As copper prices have fallen sharply since peaking in February, the move by the major players is making analysts increasingly positive about the important metal.

The copper market has been mixed recently due to the news about the big players in the industry. Most recently BHP – the Australian resource giant raised its offer to buy copper miner OZ Minerals this month to AUD 9.6 billion, or $6.4 billion, after being rejected earlier with a bid for $8.3 billion or $5.8 billion.

This move by the metal giant has implicitly answered the question of how long-term copper price expectations are. The giant is bullish on the copper market – in stark contrast to other resources like oil or coal.

A representative of BHP said: “The company’s new price proposition will bring value to BHP shareholders by increasing access to the most attractive and forward-looking products. Add to our portfolio of growth options.” President Ken MacKenzie said in a statement when BHP launched what it called its best and last offer in November.

The new bid is at AUD 28.25/share, 49% higher than the trading price of OZ Minerals stock before BHP made its first bid in August. This is seen as a sign of a positive outlook. industry and investors’ long-term outlook for copper despite the metal’s recent price decline.

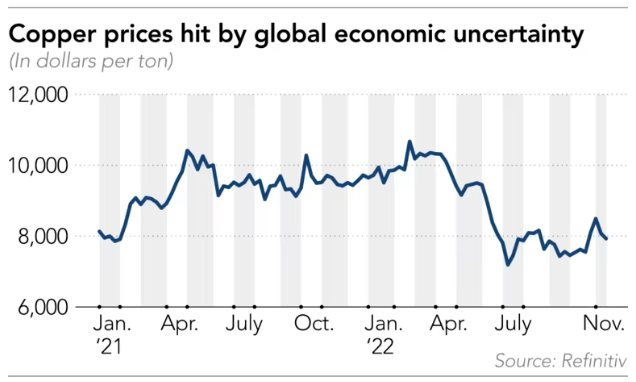

Talking about the role of copper, this metal has long been called “Dr. Copper” – referring to a kind of pointer that reliably signals the direction of the world economy. Recent forecasts have given a bleak picture of the economy: the price of copper on the London Metal Exchange has fallen 24% from its February record high of $10,674 a tonne to 8,068 USD/ton at the end of November.

Copper prices have had a long slide since the beginning of February. Source: Refinitiv

The reason for this distrust is the impetus for central banks around the globe to raise interest rates to combat inflation. A dark cloud is covering the Chinese market – the world’s largest copper consuming country because of the Zero Covid policy that this country is pursuing. There is no indication as to when these policies will be fully lifted.

Copper is used mainly for electrical wiring, buildings and infrastructure so demand in China is the main driver of the copper market. The country’s real estate sector is grappling with a financial crisis. China has recently revealed about bailout packages for the real estate sector. And while banks have pledged to provide additional credit to developers and buyers, analysts say this should have happened sooner.

“With consumer confidence so low, we don’t think these rescue steps will be enough to spur a rebound in housing construction activity,” said Caroline Bain, chief commodities economist. at Capital Economics, adds that metal prices will fall further.

Despite the headwinds, most analysts agree that copper prices are likely to rebound in the long-term thanks to a boost in global decarbonisation and further increased demand. Electric vehicles, along with wind and solar energy devices, will require more wiring. According to the International Energy Agency, copper demand in 2040 could be two to three times higher than in 2020, depending on climate policy assumptions.

“There is a risk that prices will fall in the short term… but this is only a temporary problem,” said Christopher LaFemina, equity analyst at Jefferies. We are bullish on copper in the medium to long term due to growing global demand and significantly limited supply.”

Tatsufumi Okoshi, senior economist at Nomura Securities, said copper production is unlikely to increase significantly, in part due to political risks in major ore producing countries like Chile and Peru. “There are growing concerns about rising environmental costs and increasing taxation on the mining industry,” said Okoshi, adding that the search for new copper deposits with large reserves is also increasing. becomes more and more difficult.

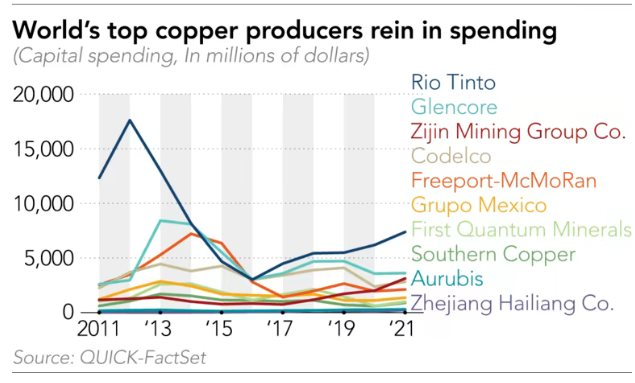

According to QUICK-FactSet, capital expenditures of the top 16 global copper producers in 2021 fell 28% to a total of about $50 billion from $69 billion in 2011. This ranking is based on output. last year from global manufacturers with data available on FactSet. These include Freeport, Glencore, Zijin Mining Group, Rio Tinto and BHP.

Capital expenditure of the big players in the industry. Graphics: Nikkei Asia

After BHP acquired OZ Minerals, some experts expected a change in industry dynamics, with more resource companies acquiring smaller producers. Rio Tinto, another major Anglo-Australian miner, is trying to strike a deal to secure more control over the Oyu Tolgoi copper mine in Mongolia by acquiring retail investors in the country. Turquoise Hill Resources – owner of the mine. Rio already owns a 51% stake in the Canadian company.

Takayuki Honma, chief economist at Sumitomo Corporation Global Research, said rising interest rates are weighing on smaller miners and may discourage new capital investment as the mining business often takes years. to provide return on investment after opening new mines.

“In the face of ever-increasing exchange rates, miners have to be even more certain of getting a sufficient return on their investment,” Honma said. Undercapitalized producers can seek economies of scale by merging with well-capitalized companies with a financial advantage.”

According to Nikkei Asia

T&G Import-Export Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 02473010868

Email: hrm@tginterjsc.com

Website: http://tgimportexport.com