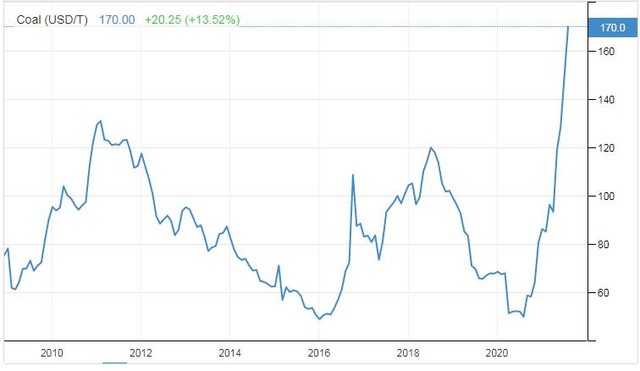

The world coal market is becoming “hot” than ever. Coal prices have continuously broken high records to reach new highs due to strong demand and many other factors.

Coal price traded on the Dalian Exchange (China) after increasing by 8% in the session of August 23 continued to increase by 6% in the session of August 24, extending the price increase sequence from the end of the third quarter of 2020 due to electricity demand. rising, concerns about coal supplies in China, infrastructure problems, and rising gas prices globally. Unusually hot weather also boosted coal demand in China, Japan, South Korea and the US markets.

On the morning of August 24, the price of coking coal on the Dalian bourse rose to a new all-time high, 2,571 yuan ($396.7) per ton, while coking coal also reached a new peak of 3,267, 50 yuan ($504.17) /ton In just 2 trading sessions, the price of coal on this floor has increased by more than 15%. 280.5 USD/ton, coke fell to 3,150.5 CNY/ton, but it was still a historical record high and increased by 6.5% compared to the previous session.

Coal prices are at historic highs

This price increase was sparked by rumors that China would stop importing Mongolian coal within two weeks from August 23 due to Covid-19, raising fears that the already scarce coal supply would be further tightened. chop.

According to Mysteel Global, Mongolia exports 28.6 million tons of coal in 2020, and China is Mongolia’s largest coal export market, buying about 95% of the total exports. About 14.55 million tons of Mongolian coal, accounting for 54% of total exports, have been transported through Ganqimaodu Port, China’s largest land border port and China’s most important coal import channel. Country. Therefore, the import halt for 2 weeks will have a significant impact on the coal industry in both China and India.

According to Mr. Zhao Yang, co-founder of China coal market information site, Meitan Jianghu, coal imported from Mongolia is mostly used in steel production. Therefore, the suspension of coal imports from this country will greatly affect China’s steel industry.

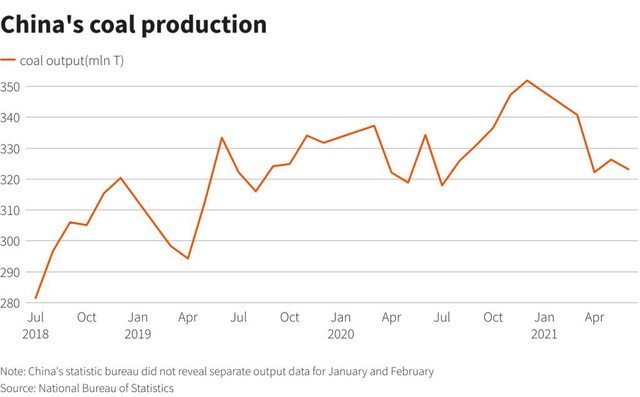

The recent rise in coal prices is also due to strong demand for power plant fuels, especially from China, which outstrips supply. The recent sharp increase in world coal prices has made Chinese consumers shift to using domestic coal, but domestic coal production also faces many problems.

Meanwhile, although the peak period of electricity use in China is coming to an end, thermal coal demand is still high due to low domestic coal production as affected by many safety and related incidents. The logistics system was disrupted due to recent heavy rains causing flooding. Heatwaves in Zhejiang, Jiangsu and Guangdong, China’s largest industrial provinces, and a rebound in industrial output have pushed up electricity demand, despite the government’s pledge to cut electricity bills. carbon emissions.

The price of US coal on August 18 rose to $172/ton, double the level of $85/ton at the beginning of 2021.

Meanwhile, the price of Australian thermal coal delivered at the port of Newcastle – a popular type of coal supplied to the Asian market this year has also increased by 106%, currently reaching more than $ 166 / ton, according to information from Argus.

