Steel prices today reached 4,773 yuan / ton on the Shanghai Exchange. Analysts say that coal prices and imports will remain high in 2022, weighing on the profit margins of steelmakers.

Steel price today on Shanghai Exchange

Steel price today delivered in May 2022 on the Shanghai Exchange increased 43 yuan to 4,773 yuan/ton at the time of the survey at 9:45 am (Vietnam time).

| Type name | Period | February 21 | Difference from previous transaction |

| Copper price | Delivery in April 2022 | 71.530 | -30 |

| Zinc price | Delivery in April 2022 | 24.810 | -350 |

| Nickel price | Delivery in April 2022 | 178.080 | +1.310 |

| Silver price | Delivery in April 2022 | 4.884 | -7 |

| Steel price | Delivery in April 2022 | 4.773 | +43 |

List of futures trading prices of some metals on the Shanghai Exchange (Unit: yuan/ton). Summary: Thao Vy

Chinese steel manufacturers predict that business results in the fourth quarter of 2021 will not be very positive, according to S&P Global Platts.

Iron ore chart at Shanghai Exchange (Source: Shfe)

The reason is that the shortage of coal and the policy of tightening environmental controls have increased production costs. At the same time, the heavily indebted real estate sector has also dealt a heavy blow to steel demand and prices.

According to calculations by S&P Global Market Intelligence based on earnings reports for 2021 on stock exchanges in Shenzhen, Shanghai and Hong Kong, five out of 11 major steel producers estimate they will post a net loss in fourth quarter.

Only four of the companies are expected to report higher quarterly earnings than a year ago, although most will still report high annual earnings for all of 2021.

The price of seaborne metallurgical coal in China hit a record high of $615 a tonne amid a supply slump in the fourth quarter, reflecting a rapid escalation in Australian export coal prices that hurt profits. of steel manufacturers.

Besides, Baoshan Iron & Steel Co. Ltd. The listed arm of the world’s largest steelmaker China Baowu Steel Group Corp., said that spending on environmental protection also increased sharply during this period.

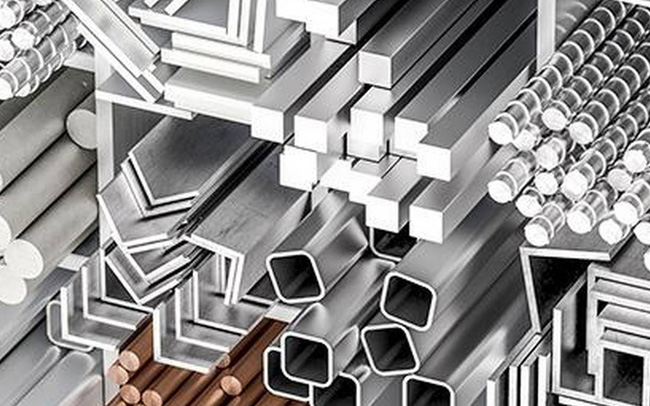

Photo: North Shore Steel

Stronger electricity demand in the fourth quarter of 2021 has outstripped domestic coal production, which has been constrained by increasing safety checks and stricter environmental requirements.

Meanwhile, steel demand has been hit hard by the liquidity crisis for the real estate sector, while efforts to secure “blue skies” for the Beijing Winter Olympics have reduced output. short term steel.

That sent steel product prices down, with the China Iron and Steel Association (CISA) steel price index falling 16.5% in the fourth quarter of 2021.

Although the electricity crisis has eased somewhat after government interventions, analysts expect coal prices and imports will remain high in 2022, weighing on profit margins of manufacturers. steel production.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com