Metals will be hardest hit when oil prices rise, partly because fuel accounts for 50% of metal production costs, and partly because countries will find new weighing solutions, which require a lot of metals to produce. export.

The world oil price has increased continuously from the beginning of 2021 until now, now returning to the record high price area of over 80 USD/barrel. This will not only affect the energy market, but will have a wide-ranging impact on financial markets, commodities in general.

Historically, there have been two times the price of crude oil surpassed the area of 80 USD/barrel. The first is the period from September 2007 to October 2008, followed by the period from September 2010 to October 2014. The common feature of these periods is a sharp increase in demand that exceeds the capacity of producing countries. However, the story of this year’s uptrend in oil prices is very different and according to the Commodity Exchange of Vietnam (MXV), this “price shock” was somewhat predictable.

The crisis was foretold

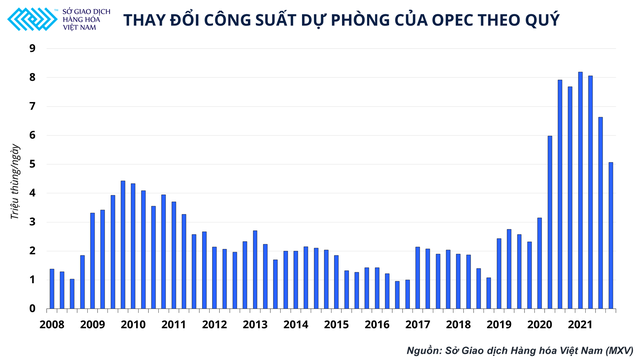

Looking at the diagram below, it can be seen that in previous periods, the world’s oil production was so short that even though OPEC had put the spare capacity into operation, the extra oil was not enough to solve the situation. shortage in the market.

It was only when the shale oil industry boomed in the US at the end of 2014, making the US the world’s largest oil producer, that the world’s oil production capacity improved, and contributed to cooling down. oil prices. The change in technology has created expectations that producing countries will now have the ability to react promptly whenever demand drives up oil prices, keeping oil levels stable.

Contrary to this expectation, although world oil demand has returned to close to the threshold of 100 million barrels per day as before the COVID-19 pandemic, the supply has not had a corresponding adjustment. In the Short-Term Energy Outlook Report released by the US Energy Information Administration (EIA) on the night of October 13, 2021, world oil consumption in the fourth quarter of this year is forecast to reach 99.98 million barrels/ day, based on the expectation that travel demand will increase when the economy recovers from the pandemic.

According to the EIA, the Organization of the Petroleum Exporting Countries (OPEC) still has a spare capacity of nearly 5 million barrels per day that has not yet been put into operation. Meanwhile, oil companies in the US also have no intention to increase production despite the price of Brent oil on the EU ICE office currently reaching 83.18 USD/barrel, up 60.5% compared to the beginning of the year; and WTI oil price on NYMEX has reached 80.44 USD/barrel, up 65.7%.

In fact, this problem has been warned by analysts since the beginning of the year, when the oil price was still in the area of 50 USD/barrel. The government’s campaign to switch to green energy makes this problem even more serious: as investment and subsidies for renewable energy projects increase, investments go into maintenance and repair. output has fallen to a multi-year record low. Big banks like Goldman Sachs have also continuously raised their oil price forecasts from $70 to $80, and are now forecasting at $90 per barrel in the fourth quarter of this year.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com