Accordingly, the weekly Newcastle coal price index (Newcastle weekly index) in September 2020 was only 46.18 USD/ton, in mid-August 2021 reached an all-time high, 195.20 USD; The South African coal index (Richards Bay index) is also up 55% year-to-date, reaching $137.06/ton.

The price of Indonesian coal is also now rising to the highest level in more than a decade, reaching 130.99 USD/ton in early August 2021.

Soaring coal demand from China, Japan and South Korea lifted Indonesia’s benchmark coal price for August 2021 to $130.99 a tonne, the highest level in more than a decade, the Indonesian energy ministry announced on Thursday. August 3.

Coal demand increases sharply, especially in North Asia

Coal demand skyrocketed from all over the world, especially China, Japan and South Korea.

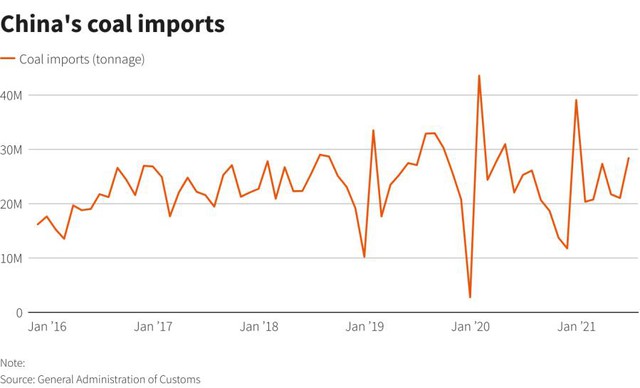

China’s coal imports jumped 35% in June from the previous month, to a 2021 high, Reuters reported on July 13. In the first six months of this year.

China’s coal imports

However, in the first 6 months of the year, the country imported 139.56 million tons of coal, down 19.7% compared to the same period last year, causing China’s coal reserves to fall to an all-time low. this August.

One of the factors driving down coal imports is Beijing’s unofficial ban on coal purchases from Australia, the world’s second-largest exporter of thermal coal. China’s coal imports from Australia, once the second-largest supplier to the market, have fallen to almost zero, with only a handful of coal imported in recent months, according to commodity analysts Kpler. recently. The unofficial ban was introduced around the middle of last year, and China’s imports from Australia fell from 9.65 million tonnes in June 2020 to just 435,559 tonnes in June this year, according to Kpler.

Instead of supplying Australia, China is trying to shift its focus to increasing imports from Indonesia, the largest exporter of thermal coal, as well as from Russia, the US and even South Africa, which are not traditional exporters to the country. China.

China’s imports from Indonesia increased from 11.77 million tons in June 2020 to 18.28 million tons in June 2021, according to Kpler. Imports from Russia increased to 5.33 million tons in June this year from 3.78 million tons in the same month last year, while imports from the US were 1.56 million tons in June, up from 572,000 tons in the same month of May. 2020.

However, China is paying a very high cost to not import Australian coal, causing the price of Indonesian coal to increase sharply.

Coal supply does not meet demand

While demand spiked, supply from major producers was limited. Trade tensions with Australia have reduced coal imports from this country into China, making coal supply in China tight. Meanwhile, supplies elsewhere are also experiencing problems due to a mine closure in Colombia and flooding in Indonesia and Australia.

Indonesia recently banned coal exports from dozens of its mining companies, causing supply from this market to shrink. Accordingly, earlier this month, Indonesia’s Ministry of Energy and Mineral Resources suspended exports of 34 coal mines for failing to meet domestic sales obligations for the January-July 2021 period.

To meet demand, China has allowed the restart of production of 15 coal mines across northern provinces within a year, such as those in Shanxi and Xinjiang. However, coal production in these mines always has potential risks such as mine safety or flood…

China’s coal imports

Price outlook will not cool down soon

Although it is at a historic record high, it is predicted that the world coal price will continue to increase because the Chinese economy is expected to prosper again by the end of this year.

Ramli Ahmad, chairman of Indonesian coal mining company Orentin Energi, said in an interview with the press: “It (coal) spilled into China. China, China, China”, and “I think China’s economy is heating up. So if they don’t import much in the first half of the year, they will import more in the second half. That is driving up prices.”

The recovery of oil prices and record high gas prices will also continue to push coal prices up. Crude oil prices are up more than 30% this year, while gas is up 55%.

In the long term, the coal market still has many opportunities to grow despite the world’s fight against carbon emissions. That is because the economies that do not have strict environmental regulations such as India, Pakistan … continue to increase the use of coal. It should be noted that Europe and the US – which are against coal use – account for only 10% of global coal demand.

Daily Times, Cnbc, Argusmedia

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com