Steel prices today increased to 5,783 yuan / ton on the Shanghai Exchange. Asian iron ore prices will continue to face downward pressure due to limited Chinese steel production and power shortages in the fourth quarter.

Steel prices continue to go up today

Steel price today delivered in January 2022 on the Shanghai Exchange increased 18 yuan to 5,783 yuan / ton at the time of the survey at 9:45 am (Vietnam time).

| Type name | Period | October 11 | Difference from yesterday |

| Copper price | Delivered in November 2021 | 69.210 | -60 |

| Zinc price | Delivered in November 2021 | 23.105 | +245 |

| Nickel price | Delivered in November 2021 | 145.210 | +2.910 |

| Silver price | Delivered in December 2021 | 4.852 | +57 |

| Steel price | Delivered in January 2022 | 5.783 | +18 |

Futures price list of some metals on the Shanghai Exchange (Unit: yuan/ton).

Asian iron ore prices will continue to face downward pressure due to limited Chinese steel production and power shortages in the fourth quarter following a sharp price correction in the third quarter, S&P Global Platts reported.

Iron ore chart at Shanghai exchange (Source: Shfe)

The IODEX iron ore index fell 46% in the third quarter as a shortage of steel production in China forced mills to resell contract iron ore volumes, leaving the market in an oversupplied state.

However, different ores have different prices, not only due to their own supply and demand dynamics but also to external factors such as the high price of coke in China.

S&P Global Platts observed 88 spot trades for popular mid-grade ores from the top three miners, Rio Tinto, BHP and Vale, in the third quarter.

This is slightly lower than the 91 deals observed in the second quarter, with the drop in spot sales from Rio Tinto partially offset by an increase from BHP.

Specifically, Rio Tinto sold 18 spot shipments of Pilbara Blend Fines (PBF) in the third quarter, down more than half from 41 in the second quarter. Meanwhile, BHP sold 59 spot shipments during the same period.

As prices fell and selling pressure increased in the third quarter, miners moved from brokerage platforms to more flexible sales channels, giving sellers a full “picture” of all bids. before deciding whether to deliver the goods or not.

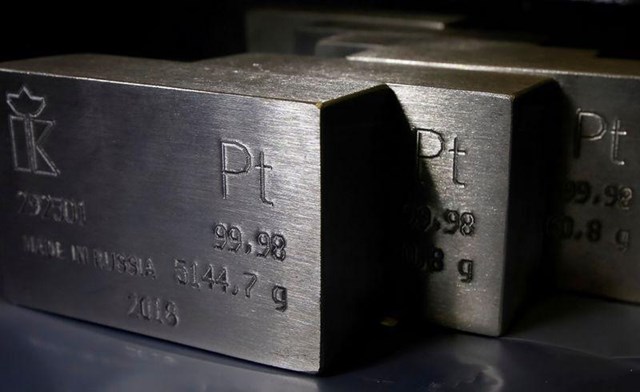

Photo: Steel Times International

As the market witnessed oversupply, premiums for mid-tier brands fell sharply, with even the most liquid brand PBF recording premiums down from $13.35/dmt in July down to around -1.30 USD/dmt in mid-September.

A spike in spot supply from BHP amid weak September demand caused a correction for mid-tier brands with lower Fe content.

Compared to last month’s 62% Fe index, the JMBF and MACF saw the biggest declines in the past three years, reaching -21.90 USD/dmt and -15.90 USD/dmt in mid-September, respectively. although the discount rate narrowed somewhat towards the end of the quarter.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com