The world iron ore market in 2021 witnessed the utmost joy of producers when prices set a record high in history, but also witnessed the most disastrous decline in history. This tragic story is expected to continue.

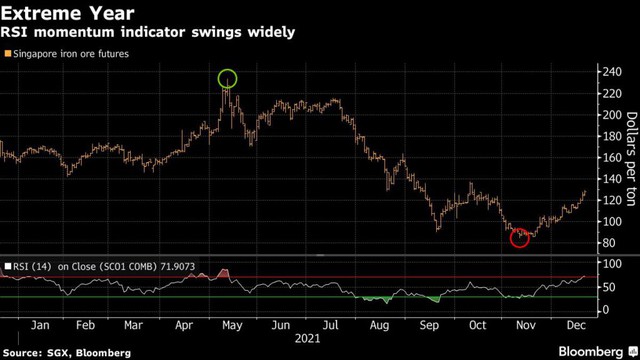

Iron ore prices skyrocketed in 2021. In May 2021, iron ore prices jumped to a record high of $237/ton, then turned back down to only about $85/ton in November 2021 due to China’s commitment cut steel production in 2021 equal or lower than 2020. In November 2021, Fitch Solutions stated that the iron ore price increase has officially ended. However, a few weeks ago, the price of this metal increased by 50% in a short time. Currently, the price of iron ore (62% iron) imported into China has returned to the level of 123 USD/ton.

Iron ore price in 2021

According to analysts, the volatility in the iron ore market will last until 2022. Here are the most memorable ‘stories’ about the iron ore market in 2021.

1. China

Iron ore is a barometer for the Chinese economy, so China’s curbs on steel production to control its carbon emissions set the bar for the metal’s performance in 2021.

In March, the Tangshan government issued a level two pollution warning, urging heavy industry companies such as steelmakers and coking plants to cut output accordingly.

The move dampened market optimism about increased demand after the Lunar New Year for iron ore in the world’s top steelmaking market.

Concerns about the debt problems of Chinese property developers, which account for about a quarter of the country’s steel demand, also added pressure on iron ore and steel prices.

After the flood of news about Evergrande’s financial difficulties, the debt-ridden real estate giant was unable to sell the property to raise money and on September 23 missed its 83.5 interest payment deadline. million USD for the dollar bond due.

Iron ore prices in China have plunged to their lowest level in nearly three years as concerns about the real estate market grow.

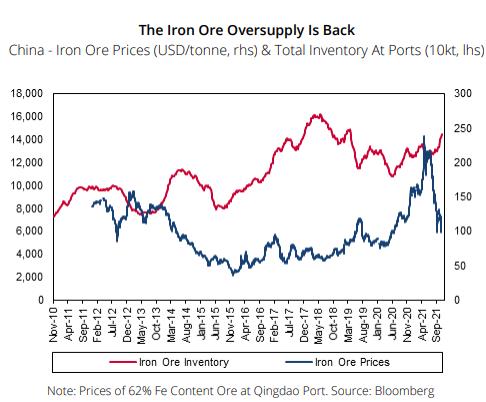

2. Excess supply is back

In terms of supply, gradually improving production growth in Brazil and Australia has begun to help loosen seaborne iron ore supplies that have long been tight.

Oversupply of iron ore is back (increasing reserves)

Vale is operating with a current iron ore production capacity of 330 million tons. The company’s Q1 2021 iron ore output was 68 million tons, 14.2% higher than Q1 2020, while Q2 2021 production was 76 million tons, 12% higher than Q2. 2020.

Meanwhile, in Australia, Fortescue has “beaten” all previous forecasts as full-year production in FY 2021 is estimated at 182 million tonnes, and plans to export 180-185 million tonnes in fiscal 2022.

Similarly, BHP reports iron ore production for fiscal 2021 at 253.5 million tonnes, which is at the upper end of the forecast range.

Among major producers, only Rio Tinto offered a bleak outlook on its half-year results, warning that exports are likely to be at multi-year lows, maxing out around 325- 340 million tons in 2021, and will need to increase production sharply in the next 5 months,” Fitch said.

3. Huge Simandou Mine

While the major manufacturers all have positive results in 2021, one treasure remains untouched.

With two billion tons of iron ore and considered the world’s highest quality iron ore mine, the giant Simandou mine in Guinea continues to be the subject of a dispute between Vale and Israeli billionaire Beny Steinmetz.

In December 2021, Steinmetz was arrested in Greece after a Swiss court found him to have engaged in bribery related to mineral rights in January 2021.

The Simandou mine, if produced at full capacity, is capable of exporting up to 100 million tons per year, becoming the world’s fifth largest source of iron ore, after Fortescue Metals and BHP.

4. Outlook for 2022

Storms are expected to continue in the iron ore market in 2022.

China is pushing to cut carbon emissions ahead of the 2022 Winter Olympics in Beijing, the country’s steel output in 2022 is expected to continue into a second year of decline, while the real estate sector is in debt. pile-up is weighing heavily on steel consumption in particular and economic growth in general.

Analyst Zeng Ning of CITIC Futures Co. “Demand for iron ore will decline across the board,” said.

“The real estate industry is quite weak, steel consumption is likely to decrease and many factories will use scrap to reduce emissions.” – Analyst Zeng Ning.

UBS Group AG expects iron ore prices in 2022 to average $85/ton, while Citigroup forecasts $96. Capital Economics predicts the price of this mineral by the end of 2022 will be at 70 USD/ton.

“We have a neutral opinion on iron ore prices going forward, following a ‘crash’ in the second half of 2021. However, we see the mineral likely to decline towards the end of 2022, and average in 2022 will be at 90 USD/ton,” said Fitch.

Among the bright spots of the iron ore market, it is possible that the Chinese Government will apply fiscal stimulus measures, monetary policy may loosen further and support the real estate industry more. property, while steel production could rebound when restrictions are lifted after the Olympics.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com