The world iron ore market is entering a strong recovery, mainly based on two factors that have not yet occurred: expectations of a new construction boom in China and the risk of supply disruption from Australia is the leading exporter in the world.

The reference iron ore contract (for May term) on the Dalian bourse has increased in a row for the past three sessions, on January 27, up 2% to 781 yuan ($123.07) per ton, the highest since from October 13. March iron ore term on the Singapore exchange also increased 1% to 139.05 USD/ton.

Meanwhile, according to data from consulting firm SteelHome, the price of imported iron ore 62%, for immediate delivery at Chinese seaports, also increased to 139 USD/ton, the highest since September 3; Spot iron ore prices in northern China hit $137.60 a tonne, up 58% from an 18-month low hit in mid-November, at $87 per ton, according to commodity price reporting agency Argus. ton.

The “catalysts” driving this rally are a mix of both fear and hope, which is the expectation that demand for the steelmaking raw material will increase sharply after steel production restrictions are eased. loose after the Beijing Winter Olympics next month.

Demand for iron ore is expected to pick up as traders return to the market after the Lunar New Year holiday, and beyond after the Winter Olympics, as steel mills are likely to replenish. inventory.

Industrial activities in China are expected to be restricted during the Olympics period to ensure smog-free skies. However, “After the holiday season, (outlook) consumption will continue to be upbeat,” said Huatai Futures analysts.

Meanwhile, the prospect of tight supply pushed prices further, even though some Chinese traders were on holiday for the New Year.

“In terms of supply, due to the recent heavy rains in Brazil and … in Australia, as well as the number of ships and the volume of imported iron ore arriving at the port, there has been a significant decrease,” Huatai Futures analysts said. .

Warnings from major mining companies Fortescue Metals Group, BHP Group and Rio Tinto about labor shortages due to a sharp increase in the number of Covid-19 infections in Australia; Along with China’s policy of increasing easing to support a slowing economy, also contributed to pushing up iron ore prices.

Supply in Australia is at risk of being affected by the rapidly spreading variant of Omicron, to Western Australia – which is one of the few areas in the world that has had a record of low Covid-19 infections thanks to border control measures. strict limits.

The Western state is home to most of Australia’s iron ore mines, which supply about 70 percent of imported iron ore from China, the world’s largest importer of the raw material.

The state recorded 24 new cases of Covid-19 on January 26. While this is tiny compared with the 17,316 new infections and 29 deaths in the state of New South Wales on the same day, it is worrisome that Western is starting an Omicron wave.

Western Australia Premier Mark McGowan said: “We have an outbreak right now and we won’t be able to bring it under control.”

Despite this pessimism, McGowan is still closing its state borders to control the spread of the Omicron variant, but this could also cause iron ore production to drop.

Many workers at remote mines live in other states and major miners fear that some will quit their jobs unless Western Australia’s border controls are eased, allowing them to travel freely between the mines and their homes in the eastern states of Australia.

Rio Tinto, BHP Group and Fortescue Metals Group, Australia’s largest iron ore miners, are all poised for possible production disruptions due to labor shortages.

The worry does not stop there as the upcoming cyclone season in Australia may be more severe than usual due to the La Nina weather phenomenon. This phenomenon has recently caused more and more powerful storms.

However, the production disruption is only a prediction, in fact the export volume is still increasing.

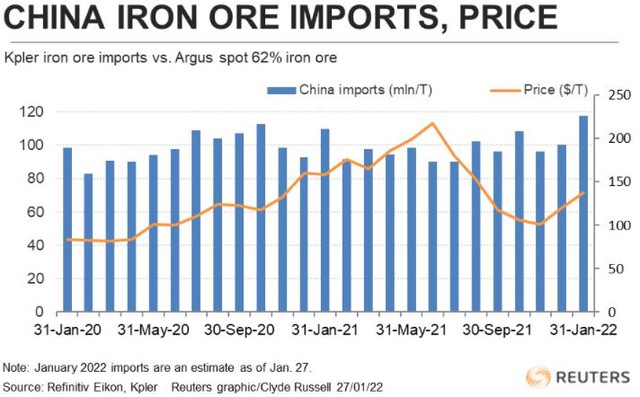

Price and import of iron ore into China.

Australia’s iron ore exports according to Refinitiv data are estimated at 74.13 million tonnes in January, down from 80.26 million in December but higher than 68.25 million tonnes in November 2021 and 71 respectively. .71 million tons of October 2021.

Solid exports in recent months have been reflected in China’s import data, with Refinitiv forecasting January imports at 117.41 million tonnes. If confirmed by official customs data, that would be the highest on record, surpassing the old record of 112.65 million tonnes in July 2020.

Commodity consultancy Kpler also expects a record high January imports of iron ore into China, with data showing 117.42 million tonnes of port scrapping. Official data is likely to show some variation as not all shipments arriving in January will be cleared in the same month.

Strong iron ore imports into China stem from hopes for the moment, specifically expectations of strong construction activity in the coming months.

Steel production in China may be restricted until March, due to the country’s desire to curb pollution during the period of the Beijing Winter Olympics and the upcoming week-long Lunar New Year holiday.

However, once this period is over, expect steel demand to pick up as construction numbers peak in the summer and as Beijing struggles to stimulate the economy to hit its growth target. .

Reference: Refinitiv

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com