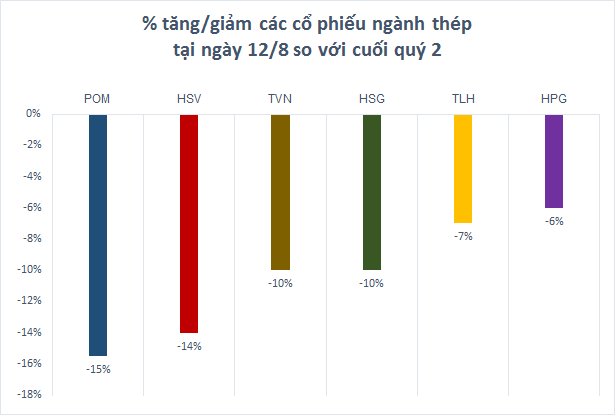

The alternating corrections caused the “wave” of steel stocks to gradually slow down, statistics on the market, since the end of the second quarter, the market price of steel stocks has decreased by 6-15%.

After the first half of 2021, the price of steel and input materials such as iron ore is showing signs of “cooling down”.

In the international market, the price of standard iron ore 62% fell to 164.5 USD/ton in trading on August 12, according to data from tradingeconomics. This price was 29% lower than the peak of 232.5 USD/ton set in mid-May.

The rise of iron ore as well as Chinese steel prices began to slow down and decrease mainly because the Chinese Government began to intervene more deeply in curbing the hot rise of steel prices.

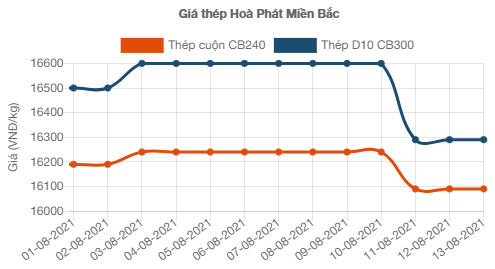

Following the downward trend in the world, in Vietnam market, since mid-May until now, Vietnam’s CB240 coil price has decreased continuously by about 7 – 8% because the domestic market is currently in the low consumption season. and the price of input materials such as billet has been more stable.

From mid-July until now, the price of construction steel has had two price reductions, many large domestic steel companies simultaneously announced to reduce steel prices by about VND 100,000-400 thousand/ton depending on brands and products. Products. Hoa Phat Steel Company – accounting for more than 30% of the domestic steel market share – on August 11 reduced the price of CB240 coil 150 VND to 16,090 VND/kg and the price of D10CB300 steel decreased by 310 VND to 16,290 VND/kg.

It can be seen that the record of net profit of most Vietnamese steel enterprises can be seen thanks to the benefit from the context of high steel demand that has led to a sharp increase in prices in Vietnam as well as globally. The group of steel stocks also “was up” in the first half of 2021.

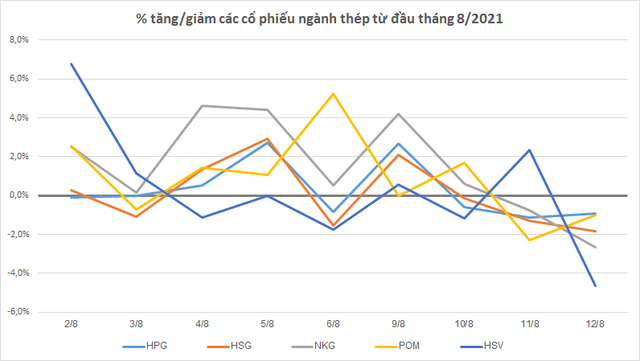

Up to now, the price has retreated to a stable level, raising concerns for investors about the end of the construction material price super cycle. The “fever” of steel stocks is no longer so hot as before. Besides the falling steel price, the pressure of profit-taking after the “hot” gain also had a negative impact on the stock price movement. Statistics on the market, since the end of the second quarter, the market price of steel stocks has decreased by 6-15%, a few small stocks have increased insignificantly.

Specifically, Pomina steel (POM) in the session 12/8 decreased 1% to 14,500 dong/share, compared to the 30/6 session, it decreased 15% in market price. The session of August 12 also marked the 5th consecutive drop of Hanoi Iron and Steel (HSV) shares, corresponding to a decrease of 14% compared to the end of June. In addition, large stocks such as HPG also decreased by 6%, HSG also decreased by 6%. down 10%, TLH decreased by 7% compared to the end of Q2.

Mirae Asset Securities in a recent assessment report emphasized that an increase in construction steel prices above 17.2 million/ton will be good in the short term, but in the long term, there will be certain effects on the industry’s direct demand. steel.

Viet Capital Securities Company (VCSC) also said that steel stock prices in the first half of the year reflected most of the expected profit increase of listed steel companies thanks to the increase in global steel prices. VCSC expects steel prices to peak and then correct in the second half of 2021, thereby causing the profit margins of steelmakers to decline in the second half of 2021 from the highs in the first half of 2021.

In the same opinion, VNDIRECT Securities believes that the expected decrease in steel prices will put significant pressure on the gross profit margin of steel companies in the second half of 2021 when cheap inventories are sold out. In particular, the influence will be larger for companies in the galvanized steel sheet segment.

In the short term, many evaluations believe that steel stocks do not have much growth momentum due to pressure, but investors can still expect at the end of the year – the peak period of the construction season and also the peak of the construction season. such as the Government’s promotion of public investment – then the demand for steel will increase strongly and be a positive support for the stock price.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com