Steel prices today increased to 4,525 yuan / ton on the Shanghai Exchange. The price volatility of iron ore in 2021 makes the market concerned about demand and interested in the price forecast of this commodity in 2022.

Steel prices today increased again.

Steel prices today May 2022 delivery on the Shanghai Exchange increased 37 yuan to 4,525 yuan/ton at the time of the survey at 9 am (Vietnam time).

| Type name | Period | January 10th | Difference from previous transaction |

| Copper price | Delivered in February 2022 | 69.770 | +430 |

| Zinc price | Delivered in February 2022 | 24.205 | -280 |

| Nickel price | Delivered in February 2022 | 153.870 | +2.810 |

| Silver price | Delivered in July 2022 | 4.642 | +7 |

| Steel price | Delivered in May 2022 | 4.525 | +37 |

List of futures trading prices of some metals on the Shanghai Exchange (Unit: yuan/ton). Summary: Thao Vy

The price volatility of iron ore, the world’s second most traded commodity by sea, in the year just ended, causing the market to worry about demand and interested in the price forecast of this commodity in 2022. .

Iron ore chart at Shanghai Exchange (Source: Shfe)

To the surprise of miners and trade officials, 2021 iron ore prices fell from an all-time high of $235.55 a tonne on May 12 to a 16-month low of around 85 USD/ton in November and finally at the end of the year.

This volatility stems from expectations of a strong recovery in steel demand, mainly in the infrastructure construction sector following the global second wave of COVID-19.

At the same time, prices are also affected by Beijing’s decree that the steel industry must limit emissions leading to production control. In the end, iron ore prices have fallen nearly 30% from their opening prices in January 2021.

Indian miners are closely monitoring any developments regarding iron ore imports and more recent restrictions on steel production in China, which buys more than 80% of its ore needs from abroad, mainly from Australia and Brazil, to capture price fluctuations.

India’s more or less following the global trend is confirmed by periodic ore price adjustments from NMDC, whose annual output is around 36 million tonnes making it the country’s largest miner.

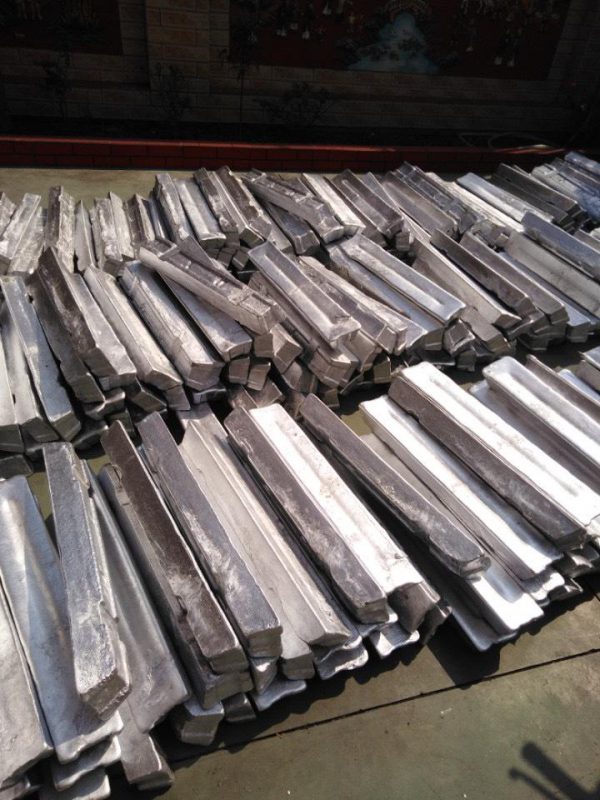

Photo: Hickman and Love

When world prices fell, NMDC lowered prices more than once. The most recent was on December 28, the NMDC price for lump ore with 65.5% Fe content was Rs 4,900/ton and for 64% Fe ore was Rs 4,060/ton, exclusive of taxes.

While such price cuts help steelmakers offset to some extent the high cost of coking coal, some mills complain that domestic mined iron ore prices are still higher than global prices. Financial Express reported.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com