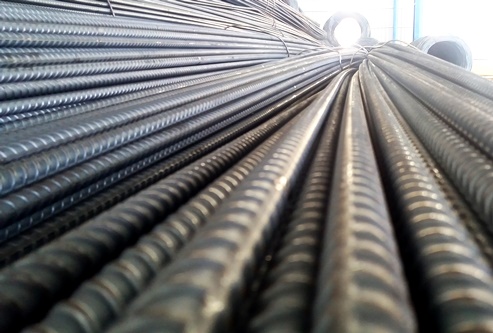

Steel prices today fell to 5,478 yuan / ton on the Shanghai Exchange. The main factor behind the decline in iron ore prices is that China is advocating to cut steel production in the second half of 2021.

Steel price today reached 5,478 yuan/ton

Steel price today January 2022 delivery on the Shanghai Exchange fell 126 yuan to 5,478 yuan/ton at the time of the survey at 9:00 (Vietnam time).

| Type name | Period | September 21 | Difference from yesterday |

| Copper price | Delivered in October 2021 | 69.270 | -940 |

| Zinc price | Delivered in October 2021 | 22.780 | +170 |

| Nickel price | Delivered in October 2021 | 143.490 | -3.780 |

| Silver price | Delivered in December 2021 | 4.871 | -178 |

| Steel price | Delivered in January 2022 | 5.478 | -126 |

Futures price list of some metals on the Shanghai Exchange (Unit: yuan/ton). Summary: Thao Vy

If iron ore’s rise to a record high in May was an overblown rally, last week’s plunge in the commodity was a tumultuous retracement, with no real move in sight. fully demonstrated by the fundamentals of supply and demand.

Iron ore chart at Shanghai exchange (Source: Shfe)

According to the Argus Commodity Price Reporting Authority assessment, the spot price of iron ore MTIOQIN62=ARG for delivery to North China fell 22.2% from the previous week to $100.45/ton on the 17th. /9.

Compared to the record high of 235.55 USD/ton reached on May 12, the price of this steelmaking material has now decreased by 57.4%.

The main factor behind the price drop is that China, which buys about two-thirds of the global seaborne iron ore, is advocating to cut steel production in the second half of 2021, to ensure that both year does not exceed last year’s record 1.065 billion tonnes.

China’s authorities say the country is moving to limit steel output to reduce pollution and energy use, especially due to rising prices of fuels for power generation, such as heat. coal power and natural gas.

Meanwhile, iron ore supplies have improved in recent months after a period of weather disruptions in top exporter Australia and a COVID-19 outbreak in second-place carrier Brazil.

However, the movement of iron ore flows around the world is nothing short of dramatic as the volatility of prices.

Photo: Canary Media

According to customs data, in the first eight months of the year, China’s iron ore imports were 746.45 million tons, down 1.7% year-on-year in 2020. Imports in August were 97.49 million tons. , the highest level since April and a sign that supply is recovering.

September is likely to see even stronger imports. Of which, Refinitiv ship-tracking data estimates up to 111 million tonnes will dock this month, and Cargo Consultants Kpler is even more optimistic with an estimate of 116.6 million.

So far, higher import volumes have not prompted a build-up of stockpiles, with SH-TOT-IRONINV inventories at the port monitored by consultants SteelHome falling for the second consecutive week. continued, ending at 130.1 million tonnes in the seven days to September 17,

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com