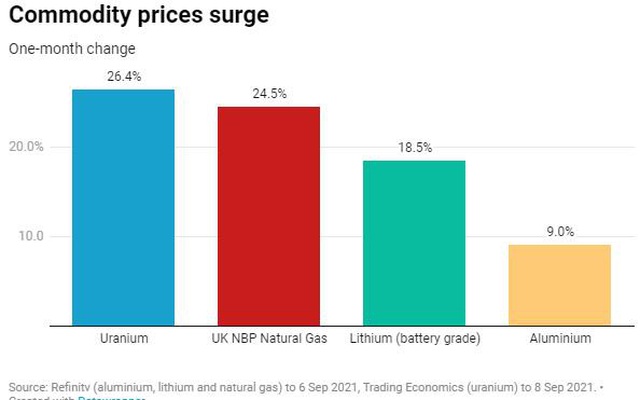

The market often focuses attention on natural resources such as oil, gold, copper and iron ore. However, focusing only on these areas means you will miss out on a number of other items that are expected to have very strong fluctuations between now and the end of the year.

Aluminum prices have hit a decade high, while natural gas prices in Europe recently set an all-time high, as uranium prices surged, as did lithium. surprising level, given the many influencing factors such as supply concerns, strong demand, and speculative buying demand.

Tight Natural Gas supply is driving electricity prices in Europe to record highs and raising concerns about a negative impact on the economic recovery.

Russia’s reduction in gas supplies has caused gas in Europe’s gas reserves to dry up since this summer.

Electricity prices in the European Union (EU) in general and in France in particular have both doubled since the beginning of this year, reaching multi-year highs and are unlikely to fall before the end of the year, signaling a “seasonal increase”. expensive heating” coming.

That combined with increased global buying competition for liquefied natural gas (LNG) and falling wind power is expected to create a “perfect storm” for the market. gas.

Competition from European and Asian buyers to buy gas amid tight supplies has pushed spot LNG prices in Asia to record seasonal highs. The October futures contract for delivery to Northeast Asian countries averaged around $20.1/mmBtu, up $0.20 from last week, continuing a rally that has lasted for several weeks. Meanwhile, November LNG futures reached nearly 21 USD/mmBtu. Thus, the price of this super-cooled fuel – also used to produce electricity – has increased 10 times compared to the level of 2 USD / mmBtu last year, when the Covid-19 pandemic reduced demand.

European and Asian importers are competing strongly for gas.

Rising gas prices can increase household costs, lead to increased inflationary pressures, and can reduce consumer spending, while also driving up energy costs for businesses. Also increased.

In the event of severe winter weather, the situation will be even more dire.

Another energy-related commodity that is also rapidly increasing in price is URANIUM. A relatively illiquid and opaque market, uranium prices have surged to a five-year high, as some information suggests the WallStreetBets community has helped drive massive volatility. of so-called meme stocks like GameStop and AMC Entertainment have increased the value of this commodity.

The launch of Toronto (Canada)’s first exchange-traded fund – Sprott Physical Uranium Trust Fund, which trades real uranium, and Japan’s reopening of nuclear power plants also mark the beginning of a new era. uranium price will move up strongly.

LITHIUM, which is used in the production of batteries for electric vehicles, is also increasing sharply amid demand for electric vehicles, particularly in markets such as China, where sales of electric vehicles have grown 164% compared to that of electric vehicles. in the same period last year to 271,000, according to the China Association of Automobile Manufacturers.

The element is also widely used in areas such as internet of things infrastructure, 5G devices, and energy storage.

According to Fastmarkets, China’s lithium carbonate price posted the biggest weekly gain. In the past week alone, the price of lithium battery grade has increased by 13.6%, while that for technical use has increased by 16.3%, both increases not seen since Fastmarkets began reporting. the price of this element in October 2017. Before that, the last week of August, the price of lithium battery production increased by 11.9% to an average of 103,500 yuan/ton ($15,950), ranging from 97,000- 110,000 yuan/ton, bringing the total increase in August to 16.9% from the previous month.

ALUMINUM prices recently surged to a 10-year high after a military coup in Guinea, the world’s second-largest producer of bauxite – the material used in aluminum production. This event made the aluminum bull run – which has lasted for quite a while – continue to increase even more strongly.

Long-term demand for aluminum is also expected to grow strongly as the metal is used in the renewable energy industry and EV infrastructure due to its lightweight nature and high electrical conductivity.

Before the coup in Chile, the price of aluminum on the London floor so far this year has increased by about 40% due to increased consumer demand as economic activity recovers from the six Covid-19 pandemics, amid smelters. in China struggle to maintain production during a period of severe seasonal power shortages and Beijing strives to limit carbon emissions in line with its commitment to the world.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com