Demand for essential metals such as copper and aluminum both spiked while supply took years to balance demand. Therefore, metal prices are not expected to cool down anytime soon.

METAL PRICES INCREASE HOT: SUSTAINABLE GROWTH OR GROWTH?

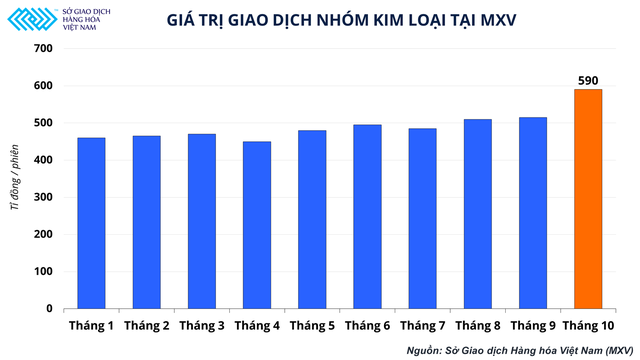

The energy crisis that is spreading across the globe has not only supported the sharp increase in crude oil and natural gas prices, but also had a major impact on metal prices recently. For the first time since August, the MXV-Index Metals crossed the 2,000-point mark and is heading for a new high since early 2021. Cash flow of domestic investors also continuously poured into the metal market, helping the trading value of the whole group to be over 600 billion dong per session in the past two weeks.

Explosion of base metal commodities

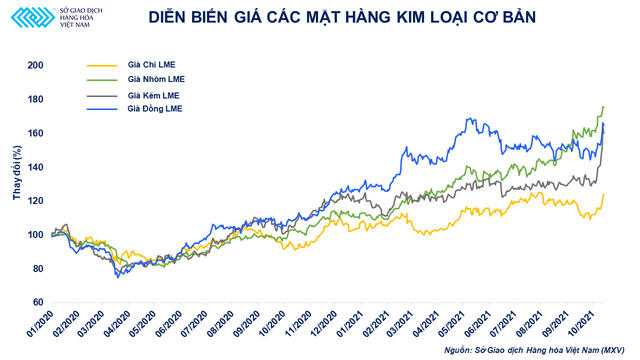

In just two weeks, December copper futures on the Comex Exchange jumped 12.5% to above $10,400/ton and stood the chance to set a new all-time high. Other metals on the LME, such as aluminum, also rose 6% to $3,112 a tonne, lead rose 10.5% to $2,376 a tonne, and zinc rose 15% to $3,508 a tonne.

At the beginning of the energy crisis, a series of factories had to suspend operations due to a lack of electricity, causing the prices of metal products to be under pressure due to reduced demand. However, later, this stagnation caused investors to worry about a decrease in the supply of base metals globally.

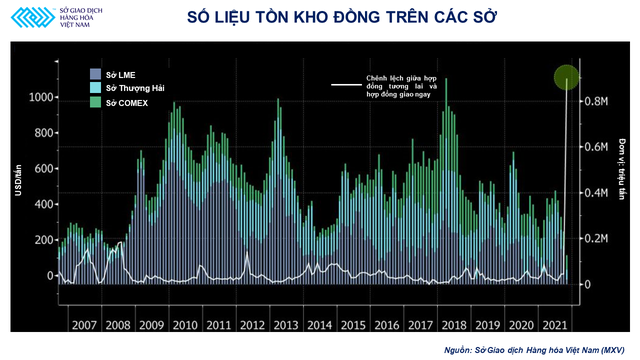

Unlike consumption demand, which will recover very quickly when countries return to normal growth, supply will take years to rebalance when demand spikes. Copper inventories on all 3 major exchanges, namely COMEX (New York), Shanghai Department, and LME (London) all dropped sharply in September.

Notably, many businesses are in need of copper reserves due to concerns about supply shortages in the near future, and this has pushed the difference between the futures and spot contract values to a high level. $1,010/ton, the highest level in 27 years.

Besides, the producer price index (PPI) of the whole China increased sharply in September, showing that manufacturers are suffering from unprecedented inflationary pressure in many years. China is a major exporter of the world, so with the current surge in input materials, consumers will soon have to share these “inflation burdens” with manufacturers. .

The energy crisis taking place this year serves as a warning bell for all countries with large industrial production needs such as Europe, the US and China, making these regions will accelerate the transformation. green to reduce dependence on crude oil and natural gas.

China is currently the country hardest hit by this energy crisis. However, in addition to promoting the use of coal to provide electricity, the world’s second largest economy has not given up on the goal of green transition and maintains its commitment to be carbon neutral by 2060. demand for metals that are not only essential in all human activities such as copper and aluminum and other metals that play an important role in renewable energy industries such as lead or zinc are forecast to increase sharply, supply will not be enough to meet.

Why is the price of iron ore and steel lost?

The metal group has not received much attention like crude oil or agricultural products, but the market always pays special attention to iron ore because it is an important raw material for steel production. In this rally of the metal group, iron prices are almost only flat or falling and without any breakout.

The root cause of the rise of iron and steel still comes from China, when the Government of this country constantly requires steel factories to cut production to save electricity and limit output. steel this year is not higher than last year. Currently, China’s steel output in the first 9 months of the year is still 2% higher than the same period last year, so for the rest of the year, factories will have to continue to reduce capacity so that output does not exceed last year’s record 1.6 billion tons. Therefore, when consumption demand declines, iron ore prices are unlikely to increase sharply.

According to the MXV Trading Division, the prices of non-ferrous metals in China’s spot market yesterday fell by 2-3% from the previous day. Specifically, aluminum was sold for about 23,120 yuan / tonne in Henan, copper about 73,460 yuan / tonne in Jiangxi and zinc in Yunnan was traded about 25,370 yuan / ton. The spot prices of these commodities are all 1-2% lower than the most-traded futures prices on the Shanghai Exchange.

China’s imported iron ore prices fluctuated slightly this week. Although sea freight rates have continuously cooled down, it is still not enough to support iron ore prices. China’s imported iron ore price yesterday increased by 2.3 USD to 124.96 USD/ton. China’s Tangshan Port has suspended shipping operations since October 19, due to the impact of the country’s environmental protection policy.

How do Vietnamese businesses respond to the rise in metal prices?

According to data from MXV Clearing Center, the average trading value of metals from the beginning of October until now has averaged VND 590 billion per session, up 15% compared to September and up 25% compared to September. with the beginning of 2021. In which, it witnessed the participation of more and more businesses in the iron, steel, copper wire and cable industries.. The proportion of cash flow of enterprises increased from 30% in January, to 65% in October this year.

Facing the galloping rise of metal prices, with the assessment that prices can reach historic highs in the near future, Vietnamese businesses are faced with a choice: hedging or betting on market volatility. . Experiencing a lot of experience in the past, metallurgical plants, construction companies, enterprises producing copper cables, etc. are all considering hedging as a central business in this context.

Futures and options contracts are being used effectively to fix the price of raw materials 3 to 6 months before the delivery time, helping businesses avoid a lot of price risks. In the final period of 2021, with the quantity of goods that have been closed, businesses can rest assured, focus on improving production, and no longer have to worry about input price problems like in previous years.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com