oil would benefit as an alternative.

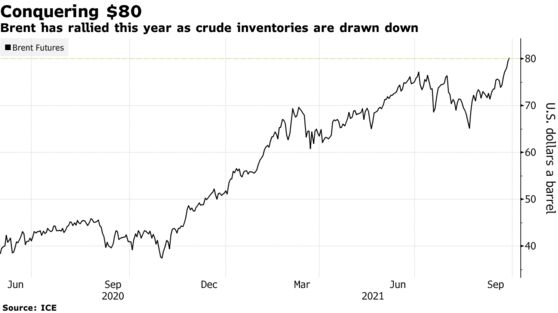

North Sea crude oil price has surpassed the 80 USD/barrel mark due to many signs that demand is exceeding supply, especially in the context that the world is facing a serious energy crisis.

Brent oil prices had a sixth consecutive increase, hitting the highest level since October 2018, while WTI light sweet oil prices also increased for several consecutive sessions.

Year-to-date, oil prices have held on to gains as rapid vaccine deployment makes it easier to live with the epidemic and that supports demand for energy. U.S. oil inventories were rapidly dwindling.

And so far soaring gas prices have led investors to bet that crude oil will benefit as an alternative. “There are many factors supporting the price of oil. Demand is recovering, the trend of “backwardation” is becoming more and more obvious. The price will certainly continue to rise.” John Driscoll, chief strategist at JTD Energy Services said. ”

Banks and traders also unanimously said that the energy industry has not invested enough in fossil fuels to ensure supply is not stressed.

Faced with the fact that worldwide demand is so strong, the Organization of the Petroleum Exporting Countries (OPEC) and its allies including Russia recently cautiously eased supply restrictions. Later today, OPEC will release its World Oil Market Outlook report with detailed market comments.

According to Vivek Dhar, an analyst at Common Wealth Bank of Australia, the world’s crude oil demand could increase by 500,000 barrels per day as soaring gas prices force consumers to switch to alternatives. This will continue to tighten supply, especially since OPEC+ only increases supply in a small way. Goldman Sachs believes that the market will not be able to balance again in the next few months.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com