Steel prices today fell to 4,123 yuan / ton on the Shanghai Exchange. Steel demand is expected to increase as countries around the world invest in building post-pandemic infrastructure.

Steel prices continue to fall today

Steel price today delivered in May 2022 on the Shanghai Exchange fell 61 yuan to 4,123 yuan/ton at the time of the survey at 8:30 am (Vietnam time).

| Type name | Period | 11/29 | Difference from previous transaction |

| Copper price | Delivered in January 2022 | 69.880 | -1.180 |

| Zinc price | Delivered in January 2022 | 22.840 | -760 |

| Nickel price | Delivered in February 2022 | 148.260 | -3.260 |

| Silver price | Delivered in June 2022 | 4.859 | -70 |

| Steel price | Delivered in May 2022 | 4.123 | -61 |

Futures trading price list of some metals on the Shanghai Exchange (Unit: yuan/ton). Summary: Thao Vy

Chairman of China Steel Corp (CSC) Wong Chao-tung forecast that steel demand will increase thanks to the world governments subsidizing infrastructure construction in the context of the COVID-19 pandemic, which tends to stabilize. Taipei Times reported.

Iron ore chart at Shanghai exchange (Source: Shfe)

“After going through tough times, the steel market will take at least a year, or most likely two years, to grow strong again,” he said.

According to him, the drop in steel prices is a “short-term respite for the market” and prices are likely to rebound early next year as mild winter temperatures around the world favor construction activity. build.

Despite the spike in COVID-19 cases in some regions and increased demand for carbon neutral steel production, CSC is expecting a positive development in the steel market due to higher commodity prices and demand. Worldwide demand continues to grow strongly.

Countries around the world, especially the US, are investing in infrastructure projects, leading to a sharp increase in steel demand. The whole world is fighting to boost the economy.

The pressure to switch to more climate-friendly production methods will be offset by higher prices. Mr. Wong said: “Nippon Steel has predicted that carbon neutrality targets will increase steel prices by more than 10%. The era of high-priced steel has arrived.”

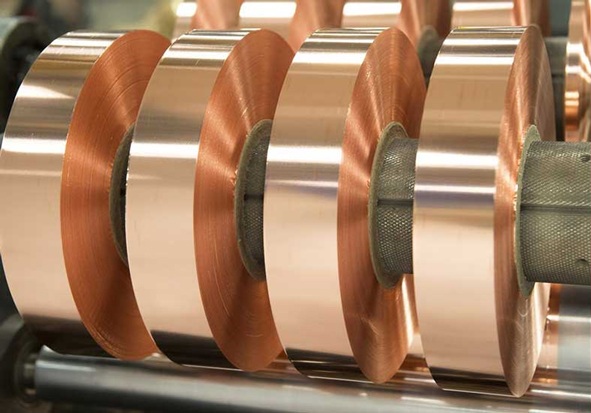

Photo: North Shore Steel

CSC Executive Vice President Hwang Chien-chih said the recent weakness in the steel market was due to logistical constraints and lack of clarity in China’s markets.

“Demand is likely to pick up in the first half of next year,” Hwang said. The medium and long-term outlook of the steel market is unaffected.”

A report by World Steel Dynamics predicts that steel prices will increase in the first half of next year amid a recovery in demand in China. However, the report also forecasts the recovery will dissipate in the second half of the year.

Mr. Hwang added: “It is not certain that steel prices will fall. It will depend on decarbonization policies from countries around the world, and whether steel prices are supported by continued high commodity prices.”

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com