The price of foreign scrap steel offered to Vietnamese customers this week dropped sharply, the price of iron ore in China also plummeted due to the decline in demand from China’s steel industry.

Scrap steel prices on the Asian market this week fell due to the recent rapid decline in steel prices in China.

Scrap sellers around the world in the week to October 29 have lowered their asking price for heavy melting scrap (HMS) 1&2 (80:20) to $560/ton, cfr Vietnam, down $5. /ton compared to the previous week, Metalbulletin quoted Fastmarkets as saying.

Although the price dropped, buyers were not interested in buying. Production activities in general did not have strong fluctuations. Vietnamese customers only pay for HMS scrap about 545 – 548 USD/ton, cfr.

While the price of imported scrap decreased, the price of steel in Vietnam increased slightly last week. Major steel producers generally offer CB240-T and CT3 coil prices at VND16.93-17.13 million ($742-752)/ton, and CB300-V, CT5 and SD295 rebar at VND295. 16.83-16.98 million VND; CB400-V and SD390 rebar at 16.83-17.03 million dong. Within a week, the price increased by about 300,000 VND/ton.

The price of HMS 1&2 steel scrap (80:20) packed in containers early last week was sold to Vietnamese customers for $490/ton cfr Vietnam.

Fastmarkets data shows that the weekly price assessment for deep-sea bulk cargoes of steel scrap, HMS 1&2 (80:20) bulk cargo on October 29 is $550-555/ton, cfr Vietnam, down. 10 USD/ton compared to 560-565 USD/ton a week earlier.

Meanwhile, Japan’s bulk H2 scrap steel is offered for sale at $538-540/ton cfr Vietnam, but buyers only pay $530/ton.

The reason why the price of scrap steel of all kinds fell last week is because China’s demand for Vietnam’s export steel has recently declined, although the price of rebar used in construction in China has recently increased, in around 700-740 USD/ton.

“Steel prices in China are falling, causing Chinese steel importers to lower their import prices for steel, even reduce or suspend imports, so Vietnamese steel mills are not willing to buy scrap at high prices. “, information from Fastmarkets.

Spot rebar and billet prices in China have been plunging since the second week of October, pressured by repeated warnings by the government that commodity prices should not rise too quickly. and the authorities will closely audit the books of businesses to ensure there is no hoarding and price manipulation.

Shredded scrap from Japan (bulk cargo) this week is offered for sale at $585/ton, Vietnam cfr, Hong Kong’s H1&H2 scrap (50:50) is offered at $520/ton cfr. Vietnam, while Hong Kong’s oversized plate & structural scrap (P&S) is offered at $560/ton cfr in Vietnam.

Fastmarkets’ weekly data also shows that H2 steel scrap originating from Japan, cfr Vietnam on October 29 was priced at $535-540/ton, down $5/ton from $540-545/ton a week. before.

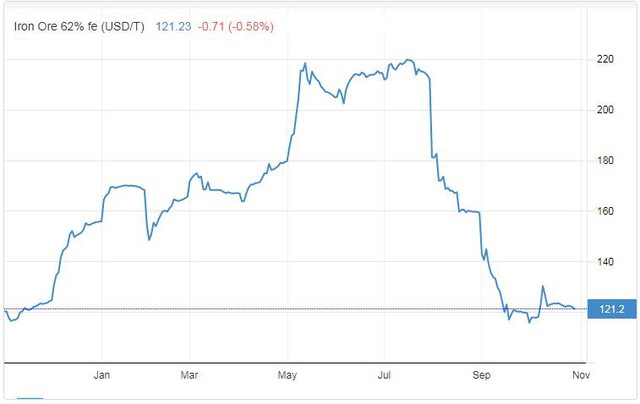

Similar to scrap, iron ore prices last week also fell as the Chinese Government stepped up measures to cool coal prices and the country’s steel output fell.

According to updated data of Fastmarkets, iron ore with 62% content imported into China, for immediate delivery at Chinese seaports, at the end of the week, Friday (October 29) was 107.28 USD/ton, down 4. 4% compared to the previous session.

Meanwhile, iron ore futures on the Dalian Stock Exchange (China) fell 3.6% to 651 yuan/ton.

Output of the five main steel products – rebar, hot-rolled coil, coil, cold-rolled coil and plate – at Chinese steelmakers tracked by consulting firm Mysteel rose 4.9 per cent in the previous year. last week, up 9.2 million tons, but still much lower than 10.7 million tons in the same period last year.

“Due to the impact of energy consumption control measures, production restrictions to meet environmental targets during the heating season (winter) and the occasion of Beijing celebration,” said analysts at CITIC Securities. With the Winter Olympics… , steel supply in the country is expected to continue to be constrained, and iron ore demand will continue to decline in the long term.”

However, due to restrained steel production, steel prices in China increased. In the session of October 29, the price of bar and hot rolled coil both increased, with steel bar on the Shanghai floor, for January delivery, up 0.8% to 4,646 yuan ($727.14) per ton. Meanwhile, hot rolled coil on this floor increased 0.9% to 5,003 yuan/ton, stainless steel for January delivery also increased 0.6% to 19,080 yuan/ton.

Despite rising in the past session, steel prices in China are currently around the lowest level since mid-March, as the Government of this country warned that it will strictly handle those who let prices of goods unreasonably high. reasonable.

The price of rebar in China is the lowest in many months.

The Ministry of Ecology and Environment says China aims to cut concentrations of hazardous airborne small particles, known as PM2.5, by an average of 4% per year in key pollution control cities in the region. this fall and winter, and will continue to regulate production at steel mills.

China’s steel industry is in a difficult period, under pressure from many sides. Recent economic data shows that the economy is weakening, in which the construction sector – accounting for a quarter of domestic steel demand, is still depressed due to the real estate crisis.

References: Metalbulletin, Tradingeconomics, Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com