Nickel metal was suddenly caught in a ‘storm’ as prices recently repeatedly broke historic highs, now hitting a decade-high as investors bet that manufacturers Automotive manufacturers will have to compete for this metal to ensure the supply of electric vehicle batteries amid declining inventories.

The reference nickel contract – 3-month futures on the London Exchange (LME) – on January 12 rose 4.4% to $22,745 a tonne, the highest since August 2011. In the previous session, January 11, the price of this metal increased by 5%.

In China, nickel prices jumped to record highs, with the Shanghai Futures Exchange February contract ending Jan. 12 surging more than 3.8% to 162,340 yuan ($25,510) a tonne. .

In 2021, nickel outperformed other metals, gaining 25% – the strongest increase since 2019, becoming the highest performing metal among industrial metals. Speculators are rushing to buy nickel with the expectation that the price will increase further

Nickel prices rose in part because concerns about economic growth in China – the world’s top consumer of the metal – had eased. In addition, high demand for nickel due to soaring sales of electric vehicles has also boosted the metal market, with major automakers ramping up production and boosting sales.

Ole Hansen, head of commodity strategy at Saxo Bank in Copenhagen, said: “The focus on China is shifting from worries about a downturn in the real estate sector to signs of economic growth. The economy will regain momentum after the Government introduces stimulus and support measures for the economy, some of which will benefit industrial metals.

The amount of nickel stored in LME warehouses has halved in the past five months, currently at its lowest level since December 2019 at 48,846 tonnes. Meanwhile, storage on the Shanghai floor is also near a record low of 4,859 tons, far below about 16,000 tons a year ago, partly because China’s stainless steel mills are buying into stock. .

The spot nickel contract is now up to $192 a tonne higher than the three-month forward contract, the highest spread since October 2019, suggesting short-term supply is tight. In December 2021, this difference was only 47 USD/ton.

The amount of nickel stored in LME warehouses has halved in the past five months, currently at its lowest level since December 2019 at 48,846 tonnes. Meanwhile, storage on the Shanghai floor is also near a record low of 4,859 tons, far below about 16,000 tons a year ago, partly because China’s stainless steel mills are buying into stock. .

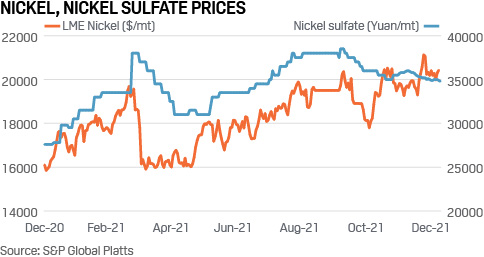

Nickel price and nickel sulfate price.

Stainless steel mills, mainly in China, account for about two-thirds of global nickel consumption. China’s production rebounded strongly after the Covid-19 pandemic, which has boosted demand for nickel imports into this market.

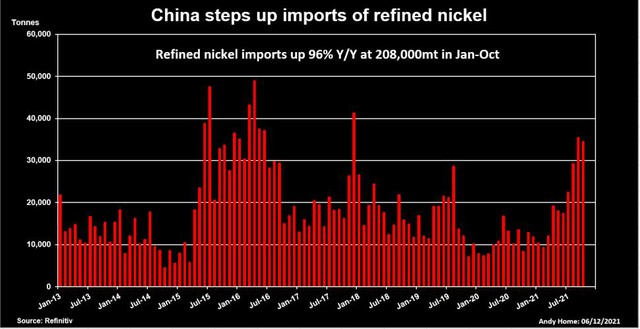

Accordingly, the country’s refined nickel imports since April 2021 have increased significantly, accumulating in the January-October period is 208,000 tons, up 96% over the same period last year.

Refined nickel imports into China increased sharply.

Not only in China, demand in other parts of the world has also exploded, causing supply to become tight.

Most of the world’s nickel supply is supplied to stainless steel producers, and global stainless steel production rebounded rapidly in 2021, recording a year-on-year growth of 25%. year-on-year, according to the International Stainless Steel Forum.

To date, electric vehicle batteries have made up only a small fraction of total global nickel consumption, but are growing rapidly.

Nickel demand for the battery industry in China, the world’s largest supplier of EV batteries, is growing rapidly in the form of imports of supercharged nickel sulphate. Import volume of this item in the first 10 months of 2021 reached 35,900 tons, up from only 4,800 tons in the first 10 months of 2020.

The synergy of the old and new nickel consuming industries defied the forecasts.

At its meeting in October 2020, the International Organization for Nickel Research (INSG) projected a 9% increase in global nickel demand in 2021. However, in April 2021, they raised their forecast to 12%, and in their most recent meeting, in October, raised this rate further to 16%.

These are super-fast growth figures, showing the strong recovery of the global economy after the first outbreaks, 2020.

S&P Global Market Intelligence forecasts a rapid recovery in global primary nickel consumption due to the expansion of stainless steel capacity in China and Indonesia.

“Demand outside of China is expected to be the key driver of global demand growth in 2022, with global consumption forecast to grow at a compound annual growth rate of around 7 percent. % during 2020-2025,” S&P said, adding: “Battery industry nickel demand is also expected to grow significantly faster, with many predicting close to 35% of total demand by the end of the year,” S&P said. this decade”.

Meanwhile, INSG also has to constantly adjust its supply data, which has been hit many times in China and other parts of the world.

In October 2020, INSG forecast that the world nickel market would have a surplus of 68,000 tons (supply-demand gap), and by October 2021, it would be reversed to forecast a supply shortage of 134,000 tons in 2021.

Supply risks are the main reason why JPMorgan analysts in December 2021 had forecast the deficit would last at least the first half of 2022, while also adjusting their forecast for nickel prices, according to the report. That increased to 23,000 USD/ton in the first quarter of 2022, down slightly to 22,000 USD/ton in the second quarter.

Goldman Sachs analysts forecast a 30,000-ton nickel market deficit in 2022, up from the August forecast of a 13,000-ton deficit.

“Nickel prices are expected to remain strong in the short-term amid the continued drawdown of already very low inventories, which should further decline,” said analysts at Jinrui Futures. However, an increase in capacity from Indonesia will limit the sharp rise in nickel prices in the medium to long term.”

References: Mining, Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com