Steel prices today increased to 4,202 yuan / ton on the Shanghai Exchange. Spot iron ore prices are now well below their steep declines during the start of the global COVID-19 pandemic last year.

Steel price increased slightly today

Steel price today delivered in January 2022 on the Shanghai Exchange increased by 11 yuan to 4,202 yuan/ton at the time of the survey at 9:20 am (Vietnam time).

| Type name | Period | 11/16 | Difference from previous transaction |

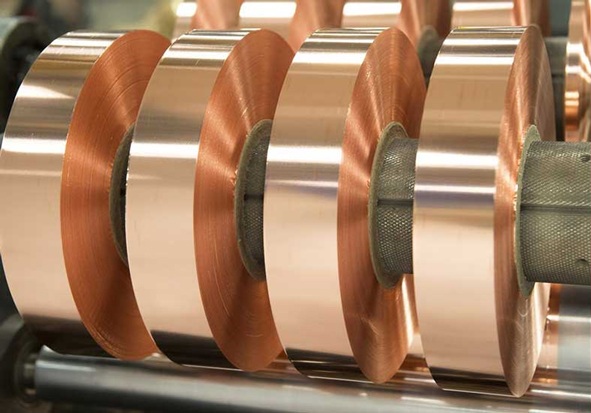

| Copper price | Delivered in December 2021 | 71.060 | +130 |

| Zinc price | Delivered in December 2021 | 22.800 | -380 |

| Nickel price | Delivered in December 2021 | 143.880 | -2.710 |

| Silver price | Delivered in December 2021 | 5.136 | -34 |

| Steel price | Delivered in January 2022 | 4.202 | +11 |

Futures trading price list of some metals on the Shanghai Exchange (Unit: yuan/ton). Summary: Thao Vy

According to Reuters, spot iron ore prices are now below the steep decline seen at the start of the global COVID-19 pandemic last year.

Iron ore chart at Shanghai exchange (Source: Shfe)

Meanwhile, market dynamics have yet to show any recovery in top importer China.

In times of strong demand, lower grade iron ore with 58% Fe tends to outperform both the standard grade 62% Fe and the high quality grade 65% Fe.

This is because steel mills in China, the country that buys nearly 70% of the global iron ore, try to produce as much steel as possible by operating the mills at high capacity utilization.

However, when steel demand is as weak as it is now, mills tend to switch to using higher grade iron ore to maximize the amount of steel produced from a small amount of input material.

In the context of coal shortage before winter in the North, the current pressure to save electricity in China also means that steel mills will try to produce as much steel as possible while still saving energy.

This dynamic is reflected as current spot prices, with 65% Fe iron ore, outperform the lower quality feedstock, although all three major grades have seen prices plummet since their record highs. record was obtained in May.

According to commodity price reporting agency Argus, the price of 65% Fe premium iron ore ended at $111.35/ton on Monday (November 15), down 58.1% from the previous level. all-time high of $265.80 on May 12.

62% Fe iron ore was at $93.55 a tonne, down 60.3% from its peak of $235.55 a tonne on May 12. Similarly, 58% Fe iron ore ended at $66.40/mt, down 67.9% from a peak of $107.10/mt.

Photo: MC Group

In contrast, when iron ore prices started to rise amid China’s ramping up of stimulus spending to boost its economy, the 58% Fe ore outperformed.

Specifically, it increased by 203.4 percent from the lowest level of $68.25/ton in 2020, to the highest level in May this year, while the 62% Fe grade increased by 196% and the 65% Fe ore increased by 181 ,3%

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com