Never in history has container shipping exploded like it is now. However, experts in the transport sector also realized that a similar phenomenon occurred in another sector, which is dry bulk, in the years 2007-2008.

Thus, looking back at the previous spike will help businesses compare with the spike in container shipping this year. Along with that, it is possible to make a forecast about this uptrend.

Dry bulk freight rates ‘then’ and now

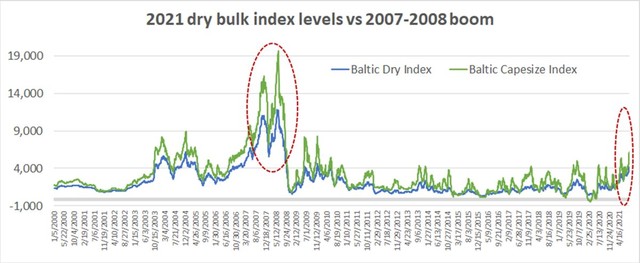

Peter Sand, Director of the BIMCO shipping association emphasized in a recent report: “Although dry bulk freight rates and ship values are currently at a high level compared to the past 10 years, this level is still high. far from the 2007-2008 period”. Bulk carriers should also recognize that there is no sign of this being the start of a super cycle, he added.

Specifically, the Baltic dry cargo chartering index (BDI) rose 1.3% to 4,201 points on August 24, its highest level since mid-2010 and extending gains for the 11th consecutive session, boosted by due to the recovery of commodity demand along with the restrictions in transportation due to the epidemic, especially in China.

However, the all-time high of 11,793 – almost triple the current level – was recorded on May 20, 2008.

Data: Baltic Exchange

Last Tuesday, according to Clarksons Platou Securities, the spot rate of Capesize ships (DWT ships ranging from 150000 tons) was equivalent to 51,500 USD per day. Meanwhile, according to a report from investment bank Dahlman Rose, this figure in June 2008 touched 233,000 USD/day.

At the time, a 5-year-old Capesize vessel sold for $150 million, today the price is around $44 million.

Rates for medium-sized Panamax cargo ships (65,000-90,000 DWT) are currently $34,300 per day. In May 2008, this peaked at $91,700 per day.

Comparing the current dry bulk market with the spike of the 2000s, Jefferies shipping analyst Randy Giveans emphasized: “I’m not saying freight rates will go back to where they were last year. 2008. The point is, this period will be better than in the past. Over the past decade, the average BDI has always been at 1,250, and never above 2,000.

Jefferies analyst Randy Giveans. Photo: John Galayda/Marine Money

“Besides, there weren’t as many investors in the 2000-2010 period as there are now, and if they did, they wouldn’t have imagined that BDI could hit 10,000. No one has even seen the index so much. At 4,000, everyone thinks it’s impossible that BDI can go higher. If you look at the data of the past 10 years, what they think is also very reasonable. But if you look at 20 years, it is not necessarily true.” Jefferies representative confirmed.

“I don’t think the BDI will be able to hit 10,000, but I also don’t think it will go back to the 1,250 average. I think it will be somewhere in the 3,000-6,000 range in the coming years.”

Cargo boxed and dry bulk goods

Ocean freight rates follow a driving force, regardless of whether they are dry bulk cargo, containers, or tankers: Spot rates are very elastic, are not bound by price regulations, and can rise at any rate. have a stop. Similar to a Greek proverb about shipping: “98 ships and 101 boxes, the market boom. 98 boxes with 101 ships, the market crashes”.

On the one hand, there is a clear difference between the current dry bulk market and the 2000 market. Today’s market is being driven by China’s record increase in imports. The current growth in demand is incomparable.

On the other hand, the exchange rate is not only related to demand, but also between supply and demand. Much of the price spike in container shipping today is not due to increased demand (with the exception of the United States), but also due to limited supply.

Port congestion caused 16% of cargo to be stuck in long lines in mid-August, plus orders at just 7% of the fleet. Analyst Randy Giveans agrees that vessel supply constraints could certainly push cargo prices higher in the coming months.

However, there are still differences between the current container crisis and the dry bulk crisis of the past. “Containers have a higher profit margin between shipping costs and goods. If an item with a high margin, like a pair of shoes made for $20, sells for $150, can still pay $100 for shipping and make a profit. With a large enough number of shoes in a container, the shoe importer can still make a good profit.”

The same goes for transporting iron ore from Brazil to China, or coal from Indonesia to China. The difference between production cost and delivery price shows that boxed goods can achieve higher profit margins than dry bulk.

What will the container shipping market look like?

Whether the current dry bulk price can increase at the level of 2007-2008 is still a big question mark. This said, no one could have predicted the current container shipping market. Or even the analysis reports 13-14 years ago showed that no one predicted the dry bulk boom then.

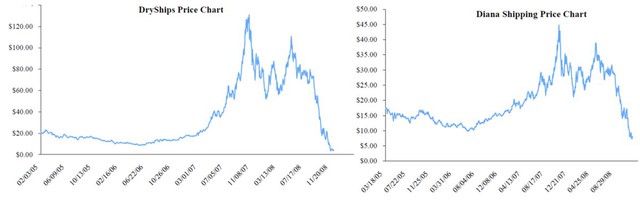

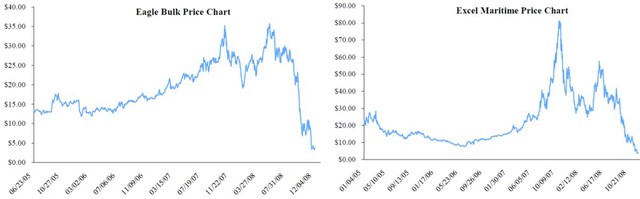

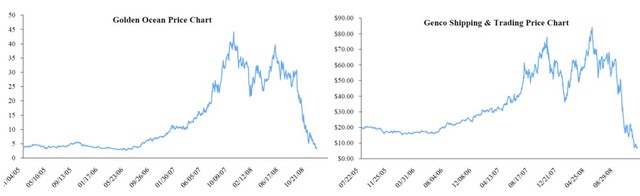

Analysts also did not anticipate a drop in the number of dry spells amid the growing financial crisis. In early 2008, both Cantor Fitzgerald and Dahlman Rose’s 52-week price targets on DryShips were $100. The stock ended 2008 trading at about $10. It never recovered and was dropped lower over the next decade by diluting services before delisting in 2019.

Experts also did not anticipate a large decrease in the amount of dry bulk cargo in the context of the financial crisis at that time. By the end of 2008, the price of Capesize, Panamaxes, Supramaxes or Handysize ships was at a lower level than it is today. The rate and volume of dry bulk cargo also decreased during the following 12 years

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com