China’s iron ore prices rose to a one-month high on Tuesday, amid optimism about the outlook for demand for the raw material in the world’s top steel producer.

Power shortages in China have raised concerns that electric arc furnaces – which use scrap iron to make steel – could be affected, meaning the steel industry will have to increase output from fish. blast furnace – use iron ore raw materials.

January 2021 iron ore futures on the Dalian Commodity Exchange (China) ended up 4.9 percent higher at 762.50 yuan ($118.24) per ton after volatile trading hours. strong movement. During the session, the price reached 769 yuan at one point, the highest since September 6.

The price of iron ore for November term on the Singapore floor ended the session on October 8 up 5.8% to 124.25 USD/ton.

However, the volatility of the market shows that investor sentiment is in a “fragile” state as the market is turbulent with signs of difficulty in China’s real estate sector, which accounts for about 1/ 4 domestic steel demand.

ANZ senior commodity strategist Daniel Hynes said: “With property developers struggling due to high debt levels, it is unlikely that demand for steel and iron ore will be strong. “.

However, the reduction of China’s steel production due to the country’s decarbonization policy is still the biggest concern.

Commonwealth Bank of Australia analyst Vivek Dhar said: “We expect China’s steel output to remain under pressure through the end of the first quarter of 2022, as the country’s authorities want to organize Winter Olympics ‘green’ in February”.

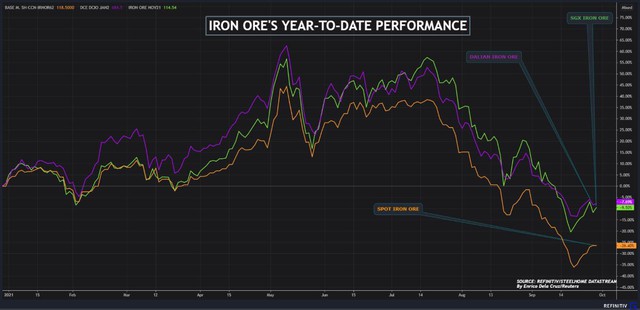

The price of imported iron ore, grade 62% iron, fell 49% to $118.50 a tonne at the end of September, from a record high of $232.50 on May 12 due to falling Chinese demand.

Also in the session 8/10, the price of rebar – used in the construction sector – on the Shanghai Futures Exchange increased by 1.8%, while hot rolled coil – used in production – increased by 1.9 %; stainless steel rose 4.7% from the most recent trading session. Dalian coking coal price also increased by 0.6%, coking coal increased by 1.9%.

Inner Mongolia, China’s second-largest coal producer, has asked 72 mines to increase annual capacity to nearly 100 million tonnes amid record high prices and severe power shortages.

Performance of iron ore in 2021.

Last week, Australia lowered its forecast for world iron ore prices at the end of 2022 from $109/ton previously expected to $93/ton, but kept its forecast for end-2021 prices at $150/ton. .

In its latest quarterly report, Australia’s Department of Industry, Science, Energy and Resources said iron ore demand from China’s steel industry fell due to slowing construction activity and the implementation of some government policies. government has led to precarious iron ore prices in recent times.

Steel demand from China’s construction sector has weakened as the country tries to cool down its overheated property market and erase the huge debt mountain of its economy.

Australia expects its iron ore exports to increase from 852 million tonnes in 2019/20 to 915 million tonnes in 2021/22, representing a 7.4% increase.

“New production is expected to be added from key projects in the Pilbara region of Western Australia, including BHP’s South Flank project (from 2021), [Fortescue Metals Group’s] Eliwana project (from 2021) ) and [Brockman Mining’s] Marillana field (from 2021)” will contribute to the increase in production.

Australia expects iron ore exports to increase as Chinese demand is strong again.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com