Steel prices on the Shanghai Stock Exchange – the reference for the Asian market – continued to rise to the highest level within 8 weeks after the Chinese Government announced measures to ease monetary policy, in the context of the capital market having fear that restricting steel production in this country will make steel supply not enough to meet demand.

The price of rebar – used in construction – on the Shanghai floor ended the session 12/7 increased 1.4% compared to the previous session, to 5,432 yuan ($839)/ton, in the middle of the session, the price sometimes reached 5,532 yuan, the highest level since May 19. Since the beginning of the year, the price of rebar has increased by 21.7%, despite a sharp decline due to the Chinese Government’s campaign to cool down the price of raw materials.

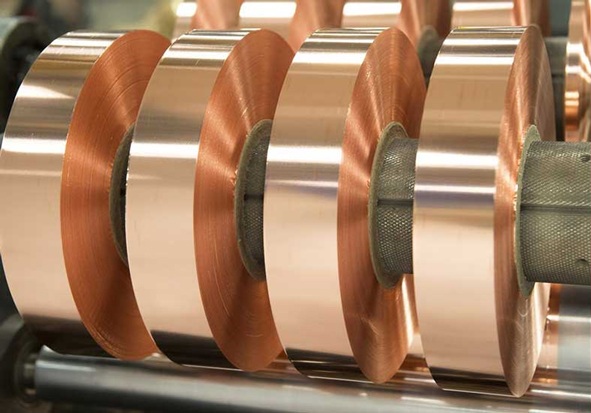

Hot rolled coil (HCR – used in production) today also ended at an increase of 1.4% to 5,828 yuan/ton from the previous session, sometimes reaching the highest level since 19/month. 5, is 5,948 yuan. Compared to the beginning of 2021, the price of HCR is now 33.8% higher.

Stainless steel today also increased 0.6% to 17,305 yuan/ton.

The capacity utilization rate of blast furnaces at 247 Chinese steel mills recovered to 86% on July 9, from 81% a week earlier, data from consultancy Mysteel showed.

Volatility of ferrous metal prices from the beginning of the year to now

The sharp increase in steel prices helped the steel material market to stabilize again after falling for 4 consecutive weeks.

Accordingly, the price of iron ore for September futures – the most traded among the tenors – today increased by 1.5% to 1,188.50 yuan/ton, sometimes up to 1,213 yuan. Iron ore for August futures on the Singapore Exchange today also increased 1.9% to 208.10 USD/ton. The price of coking coal on the Dalian bourse today increased 2%, while coking coal increased 1%.

The iron and steel market suddenly rebounded, ending a streak of a consecutive month of gloom, when iron ore prices have fallen for the past 4 weeks because concerns about China’s control of steel production not only overshadowed demand. for the steelmaking raw material that could lead to an iron ore surplus, as iron ore supplies from the world’s top four miners are expected to increase significantly in the second half of 2021.

On the afternoon of July 9, the People’s Bank of China (PBoC) announced that it would cut the reserve requirement ratio (RRR) of banks by 50 basis points, effective from 15 July. freed about 1 trillion yuan out of banks to spur a recovery in the domestic economy, as there have been some signs that the recovery appears to be slowing.

This move attracted great attention because while many major central banks, led by the US central bank (Fed), signaled that they might soon tighten their currency, China went the opposite way. .

RRR is considered a powerful monetary policy tool when it directly affects the amount of money in circulation. By varying the reserve requirement ratio, the central bank can regulate the money supply with the goal of controlling inflation or promoting growth. The last time the Central Bank of China (PBoC) cut the RRR was in April 2020 as the country struggled to respond to the Covid-19 pandemic.

In the past time, steel prices have had a strong period of increase due to China’s restriction on steel production to reduce carbon emissions as committed to the world.

However, analysts are still cautious when commenting on the prospect of China’s steel market.

“The reality is it will probably take 6-9 months for the RRR cuts to impact steel production and iron ore consumption,” said Atilla Widnell, managing director of Navigate Commodities in Singapore. such a long period of time will probably dissipate the excitement of this market towards that policy of the PBoC.

Mr. Widnell also said: “Sooner or later, the Government will have to rein in its ambition to reduce steel production in 2021, otherwise the risk of a speculative asset bubble will increase further.”

Reference: Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com