Experts predict that the world and Vietnam iron and steel markets will have strong fluctuations in the third and fourth quarters of this year.

In 2021, the story of the iron and steel market is a very hot topic, not only for commodity investors, but also for stock investors of the steel industry, construction industry and real estate. Any fluctuations in world prices will directly affect the business activities of domestic enterprises.

Closing the week from July 19 to July 25, 2021, the August Iron Ore contract price on the Singapore Exchange plummeted 7.7% to $197.33/ton. The price of iron ore on the Dalian Department of China fell nearly 10% to 173.6 USD/ton, the biggest weekly drop since February 2020 and is now 17% lower than the peak in May of this year. now on.

According to information from Reuters, China has opened an anti-dumping investigation against flat rolled steel coil imported from Japan, Korea and the European Union (EU). Japanese steel producers including FE Steel Corp, Nippon Steel and Sumitomo Metal will have to pay tariffs ranging from 39% to 45.7%; businesses in the EU will have to pay 46.3% and the tax rate for Korea will be 37.3%.

Falling raw material prices may cause businesses to reduce their selling prices of finished steel products in August. However, according to the Commodity Exchange of Vietnam (MXV), in the next price adjustment periods, it is still too much. early to expect iron and steel prices will continue to fall further. The market still has many unpredictable factors and domestic enterprises still need to properly implement price hedging operations, not to take risks and be subjective in this period.

Europe – America industry recovers, scrap steel price continues to increase

In the US, construction activities are still going on actively after a favorable Covid-19 vaccination campaign. The sharp increase in scrap steel prices represents a strong boom in demand during the construction season. The average selling price for coil and long steel products increased by more than $250 in the second quarter to nearly $1,300/ton. The price of scrap increased by nearly 70 USD to 440 USD/ton.

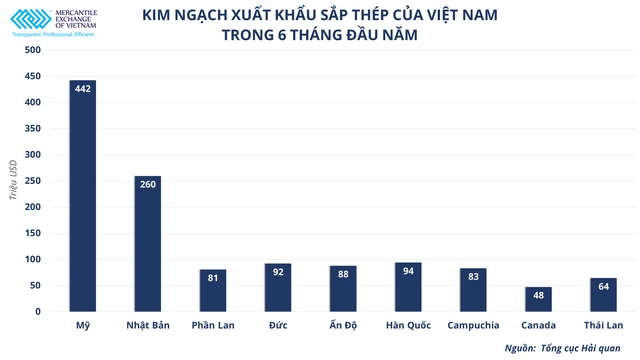

Steel consumption mainly comes from the automotive and industrial sectors, while the energy sector is showing signs of recovery. Moreover, optimism about the progress of construction projects boosted orders and supported steel prices. According to MXV’s assessment, this development can be maintained in the second half of this year, especially the third quarter and the first half of the fourth quarter, with the expectation that steel demand will exceed supply in major markets such as Europe or the US. . In particular, North America is still an important destination for Vietnamese steel.

Meanwhile, the price of scrap scrap originating from the UK is 530 – 540 USD/ton CFR, the US is 525 – 530 USD/ton CFR and the highest is in the EU with 570 – 580 USD/ton CFR.

Chinese iron ore prices cool down, finished steel moves in opposite directions

China’s iron ore prices are dominating world prices when accounting for 70% of seaborne transactions. The Chinese government recently asked some steel mills in Jiangsu, Fujian and Yunnan provinces to cut production, to ensure this year’s output does not exceed last year’s, especially in Tangshan, the capital city of China. the country’s steelmaking government. Authorities announced that they will strictly handle factories that violate regulations.

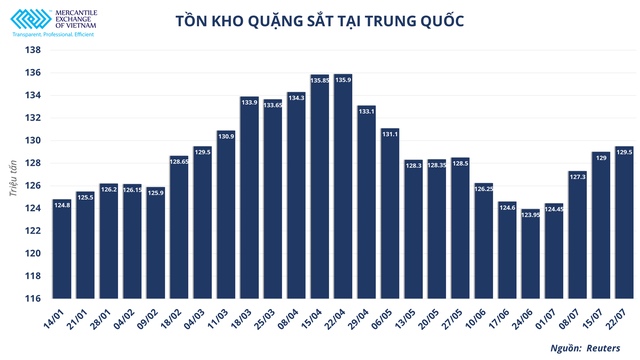

In the past week, the storms that caused historic flooding in the country of billions of people at this time caused serious damage and delayed many production activities. The price of sea-borne iron ore also fell sharply. Portside ore stocks continue to grow as most mills in northern China reduce their stockpiles at mills. Iron ore inventories at 46 main ports of China reached 129.5 million tons as of July 22, up 500,000 tons from the previous week.

Meanwhile, finished steel prices have mixed movements. Large steel producers like Shagang increased construction steel prices by about $38/ton, while the market average increased slightly from $5-12/ton. In the opposite direction, the price of hot rolled and cold rolled steel decreased slightly.

According to MXV, manufacturers raised construction steel prices for two consecutive weeks for the following reasons. Firstly, the market sentiment was boosted by the anticipation of tightening steel production at the end of the year, combined with the PBoC Central Bank cutting the reserve requirement ratio from July 15 to support the economy. Second, the price difference between rebar and hot rolled coil (HRC) is widening, which may cause rebar manufacturers to incur losses. Third, active buying and selling activities also supported market sentiment.

Since mid-May until now, Vietnam’s CB240 coil price has decreased continuously by about 7-8%. Many steel manufacturers have announced to lower prices 6 times, from nearly 17.4 million VND/ton to 16.1 million VND/ton (depending on the business) on July 23, due to the current domestic market. now is in the low consumption season and the price of input materials such as billet has been more stable.

With the above fluctuations, the iron and steel market in the world and in Vietnam may have stronger fluctuations in the third and fourth quarters of this year.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com