Before Western sanctions, China is buying barrels of Russian oil through “secret” methods, so the amount of Russian oil flowing to China is still increasing rapidly as Russia tries to find alternative customers to the EU.

Volume soars

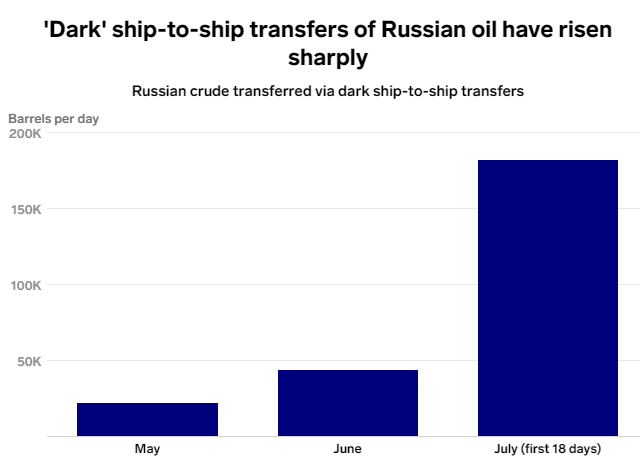

The amount of Russian oil transported via consignment, or so-called “black” transfers, has increased dramatically in the past few months. Western sanctions imposed on Russian oil have resulted in these barrels being secretly traded in the global and Asian markets, which Russia targets.

According to energy analysis firm Vortexa, in the first 18 days of July, the volume of Russian crude oil transferred through such transfers reached 182,000 bpd, a significant increase from 44,000 bpd in June. Much of that oil has gone to China.

The volume of oil transported through Russian consignment ships skyrocketed. Graphics: Business Insider

While transferring between ships, the merchants loaded their goods into another vessel while they were at sea. Such a transfer meant that at least one vessel had switched off its signal to avoid authorities’ control of their location.

Analysts at Vortexa also added that the ships had left Russia laden with Russian oil, headed for the Atlantic and then loaded their cargo onto other ships.

The surge in such deals has come across the global oil market following the conflict between Russia and Ukraine in late February. Western sanctions against Russia have made international companies wary when dealing with Russian products. The US and UK have banned Russian oil imports, while the European Union is planning to quickly remove oil from the country.

Due to sanctions from European companies, Russia has redirected its crude oil exports to the Asian market. In particular, India and China are the two countries that are most interested in Russian oil because Russian oil is being sold at a preferential price.

According to Vortexa data, as of July 25, there were four large crude oil tankers – VLCCs are currently loaded with Russian crude oil to Asia, and receive their cargoes from another ship in the Atlantic.

Why have this purchase method?

Lloyd’s List, a shipping industry magazine, said this week that five “older” Chinese ships have been at the center of recent shipments of Russian crude oil in the Atlantic. Commodity data firm Kpler says it is also seeing a spike in “darkness” as exports to Asia jump from pre-conflict levels.

David Wech, chief economist at Vortexa, said China’s reason for getting Russian crude through ship-to-ship transfers is hard to explain. “India can buy as much crude oil as they want because they don’t care about other factors,” he said. He added that sanctions do not prevent India or China from buying Russian crude.

However, Mr Wech said it is possible that Chinese and Indian companies may be taking steps to adapt to this in order to avoid possible harsher sanctions in the future.

Another theory is that Chinese companies may be trying to avoid reputational damage. Last month, the top US energy adviser urged India to limit purchases of Russian crude oil and avoid hurting the country’s standing in the international arena.

Wech added that China’s large state-owned companies are not involved in the dark transfers, which are largely carried out by smaller, independent companies that have been established recently.

Last week, Vortexa said that oil tankers that used to carry barrels of Iranian oil were switching to transporting crude oil from Russia. Russia, Iran and Venezuela – all countries bearing the weight of US sanctions – are increasingly competing to sell their oil to India and China.

References: Reuters, Business Insider

T&G Import-Export Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 02473010868

Email: hrm@tginterjsc.com

Website: http://tgimportexport.com