Almost all the debate surrounding Germany’s economic relationship with Russia since the country launched its special military operation in Ukraine has focused on gas and oil.

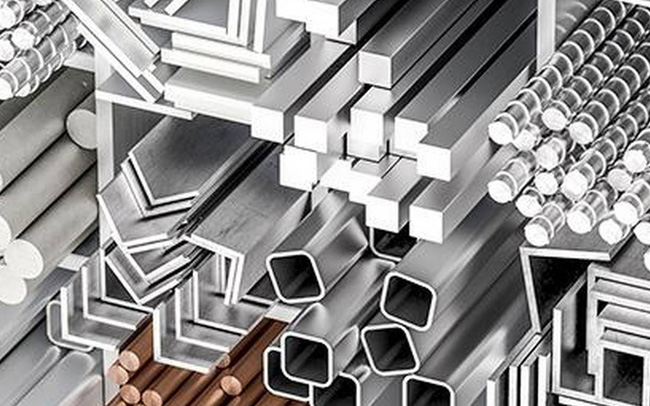

The rationale is that Germany buys more Russian oil and gas than any other European country, making energy Russia’s most lucrative export to Germany by far. However, many German companies rely on a steady supply of many other Russian exports, especially raw materials such as nickel, palladium, copper and chromium.

In 2020, Russia is Germany’s largest supplier of crude nickel, accounting for 39% of the country’s supply, according to the MIT Economic Watch.

Russia also supplies about 25% of German imports of palladium and about 15% to 20% of the heavy metals chromium and cadmium, which are used in industry. In addition, 11% of refined copper, 10.9% of platinum and 8.5% of iron ore were also imported from Russia in 2020.

A recent study by the German Economic Institute, based in Cologne, admits that some of the raw materials Germany imports from Russia will be hard to replace.

In a statement, the institute said that new trade relationships with a number of countries that substitute exports of these raw materials are urgently needed, of which nickel is a particularly important material to consider. Currently, Germany’s second largest crude nickel importer after Russia in 2020 is the Netherlands with 29%.

Tesla CEO Elon Musk, on his personal Twitter page from July 2020, wrote: “Nickel is the biggest challenge for large-capacity batteries.”

First-grade nickel prices have doubled in the past two years and the Russia-Ukraine conflict has investors worried that Russia could impose an export ban.

Volkswagen, one of the companies aiming to become the world’s largest electric vehicle (EV) maker, has announced that it has reached an agreement with Chinese companies Huayou Cobalt and Tsingshan Group to build a joint venture to secure raw cobalt and nickel supplies in Indonesia, one of the world’s largest producers.

However, uncertainty over Russian raw materials remains a factor dogging the market. Some analysts forecast that the nickel crisis alone would add at least $1,000 (919 euros) to the cost of buying a new electric car for consumers.

Nickel is used in the production of stainless steel but is also a key component for the lithium-ion batteries needed to power electric cars. Palladium is also important to car manufacturers, as it is a key ingredient in the production of catalytic converters, which help clean exhaust fumes in gasoline and hybrid vehicles.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com