Coal prices in China rose about 9% on October 18, hitting a new record high as supplies remained tight despite Beijing’s increased efforts to boost output.

Accordingly, the price of coking coal for the term of January 2022 in the session of October 18 sometimes increased by 9% to 3,869 yuan (US$601.24)/ton, still ending the session 8.4% higher than the previous session. before (October 15), reached 3,847 yuan/ton.

Coke futures also rose 9% this session to 4,344 yuan/ton.

The price of thermal coal for January 2021 on the Zhengzhou Exchange has reached a historic record high of 1,669.40 yuan (US$259.42) per tonne on October 15. Compared to the same time last year, the price of thermal coal in China has increased by more than 200%.

The tight coal supply situation in China has not eased, especially when the Government needs to ensure electricity demand for heating in winter.

China produced 334.1 million tons of coal in September 2021, down from 335.24 million tons in August 2021 and down 0.9 percent, data from the National Bureau of Statistics of China showed. compared with the same month last year. Of which, the production of coke in September alone decreased by 9.6% over the same period last year, reaching only 37.18 million tons.

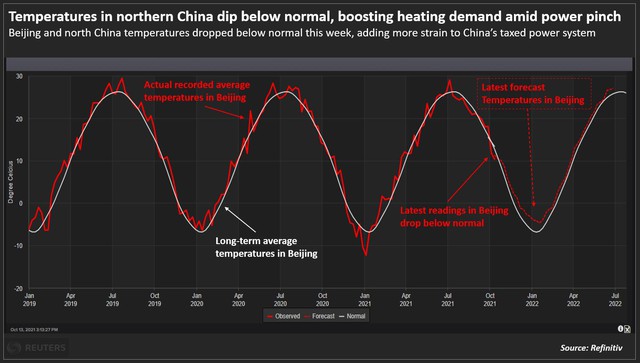

China’s energy crisis was exacerbated by a cold front on Friday, sending temperatures dropping across much of the country, forcing power plants to scramble. coal hoarding, pushing coal prices to new highs.

Electricity demand for heating homes and offices is expected to soar this week along with the northeast monsoon. The meteorological agency predicts that the average temperature in some areas of central and eastern China could drop by about 16 degrees Celsius in the coming days.

Temperatures in Northern China drop below normal, boosting heating demand mạnh

Coal shortages, high fuel prices and explosive demand in the industrial sector in the wake of the Covid-19 pandemic have caused widespread power shortages in the world’s second-largest economy.

The electricity quota distribution regime has been in place in at least 17 of the more than 30 regions in China since September, forcing some factories to suspend production and disrupt supply chains. The policy of switching to greener fuels also contributed to production disruptions in many factories.

Power distribution map in China: Provinces have varying degrees of power cuts.

China’s three northeastern provinces, Jilin, Heilongjiang and Liaoning – were among those hardest hit by power shortages last month – and several areas in Northern China, including Inner Mongolia and Gansu, have begun to need heating in the winter to cope with colder than usual weather – mainly coal-fired electricity.

Beijing has taken a series of measures to curb rising prices, including increasing domestic coal production and cutting power to industries and some power-intensive factories during periods of peak demand. . The government has repeatedly assured users that a supply of heating energy will be guaranteed during the winter.

However, power shortages are expected to continue early next year. Analysts and traders both forecast a 12% drop in industrial electricity consumption in the fourth quarter due to a coal supply shortage and local governments having to prioritize electricity for residential users.

Earlier this week, China, in its boldest move in its decades-long power sector reform, said it allowed thermal power prices to fluctuate by up to 20% from baseline as of Oct. allowing power plants to pass on increased generation costs to commercial and industrial users. It is known that China has set a target of “carbon neutrality” by 2060, and Beijing is trying to reduce its dependence on polluting coal power sources to switch to wind power, solar energy and hydroelectricity.

Even so, it is expected that coal will still provide the majority of electricity demand in China for some time to come.

Steel, aluminum, cement and chemical producers are expected to face higher and more volatile electricity costs under the new policy, putting pressure on profit margins. Recent data shows that China’s factory price inflation hit a record high in September. Accordingly, producer prices in China in September 2021 increased by 10.7% year-on-year, the highest increase in at least 25 years. Meanwhile, cold winter weather can make the situation worse.

China is not the only country experiencing power supply difficulties, which has led to fuel shortages and power outages in several countries. The energy crisis has highlighted the difficulty of cutting the global economy’s reliance on fossil fuels, as world leaders work to find ways to tackle change. climate at the Glasgow talks next month.

Coal prices rose globally on the back of booming electricity demand and tight supply in China.

References: Marketwatch, Refinitiv

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com