Recently, European leaders announced plans to gradually phase out coal imports from Russia in a move to impose new sanctions on this country.

On April 5, the European Commission (EC) proposed a phased ban on Russian coal imports totaling 4 billion euros ($4.3 billion) a year, as part of the 5th round of sanctions against Russia. Other proposals would target the technology sector and imports of Russian manufactured goods, valued at 10 billion euros ($10.9 billion).

Previously, Europe had imposed sanctions since Russian President Vladimir Putin launched a military campaign in Ukraine in late February, but still “evaded” the country’s energy sector. However, when the military situation became more tense, the EU decided to take a tougher action.

It is expected that new details on the new round of sanctions, including the timing of the implementation of the ban on coal imports, will be announced today, when EU ambassadors join the meeting to negotiate. These measures still need the approval of all 27 member states.

The ban on coal imports will affect some countries on the continent, but it is still one of the easiest energy sources to “withdraw” when much of the world is doing this. But, a more complicated question is what happens next?

How much coal does Europe import from Russia?

According to the International Energy Agency (IEA), Russia is the third largest coal exporter in the world by 2020, after Australia and Indonesia, of which Europe is the largest customer. IEA data shows that the continent received 57 million tonnes of coal from Russia that year, compared with 31 million tonnes from China. This amounted to half of Europe’s coal production that year, according to Eurostat.

However, the EU has gradually reduced the use of the world’s dirtiest fossil fuel. According to an analysis by the energy consultancy Ember, the amount of electricity produced from coal has been steadily decreasing across the bloc in recent years, falling by 29% between 2017 and 2019.

Furthermore, despite a brief surge in coal use last year due to record gas prices, the IEA predicts that European coal demand will continue to decline. Total imports are expected to decline by 6% by 2024, even before Russia launches a military campaign in Ukraine.

Other countries will likely buy Russian coal. The IEA expects India’s coal imports to grow by 4% in 2024 and more than 6% in Southeast Asia. The agency said in a report released in December that Russia has benefited from a surge in exports to China, after it stopped importing coal from Australia.

Will coal prices come out after the EU bans?

However, the shortage of supply may become a “headache” for countries that are still using coal to generate electricity, including Poland and Germany. According to the IEA, a drop in supply and a rebound in demand in China helped push global coal prices to an all-time high in October 2021.

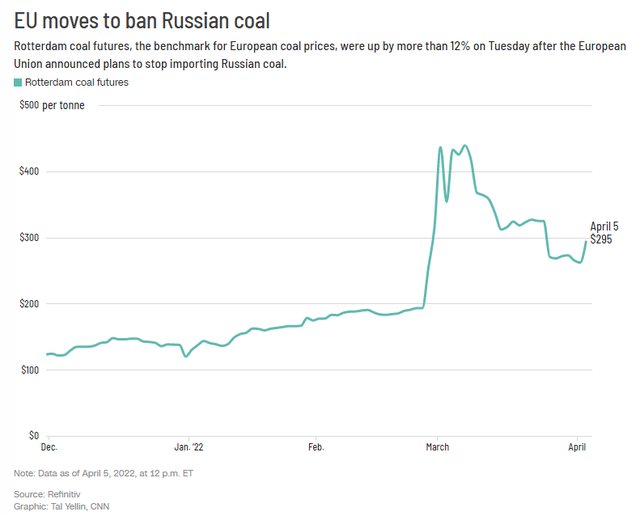

Furthermore, the price hike is likely to last even longer as the EU makes this move. Data from Independent Commodity Intelligence Services shows that coal futures in Rotterdam – the reference price for coal in Europe, closed at $257/ton on April 4 and sometimes went up to $295.

Matthew Jones, senior electricity and carbon analyst at ICIS, said the ban on coal imports would “add to the already tight supply situation in Europe and lead to ‘madness’. crazy’ looking for an alternative to coal.” He added: “Rotterdam coal futures for delivery last month on ICE were up almost 15% and last year 13% after the news was announced.”

Meanwhile, Matthew Jones, director of energy, climate and resources at Eurasia Group, thinks that EU countries can weather this shock. The team also said that if the EU buys Australian coal, this will be a move to help alleviate the shortage.

“The imposition of sanctions on coal will also make life more difficult in many parts of Europe. But energy companies can deal with this,” he said.

What does the EU have left to impose sanctions?

Notably, Russian oil and gas are not included in the latest round of sanctions. The EU imports 26% of crude oil and 46% of gas from Russia in 2020, according to Eurostat. However, stopping the import of these two fuels is being discussed.

Currently, the US has exploited its strategic oil reserves, “discharged” 180 million barrels to help cool down gasoline prices and cope with the decline in oil supply from Russia. The IEA also agreed to release more oil from member countries during an emergency meeting last week.

But natural gas remains a difficult target for sanctions to target, in part because of differences among EU member states in their dependence on Russian energy. The bloc’s leaders have pledged to reduce Russia’s gas consumption by 66% by the end of the year and decouple from Russian energy by 2027.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com