Iron ore prices on the Asian market recovered on November 8, ending a series of seven consecutive declines compared to selling, although the increase in this session was not large.

Although the price increased in this session, it has not yet touched the threshold of 100 USD/ton, in the context of volatile trading activities due to weak Chinese demand and high iron ore inventories.

Ending the session on November 8, the iron ore contract for January futures traded on the Dalian Exchange increased by 1.4% to 570.5 CNY ($89.17)/ton. Iron ore for December delivery on the Singapore Exchange also gained 0.5% to $91.95 a tonne at the close, after falling 2.2% in the same session to $89.45.

In the domestic market, steel prices recently tended to increase again. From October 18 to October 28, 2021, domestic steel enterprises had two adjustments, with a total increase of 1,070 VND/kg – 1,310 VND/kg depending on product type and brand. The reason for the price increase, according to the Vietnam Steel Association (VSA), is the impact of input costs on the global market, with both fuel and steel material prices increasing complicatedly according to the trend in the global market. past months. Despite the recent decline, iron ore prices are still much higher than in previous years.

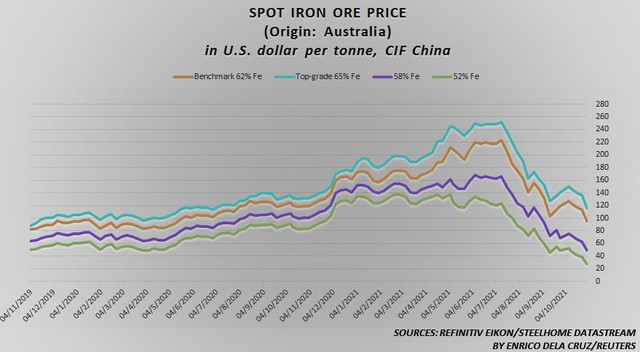

The price of Australian 62% iron ore imported to China has fallen more than 140% from a record high of $232.50 a tonne in May, as Chinese demand fell. Currently, 62% of Australia’s iron ore is trading at $94.50 a tonne, the lowest level since May 2020, according to consulting firm SteelHome.

Price of Australian iron ore imported into China.

Steel prices on the Shanghai trading floor also increased at the same time, with rebar futures on the Shanghai trading floor up 2.6%, while hot rolled coil rose 0.4%, especially stainless steel almost did not. change. Coking coal and coke, another raw material in steel production, also gained 0.5% and 1.7% respectively in the same session.

SteelHome data showed that the accumulation of imported iron ore at Chinese ports ended the week at a 31-month high of 145.10 million tonnes, adding to further downward pressure on prices.

Atilla Widnell, managing director of Navigate Commodities, based in Singapore, said he has adjusted his near-term price target to $97.92-$101.16/ton, CFR China, from 91. 18 – 101.24 USD previously offered, because the iron ore market showed signs of being oversold.

Iron ore exports from Australia and Brazil fell about 4.5 million tonnes last week from the previous week, according to Navigate data. Mr Widnell said: “Australia’s reduction in iron ore exports could be a sign that the output of this steel material from high marginal cost producers is being affected by the relative decline in iron ore prices. low in recent times.

The overall market sentiment is also improving after data showed that the world’s top steel producer – China – had exports in October, although slowing, still higher than analysts’ expectations. growth due to improved global demand.

The iron and steel market has cooled down recently due to China’s slowing economic growth and strong anti-pollution measures in the country.

Iron ore imports into China fell 4.2 percent in October, the second straight month of decline, as limited steel output undermined demand for the raw material.

Data from the General Department of Customs shows that the world’s top iron ore consumer imported 91.61 million tons of iron ore in the past month, down from 95.61 million in September. Compared to October In 2020, imports in the past month also fell 14.2% after the government implemented environmental control measures and demand for steel products weakened.

“Over the next few years, China’s energy consumption control measures will continue to weigh on the country’s crude steel production and also affect demand for iron ore imports,” GF Futures said. in a newsletter sent to its customers.

The reference iron ore futures price on the Dalian bourse has halved from its record high of 1,227 yuan ($191.90) per ton in mid-May.

GF Futures expects China’s iron ore imports to fall 5% to 7% in the second half of the year due to falling steel output.

In the first 10 months of 2021, China imported 933.48 million tons of iron ore, down 4.2% year on year. The country’s steel exports in October were 4.5 million tons, down 8.5% month on month, but up 11.4% year on year. Steel imports in the same month fell 10% on the month, to 1.13 million tons, compared with 1.93 million tons imported in the same month a year ago.

The face of the world steel market may change after the US and the European Union (EU) end their conflict over steel and aluminum tariffs. The EU and the US argue that overproduction in China is threatening the survival of their steel industries.

On October 31, the US and EU reached a truce on these two metals, and confirmed they would work together to reach a global agreement to deal with overproduction. surplus in this industry. Under the agreement, Washington will tax-free allowing EU countries to access the US market tax-free with a volume equivalent to the level before the administration of former President Donald Trump imposed tariffs in 2018. In return, the EU will drop retaliatory tariffs on the US market. American goods such as spirits, electric trains and Harley-Davidson motorcycles.

Not only returning to the status quo before 2018, the US and EU also plan to deal with the threat of climate change and overproduction in this industry – one of the world’s largest CO2 emitters. .

Following the agreement with the EU, the US is conducting preliminary negotiations on the future of steel and aluminum tariffs between the US and Japan, also aimed at addressing the root cause of non-market overcapacity.

This will be a challenge for China, which produces more than half of the world’s steel, and could exert lasting downward pressure on steel prices in China.

References: Reuters, Metalbulletin

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com