Steel prices today fell to 4,696 yuan / ton on the Shanghai Exchange. In China, iron ore futures rose on expectations of strong demand boosted by new stimulus measures by Beijing.

Steel prices today go down. Today’s steel for delivery in May 2022 on the Shanghai Exchange fell 21 yuan to 4,696 yuan/ton at the time of the survey at 9:45 am (Vietnam time).

| Type name | Period | January 24th | Difference from previous transaction |

| Copper price | Delivery in March 2022 | 70.640 | -650 |

| Zinc price | Delivery in March 2022 | 24.880 | -355 |

| Nickel price | Delivery in March 2022 | 177.610 | +2.260 |

| Silver price | Delivery in March 2022 | 4.988 | -74 |

| Steel price | Delivery in July 2022 | 4.696 | -21 |

List of futures trading prices of some metals on the Shanghai Exchange (Unit: yuan/ton). Summary: Thao Vy

On Friday (January 21), iron ore futures on China’s Dalian Commodity Exchange (DCE) rose about 3%, recording a third consecutive week of gains, Reuters reported.

Iron ore chart at Shanghai Exchange (Source: Shfe)

Accordingly, the price of iron ore for delivery in May 2022 increased 3% to 762 yuan/ton (equivalent to 120.12 USD/ton) during the session. This is the highest level since October 13.

At the close, the contract recorded a 2.2% gain to 756 yuan a tonne, revised weekly gains to 4.6%.

The reason for this increase was expectations of strong consumer demand, boosted by new stimulus measures by Beijing, while steel prices were limited by production restrictions at factories. .

The capacity utilization rate of blast furnaces at 247 steel mills across the country continued to recover and stood at 81.08% last week, up from 79.89% a week earlier.

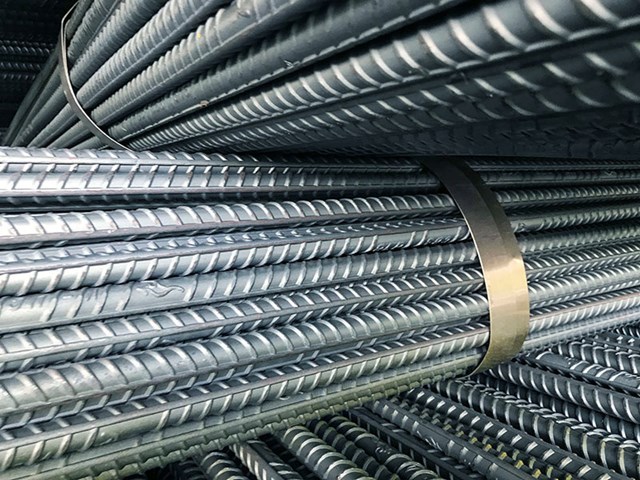

Photo: Hickman and Love

SinoSteel Futures analysts said: “There are many predictions that steel production will continue in the medium term, but also warn that short-term demand for steelmaking materials is under pressure due to World Winter Olympics and pandemic-related restrictions”.

China’s recent monetary policy is in line with the requirements of the central government, and more is expected to support the world’s second-largest economy, Huatai Futures said.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com