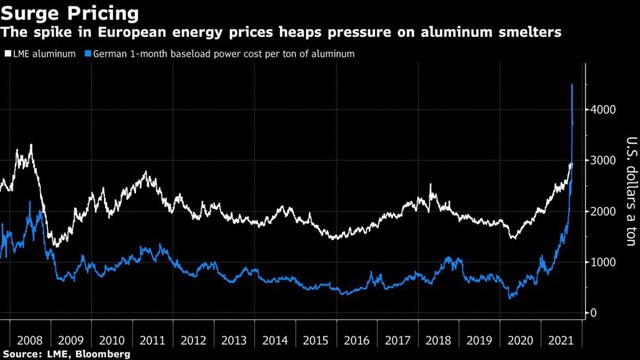

Aluminum prices are up 50% in 2021, to more than $3,000/ton, but investors believe the price could exceed $4,000 because of severe power shortages in China and Europe right now.

Aluminum prices are up 50% this year but some investors are now betting on even more spikes. The metal used in everything from beer cans to iPhones takes a lot of energy to produce, and rising electricity prices are putting pressure on supply.

Industry insiders often joke that aluminum is electrical but solid. Each ton of aluminum requires about 14 megawatt-hours of electricity to produce, enough for the average UK family to use for more than three years. If the 65 million ton aluminum industry were a country, it would be the world’s fifth largest electricity consumer.

Investors believe that aluminum prices can reach $4,000/ton.

This means aluminum will be one of the first targets targeted in China’s efforts to limit industrial energy use. Even before the power crisis hit, Beijing placed a strict limit on aluminum production, ending the previous period of continuous production expansion. Now, with energy costs soaring across Asia and Europe, the risk of aluminum supply cuts is growing.

Aluminum prices rose 1.6 percent to $3,014.50 per tonne on the LME on October 12, the highest since July 2008. According to active traders in the market, investors are clamoring to buy at up to $4,000 a tonne – betting that the price could break through $4,000 to hit an all-time high.

Many aluminum mills in China have tightened production and the country’s output may have peaked, at least in the short term, according to Mark Hansen, CEO of Concord Resources Ltd. based in London said. He predicted that with the current market deficit, the price could reach 3,400 USD/ton in the next 12 months.

The pressure on the aluminum industry is enormous. In the Netherlands, aluminum producer Aldel will cut output this week due to high electricity prices, Dutch broadcaster NOS reported.

Currently, traders, investors and analysts are closely monitoring the situation from China. Under production pressure, market demand exploded, China imported a very large amount of this metal. However, they still export a large amount of semi-finished aluminum, partly due to tax relief support.

“Given the severity of the power shortages and the cuts we’ve seen, it doesn’t make sense for China to export large amounts of aluminum every month. It’s like they’re exporting energy resources. So,” said James Luke, director of the Schroders Commodity Fund.

A chart of aluminum prices and energy costs to produce 1 ton of aluminum in Germany.

Analysts, including Goldman Sachs, say it is likely that Beijing will cancel the reduction of value-added tax on exports to slow the flow of metals out of the country. With China continuing to import large quantities of aluminum next year, the rest of the world will be severely short, raising the risk of a price spike.

The soaring aluminum prices this year will prompt manufacturers to reopen old factories and consider adding new supplies. However, the spike in electricity costs is putting pressure on smelters and making it difficult to restart plants.

For example, if an aluminum smelter in Germany wanted to reopen, it would have to pay about $4,000 in electricity to produce 1 ton of aluminum, far exceeding current aluminum prices.

“The global metals market will be the tightest ever in 2022,” said Eoin Dinmore, head of aluminum basic product research at CRU.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com