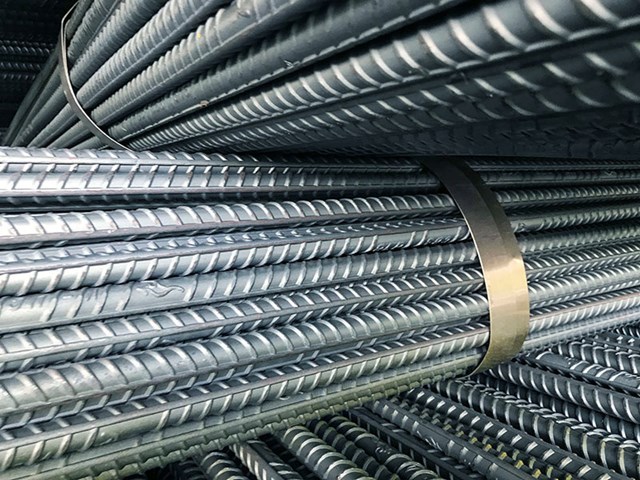

Steel prices today increased to 4,456 yuan / ton on the Shanghai Exchange. China’s steel output is expected to move higher after the Beijing Winter Olympics in February 2022, when restrictions may be partially lifted.

Steel prices today maintain upward momentum

Steel price today delivered in May 2022 on the Shanghai Exchange increased 63 yuan to 4,456 yuan / ton at the time of the survey at 9:15 am (Vietnam time).

| Tên loại | Kỳ hạn |

Ngày 7/12 |

Chênh lệch so với giao dịch trước đó |

| Giá đồng | Giao tháng 1/2022 | 69.540 | +210 |

| Giá kẽm | Giao tháng 1/2022 | 22.835 | -45 |

| Giá niken | Giao tháng 2/2022 | 146.740 | -1.220 |

| Giá bạc | Giao tháng 6/2022 | 4.709 | -14 |

| Giá thép | Giao tháng 5/2022 | 4.456 | +63 |

List of futures trading prices of some metals on the Shanghai Exchange (Unit: yuan/ton). Summary: Thao Vy

On Monday (December 6), iron ore futures on the Dalian Exchange (DCE) and the Singapore Exchange (SGX) simultaneously rose, but gains were capped on concerns about output control. steel in China, Reuters reported.

Iron ore chart at Shanghai Exchange (Source: Shfe)

Specifically, the price of iron ore for delivery in May 2022, the most traded on the DCE, ended the daytime session 1.6% higher at 615.50 yuan/ton (equivalent to 96.58). USD/ton).

Earlier in the session, this contract was also adjusted up 4.2%.

Similarly, iron ore contract for delivery in January 2022 on SGX also increased 2.1% to 103.70 USD/ton. The highest level recorded in the session was 104.60 USD/ton.

The reason for this increase is the expectation that accommodative monetary policy in China can limit the downside risk facing this world’s largest steel producer and consumer.

General sentiment remained upbeat after state media on Friday quoted Premier Li Keqiang as saying China would cut banks’ reserve requirement ratios in a timely manner.

However, pollution warnings in the top steel-producing city of Tangshan mean production cuts in industrial sectors including steel and coke, and worries about developer debt. Chinese real estate has helped optimistic investors.

Photo: Shanghai Unite Steel

Atilla Widnell, Managing Director of Navigate Commodities in Singapore, said: “While we expect China’s steel output and iron ore demand to decline in 2022, the outlook for easing monetary policy is not. and China’s ‘three red lines’ will soften the downturn.”

By drawing “three red lines”, Chinese regulators have laid out the financial requirements that developers must meet in order to get new bank loans.

Market expectations are showing that domestic steel production will move higher after the Beijing Winter Olympics in February 2022, when restrictions may be partially lifted.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com