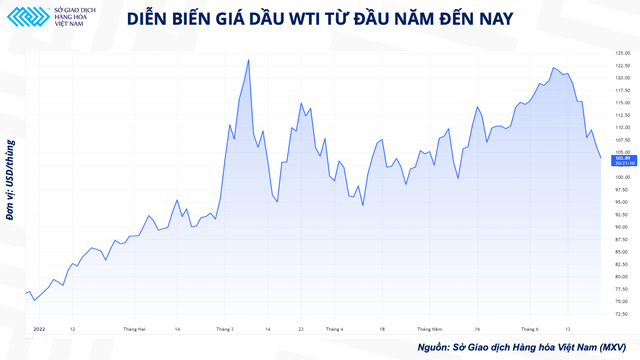

In less than 2 weeks, the price of oil has dropped by more than 15%.

The oil market rally has continued through the end of last year until now, as the conflict between Russia and Ukraine exacerbated disruptions to global energy supplies. However, concerns about a decrease in demand are somewhat overwhelming the supply factors, so oil prices have been under a lot of pressure recently.

Ending the session on June 22, WTI price fell 3.04% to 106.19 USD/barrel while Brent price decreased by 2.54% to 111.74 USD/barrel. The MXV-Index Energy, which measures the volatility of commodity prices in the group, fell 1.63% to 5,398.48 points.

The crude oil market is experiencing the strongest correction since March. In less than two weeks, oil prices fell more than 15% and hit a one-month low.

Economic recession threatens oil consumption outlook

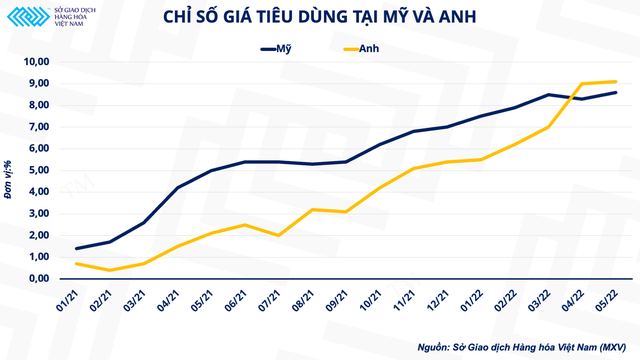

Oil prices in particular as well as energy costs in general have skyrocketed in recent years, which has created inflationary pressure on many major economies in the world, forcing central banks of many countries to take measures to causing prices to drop. The US consumer price index (CPI) in May increased by 8.6% and is still anchored at the highest level in 40 years. Recently, the CPI of the UK and Canada also increased by 9.1% and 7.7%, respectively, which are both record increases in decades.

The US Federal Reserve (Fed) is currently pioneering the process of raising interest rates to curb the escalating inflation. The agency has raised interest rates from 0% to 1.75% after three rate hikes this year, and is expected to end the year with a target rate of 3.4%. The Bank of England (BOE) followed suit and raised interest rates for the fifth time in a row to 1.25%.

High borrowing costs along with tight money supply will make production and business activities difficult. Businesses will have to cut labor and output in the context of input costs that have not cooled down.

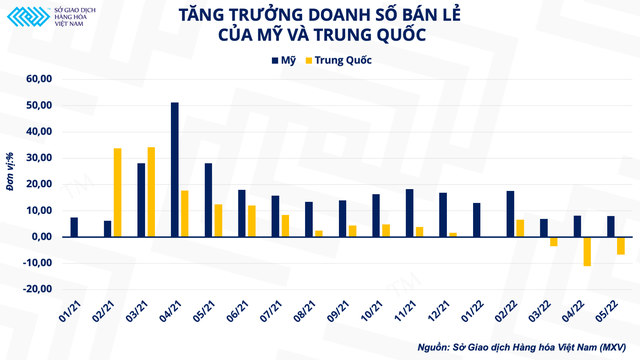

Theoretically, an economic recession is usually recorded after two consecutive quarters of negative gross domestic product (GDP), accompanied by negative economic indicators such as rising unemployment rate. , or retail sales decline.

Currently, retail sales in the last three months in China have all decreased year-on-year due to the impact of strict anti-epidemic measures. In the US, consumers are also cutting back on spending amid rising costs of goods. Retail sales of the last three months also grew at a much lower rate than the same period last year.

In addition, car sales and home sales in the US both declined in May. These are all early indicators that the world’s largest economy is entering a recession.

Struggling with the US and China, which are major trading partners with many countries, could have a negative spillover effect, with influence extending beyond the borders of both economies. Top of the world.

Oil prices are usually very sensitive to news about economic growth prospects, so it is likely that traders have already started reacting to the risk that US GDP will continue to grow negative in the third quarter. , after falling 1.4% in the first quarter of 2022. Pressures are mounting on the market amid concerns that global oil consumption will decline because of the economic downturn.

Can supply concerns bring prices back to old highs?

Currently, the world crude oil market is still in a state of “price inversion”, in other words, the near-month contract is priced higher than the far-away contract, reflecting a tight supply situation in the short term. .

Concerns about the economic recession are still at the predicted level, while the demand for oil and refined products shows no signs of weakening. According to the American Automobile Association, the average gasoline price in this country has reached $5/gallon (3.79 liters), due to the effect of limited refining capacity and difficulty in meeting demand during consumption. summer peak season.

Even so, analysts at Goldman Sachs repeatedly emphasized the short-term supply squeeze in the oil market, noting that Americans can still accept higher energy prices. .

On the part of the Organization of the Petroleum Exporting Countries (OPEC), the group’s current production capacity is also difficult to meet the committed quota of 648,000 barrels, due to reduced supply and instability in some countries. members such as Libya and Nigeria.

It can be seen that the supply disruption will still be a factor for the high price of crude oil, however, investors are witnessing the clear determination of the authorities in stabilizing prices.

In addition to slowing the economy’s growth to dampen demand, the Fed’s monetary policy is helping to strengthen the dollar, and driving down the cost of holding real crude, as well as other costs. oil imports and exports increased.

In testimony before the US Congress yesterday, Fed Chairman Jerome Powell, while expressing his expectation that the economic situation is quite favorable, with a strong labor market and sustained high demand, also admits that there is a possibility that the US will have to accept a recession. Combined with the recession warnings from investment banks such as Citibank and Nomura, oil prices have recently continued to be under pressure following the general momentum of the financial markets.

US Treasury Secretary Janet Yellen is also planning with allies to impose a ceiling on Russian oil prices, in order to increase supply to the world crude oil market, and limit the impact. negative effects of rising energy prices on underdeveloped countries.

In addition, the US Energy Secretary is expected to meet with directors of large energy companies today, with the hope of finding out the cause or solution of high fuel prices.

If the authorities are determined to implement the above plans to control inflation, combined with the fear of an economic recession, the world crude oil market will be under great pressure and in the short term, the price will hardly be able to recover. back to the old peak set in March.

T&G Import-Export Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 02473010868

Email: hrm@tginterjsc.com

Website: http://tgimportexport.com