US President Joe Biden is working hard to change the fact that Americans are facing sky-high gas prices. There are opinions that it is too late for Mr. Biden to reduce the cost for the American people during Thanksgiving. So what is the truth of this story?

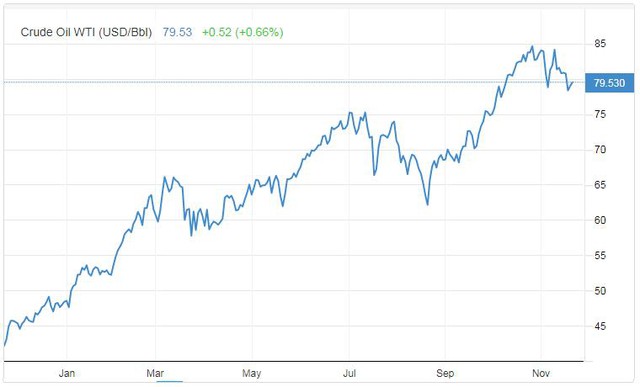

Oil price in 2021 will increase by over 60%

Although oil prices have fallen in a row for the past 4 weeks since the US started paying attention to the high price of gasoline and trying to bring prices back to orbit, the price is still around 80-82 USD/barrel, close to the level. The highest level in recent years and is too high compared to the tolerance of the economy as well as of consumers.

Since the beginning of November, the US President has called on many countries to join hands to lower the price of petrol. International organizations also warn that too high gasoline prices will affect oil demand in particular and demand for goods and services in general, thereby negatively affecting the weak economy after the Covid pandemic. -19. Some organizations have lowered their forecast for oil demand in the coming time.

However, oil prices just stopped rising, not falling as much as expected. The most recent trading session, November 18, oil price ended the lowest point in 6 weeks, according to which Brent crude oil increased 96 US cents, or 1.2%, to 81.24 USD/barrel, sweet oil US light (WTI) rose 65 US cents, or 0.8%, to 79.01 USD/barrel.

Year-to-date, the price of WTI oil is still up 64%, while Brent is up 58%.

Analysts attribute the rise in oil prices to a strong rebound in demand after the Covid-19 pandemic, with most parts of the world returning to pre-pandemic levels, while the Organization Oil exporting countries and their allies (OPEC +) still maintain the roadmap to restore output, not accelerate as proposed by Mr. Biden. Analysts estimate global fuel demand will grow by about 5-6 million bpd this year.

Rising coal and gas prices on the back of stronger demand and congested transportation also contributed to heating up the oil market.

Since the beginning of March this year, the price of natural gas in the European Union (EU) has increased by 618% and in the US by 127% while the world coal price has increased several hundred percent.

On the OPEC+ side, despite the shortage of supply, the organization still emphasized the need to be “cautious and attentive to the constantly changing market situation”. The OPEC+ group seems to be comfortable with oil prices around $80, despite concerns that high prices could stifle a weak recovery in the world economy and thereby dampen oil demand.

WTI oil price movements over the past year.

US President carefully finds solutions to lower gasoline prices

Escalating energy prices are one of the main causes of warming inflation around the world. In the US, skyrocketing gasoline prices caused the consumer price index (CPI) to increase the most in 31 years, up 6.2% in October 2021 over the same period last year, choking American families. , which has just struggled to get out of the health crisis, Covid-19.

Inflation has grown too hot, leaving US policymakers in a dilemma, because the US economy has not recovered firmly enough for the central bank to withdraw stimulus policies. but maintaining the current loosening policies will help increase inflation.

In that context, on the eve of the November meeting of OPEC + – November 4, President Joe Biden criticized OPEC +’s indecision that contributed to the escalation of gasoline prices in the US as well as around the world. and asked the organization to boost oil supply further. Not only the US, countries such as India, Japan… also complained about the high gasoline prices and voiced their request to OPEC + to increase production. However, these wishes have not been met by OPEC+, which is maintaining the balance of the market and remains alert to potential changes in demand. The November meeting of OPEC+ ended with the group agreeing to stick to its plan to increase oil production by 400,000 bpd from December as planned.

Unable to rely on the outside, US President Biden then asked the National Economic Council to find ways to reduce energy costs and the Federal Trade Commission to limit manipulation of the energy market. .

In addition, Mr. Biden plans to export oil from the National Strategic Petroleum Reserve (SPR), and most recently has asked a number of countries to join the action.

Is the SPR oil release coordinated plan feasible?

Some sources said that President Biden’s government on November 17 raised the issue with close allies, including Japan, South Korea and India – the world’s largest oil consumer, and also shared with China about considering releasing part of its crude oil reserves in a coordinated effort to control energy prices to promote economic recovery.

However, as of now there have been no talks on the matter, so no decision has been made on whether to pursue this or any other action on the price. oil or not.

The White House itself declined to comment on the details of specific conversations with the US government with other countries. A spokesman for the White House National Security Council said: “No decisions have been made. There is nothing to report other than ongoing discussions and we are looking at a range of tools. necessary, needs”.

Information from the Ministry of Industry of Japan said that, according to the country’s law, this can not “release” crude oil reserves of SPR to lower energy prices. South Korea also has information that it is considering a request from the US government, but adds that it can only do so in the event of a supply imbalance. The attitudes of Japan and South Korea indicate opposition to the release of oil from the reserve.

The Chinese side did not comment on the US request. The world’s second-largest economy in September announced it would begin selling less SPR oil to cool the energy market. China’s economy is heavily dependent on imported oil from abroad. For years, Beijing has worked to build up its emergency oil reserves. China does not publish much data on its oil reserves. However, in 2017, China announced the establishment of nine major storage facilities across the country with a total capacity of 37.7 million tons.

Thus, until now, among the major economies, only the US wants to “peak” to coordinate the export of SPR oil reserves.

Observers say the “release” of strategic reserves, even if only the US and China act, will likely cause prices to fall, at least temporarily. In September, just China’s announcement that it would sell SPR oil was enough to reverse the previous upward trend in oil prices. Therefore, the release of oil reserves by major countries will be an unprecedented challenge for OPEC.

However, how long will oil prices fall in the current context, when inflation is rising globally and energy prices are all high? That’s a big question with no definitive answer.

Analysts say the crude oil market remains essentially tight and any volume released from stockpiles is unlikely to affect the global balance, and will have only limited impact. oil prices.

However, the move to release strategic stockpiles, if implemented, is seen as a signal to the OPEC+ group that it should ramp up production to meet demand from major economies.

References: Bloomberg, Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.co