Steel prices have cooled down sharply in May and June but some other construction materials such as cement and sand still increased strongly – creating challenges in boosting construction investment.f1

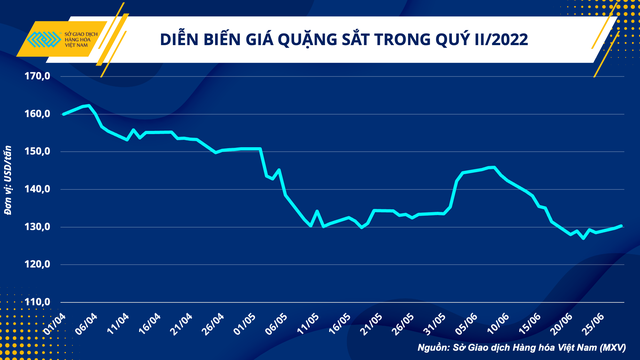

World iron ore prices fell 20% from the beginning of the second quarter of 2022

In the second quarter, the world iron and steel market was constantly under pressure after a series of negative news on the price of futures contracts. According to the Vietnam Commodity Exchange (MXV), the MXV-Index Metals has dropped more than 20% since the beginning of April until now. Notably, during the same period mentioned above, the price of iron ore linked to the Singapore Exchange (SGX) also plunged more than 20%, to about 110 USD/ton.

The problem of controlling inflation in the world’s leading economies is still the focus of investors recently. A series of major central banks, led by the US Federal Reserve (Fed), have continuously made moves to raise interest rates, tighten monetary policy to stabilize escalating prices, and try to bring balance to the market. supply and demand balance of the economy.

However, this requires a trade-off in terms of growth goals, as businesses face higher borrowing costs, limiting production capacity. Followed by a decrease in the demand for input materials. With a key role for the industry and construction investment, the iron and steel industry is directly facing significant challenges.

According to MXV, more than 50% of iron and steel demand is used for construction and infrastructure development. However, in recent times, the real estate sector, which is the lever for economic growth, is facing many challenges in the face of the global recession. Data from the beginning of the year to now show that home sales and the number of building permits in the US have continuously declined, indirectly affecting iron and steel consumption demand and putting pressure on prices.

In addition, the situation of the Covid-19 epidemic in China is still affecting the balance of supply and demand in the world’s largest iron and steel consuming country. Businesses ramped up production after Shanghai lifted its lockdown at the end of April in the hope that government stimulus would support economic growth again.

However, new infections continue to appear, while demand is still suffering, causing the steel market to fall into an oversupplied state. The profit margin of the manufacturing enterprises weakened and the output was therefore cut, directly causing the iron ore price to plunge in recent trading sessions. In the 2 weeks of mid-June, SGX iron ore prices recorded a series of 8 consecutive declines.

Vietnam depends on imported raw materials

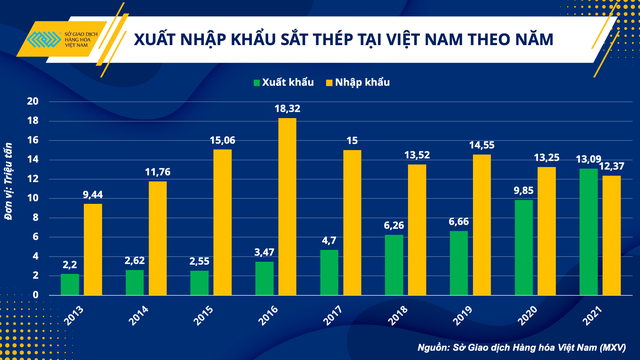

In recent years, the domestic steel industry is making remarkable progress and limiting its dependence on imported raw materials. Vietnam’s steel industry has also achieved great achievements when for the first time in the history of steel exports in 2021 and exported to more than 30 countries around the world.

Specifically, Vietnam’s exports of iron and steel of all kinds in 2021 increased by nearly 25% compared to 2020, corresponding to an increase of more than 3.2 million tons. According to data from the General Department of Customs, as of mid-June 2022, Vietnam’s iron and steel exports reached about 4.4 million tons, down about 15% over the same period last year, mainly due to the effects of the pandemic. disease at the beginning of the year. However, compared to the same period in 2020, iron and steel exports have increased by more than 11%.

However, in the short term, the construction material industry in Vietnam is still heavily dependent on imported raw materials, most notably iron ore, scrap steel, or coking coal. Pham Quang Anh, Director of the Vietnam Commodity News Center said: “The domestic supply of iron ore is only enough to meet 30% of the demand for domestic steel production, while the cost of iron ore accounts for 20 – 30% of the cost of finished steel. Fluctuations in world prices will greatly affect the domestic construction material industry and thus, directly affect industrial activities and construction investment.

According to the Ministry of Industry and Trade, in 2022, Vietnam will continue to have to import many types of materials for steel production, including about 18 million tons of iron ore, 6.5 million tons of scrap steel and 6.5 million tons of smelted coke. fat. In the context of the global economy being faced with many challenges from geopolitical tensions, complicated epidemic factors or concerns about slowing growth, increasing autonomy for the construction materials industry in general and iron and steel in particular in Vietnam has become a key factor for socio-economic development.

Steel prices fall but other materials still rise

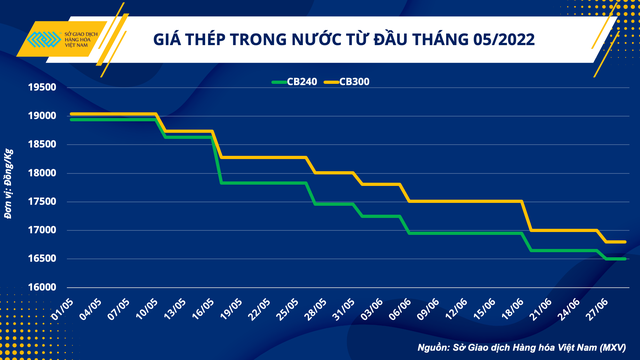

In less than 2 months, the domestic steel price has been adjusted down 7 times with a total decrease of about 2.5 million VND/ton, currently fluctuating in the range of 16.6 – 17 million VND/ton due to the continuous decline in iron ore prices.

Compared with the skyrocketing price at the beginning of the year, causing a series of construction contractors to delay projects and “stretching” because of costs, the cooling steel price will bring an opportunity to speed up the construction investment progress. .

According to the plan approved by the Government, the socio-economic development and recovery program in the period of 2022 – 2023 has a total scale of up to VND 347,000 billion, equivalent to about 4.2% of GDP in 2021. In which There are 16 key transport infrastructure projects by the end of this year. In the context of iron and steel prices starting to cool down, it will contribute to supporting construction investment activities after a period of interruption because of the epidemic.

However, in contrast to iron and steel, the prices of some other construction materials are still on the rise. Typically, cement has had three price increases since the beginning of 2022 after coal prices doubled over the same period last year due to tight supply. The price of concrete sand also increased by more than 20% compared to the beginning of June 2021. Other construction materials such as brick and stone also fluctuated slightly compared to the previous year. Contradictory developments in the price of construction materials will still create great challenges in the process of growth recovery of our country.

In addition, the economic recession pressure not only affects the leading economies but also causes a domino effect for developing countries. Weakening demand in the world will put iron and steel exports under a lot of pressure, and this requires domestic steel quality to be enhanced.

To do so, investment in production technology lines needs to be promoted, and this will also be the key to solving the problem of raw material autonomy and bringing great economic efficiency to the industry. building materials in Vietnam.

T&G Import-Export Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 02473010868

Email: hrm@tginterjsc.com

Website: http://tgimportexport.com