Iron ore for September futures fell 8.8% to 1,121 CNY (equivalent to 173.31)/ton, sometimes down to only 1,118.5 CNY, the lowest since June 8. Iron ore for July delivery on the Singapore Exchange fell 5.7 percent to $195.05 a tonne, the lowest level since June 8.

Iron ore prices in Asia fell in the last session as the Chinese Government expanded its investigation into the market as prices of the main raw material in steel production fell but remained high despite warnings against activity. speculation from the government of this country.

Iron ore for September term on Dalian trading floor this session fell 8.8% to 1,121 CNY (equivalent to 173.31) / ton, sometimes down to only 1,118.5 CNY, the lowest since June 8.

Iron ore for July delivery on the Singapore Exchange fell 5.7 percent to $195.05 a tonne, the lowest level since June 8.

The decline in iron ore drags down the prices of related goods. The price of rebar on the Shanghai trading floor this session fell 4.2%, hot rolled coil fell 4.3%, non-imitation steel fell 0.6%, Dalian coking coal fell 4.2% and coking coal fell 5.4% compared to the previous session.

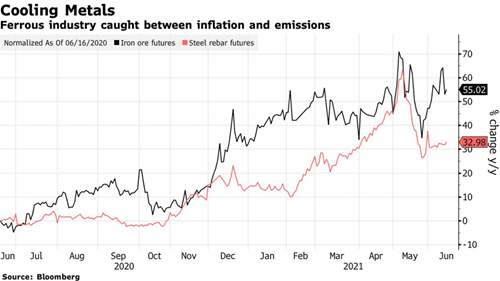

Price movements of iron ore futures (black) and bar steel futures prices (red) in China. Unit: % change over the same period last year.

China’s National Development and Reform Commission (NDRC) and China’s Market Regulatory Authority announced “severely punishing and exposing” abnormal market behavior such as price inflation and hoarding.

Authorities visited the Beijing Iron Ore Trading Center to discuss efforts to secure supply and stabilize prices, according to a statement from the NDRC.

Spot iron ore prices have been above $200 a tonne for the past three weeks, despite efforts from Beijing to control prices – boosted in part by speculative trading. Spot iron ore prices peaked above $230/ton in May.

Iron ore prices in Dalian and Singapore are under pressure as investor sentiment is affected by a seasonal slowdown in construction activity.

“Construction rebar inventories at steel mills and warehouses in China are both increasing,” said Atilla Widnell, managing director at Navigate Commodities, Singapore.

Iron ore prices have experienced several weeks of volatility as the Chinese government tries to cool steel prices in the country amid soaring steel demand, constrained supply, and a recovery in global industrial production. Construction rebar prices in China are now down about 18 percent from their peak in May, but are still well above the long-term average. Iron ore prices are now down about 10% from their record highs set in May.

China’s steel demand is forecast to weaken in the second half of this year, but this is a somewhat uncertain forecast. In addition, huge global stimulus packages can boost demand for steel and other construction materials. Not to mention, China both wants to reduce steel price fever and wants to curb steel output to protect the environment. school. These are two completely conflicting goals.

Source: VITIC/Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com