Prices of all iron and steel grades rose this week, with stainless steel gaining the most, more than 7%, while iron ore gained more than 6%, other products also on the rise.

The price of stainless steel on the Chinese market at the end of the week continued to increase by nearly 7% to a new record high due to strong consumption while the supply of raw materials did not meet the demand, amid the market’s unease. concerned about China cutting steel production.

The reference futures stainless steel contract – August 2021 – July 16 session rose 6.7% to 19,175 yuan (US$2,965.15)/ton during the session, ending the session still high. 4.3% higher than the previous close at 18,740 yuan/ton, the highest level since stainless steel contract trading began on the Shanghai exchange in 2019. This is the twelfth session. 3 in a row stainless steel prices hit all-time highs.

“Consumption (stainless steel) downstream is relatively good, supply and demand are both strong,” said Huatai Futures, adding that recent concerns about a cut in steel output (in China) countries) also affects the supply outlook.

Environmentally targeted production controls in China to limit energy-intensive and high-emissions projects have led to shortages of iron alloys, such as ferrochrome, the raw material for stainless steel production. rust.

Prices of other steel products and raw materials for steel production in the session 16/7 mostly continued to increase. Accordingly, the price of rebar – used in construction – on the Shanghai floor, for October delivery, increased by 0.2% to 5,559 yuan/ton, while the price of hot-rolled coil – used in manufacturing and manufacturing – down 0.1% to 5,952 yuan/ton.

The price of iron ore for September delivery on Dalian trading floor increased by 1.9% to 1,241 yuan/ton; iron ore 62% of spot imports at Chinese seaports increased by 1 USD to 221.5 USD/ton; Dalian coking coal rose 2.4% to 2,053 yuan a tonne, and coking coal rose 3.1% to 2,693 yuan a tonne.

| Product | Price 9/7 | Price 16/7 | +/- (%) |

| Iron Ore | 1.163 | 1.241 | 6,3 |

| Rebar steel | 5.428 | 5.559 | 2,4 |

| Hot rolled steel coil | 5.798 | 5.952 | 2,6 |

| Stainless Steel | 17.360 | 18.740 | 7,4 |

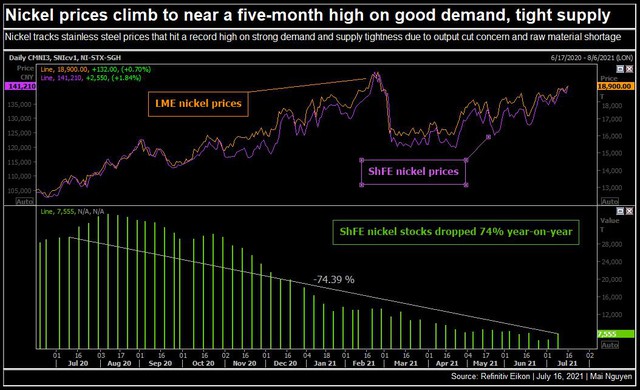

Nickel price highest in nearly 5 months – an important factor pushing stainless steel prices hot

Nickel prices have recently continued to increase sharply due to high demand from many sectors, spurred by the recovery of the world economy after the Covid-19 pandemic.

On the afternoon of July 16, the price of 3-month nickel futures (reference contract) on the London Stock Exchange (LME) reached 19,205 USD/ton, the highest since February 25, 2021. On the same day, August nickel futures on the Shanghai Exchange (ShFE) near the end of the session rose 3.6% to 143,710 yuan (US$22,225.49) per ton, the highest since February 26.

Nickel is used largely in the production of stainless steel. In addition, the demand for nickel in the production of electric vehicle batteries is expected to increase rapidly in the coming years.

The amount of nickel in stock on ShFE is now only 7,555 tons, down 58% year-to-date and 74% lower than at the same time last year. The reason is that while demand for nickel has increased sharply, China’s production has decreased. Information from research firm Antaike said that China’s nickel cathode production in the first six months of 2021 decreased by 4.4% compared to the same period last year, reaching only 79,400 tons.

How long will the increase in Chinese steel prices last?

To answer this question, it is necessary to look back at the evolution of the Chinese iron and steel market.

Steel futures prices on the Shanghai floor this week continuously increased, reaching the highest level within 8 weeks. Both rebar and hot-rolled coil this week returned to highs not seen since May 19, 2021 – a turning point for the steel market when prices collapsed due to stern warnings from Beijing about punishing speculative activities as well as warning that they will find ways to prevent excessively high commodity prices.

Since May 19, the price of iron and steel in China has plummeted. But not long after, the price rose again.

Notably, the reason for the steady recovery of Chinese steel prices is also due to Beijing’s efforts to limit production capacity to reduce emissions for environmental purposes, which has led to concerns about the lack of raw materials. due to the strong demand for iron and steel.

China’s crude steel output fell by 5.6% in June 2021 from a record high in May. Accordingly, Chinese steel mills produced 93.88 million tons of steel in June, compared to 99.45 million tons in May. Although down from the previous month, June production is still 1.5% higher than the same month of 2020.

Although steel prices rebounded, demand for these products in China remained stable at a high level. Data from consulting firm Mysteel showed that consumption of five main steel products in China in the week to July 15 increased by 3.9% from the previous week, to 10.77 million tons, while inventories steel fell for the first week in 6 weeks.

Imports of steel scrap and billet into China in the second quarter of 2021 decreased compared to the first quarter of 2021, but not because of weak Chinese demand, but because prices in China are lower than prices in other markets. neighboring markets, such as Japan, make it impossible for Chinese importers to profit from buying from abroad. For this third quarter, the demand for imported materials and steel prices in China can only cool down if Beijing changes its output control policy, such as having a more cautious policy in the last 6 months of the year to avoid rising steel prices.

Also related to demand, the People’s Bank of China announced to cut the reserve requirement ratio for banks, with a reduction of 50 basis points, effective from July 15. This would give the market about 1 trillion yuan more liquidity, helping underpin an economic recovery that is showing signs of losing momentum. Increased liquidity means commodity prices will continue to increase, especially iron and steel.

References: Refinitiv, Agmetalminer

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com